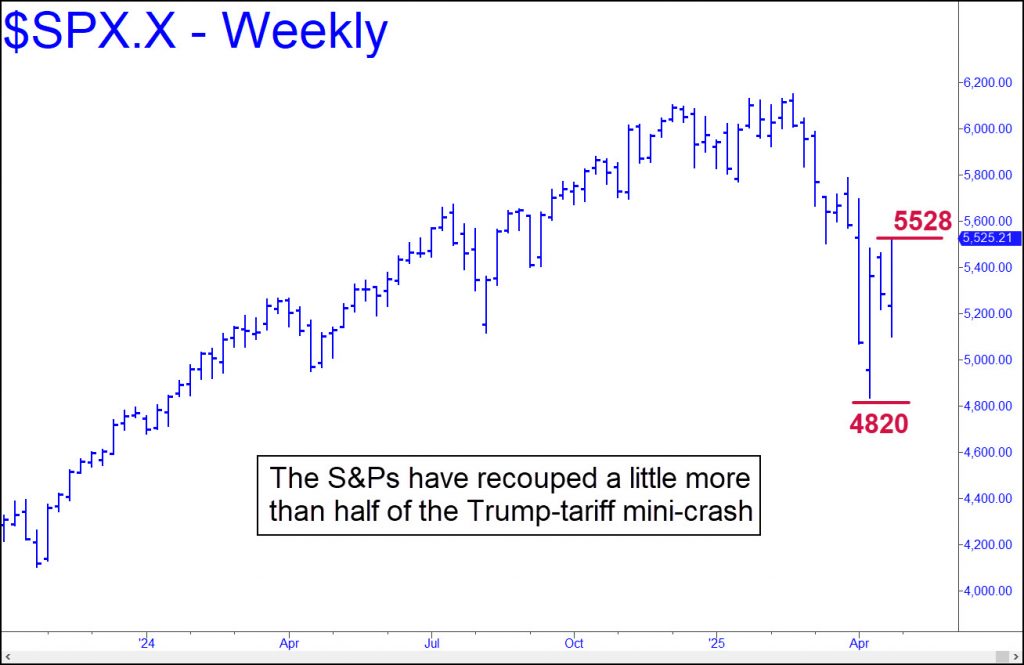

[My prediction three weeks ago that the bear market had seen its worst seemed crazy at the time — particularly to me, because I’m an inveterate permabear. However, last week, bulls distanced themselves further from the low of the mini-crash that occurred when tariff panic was in the air. I’d said the selling would take the S&Ps no lower than 4820, and that is almost exactly what occurred: a 4835 low marked the bottom of a 1312-point plunge. If it also caught the bear’s last gasp, that would mean everyone taking pot-shots at Trump for screwing up the world is flat-out wrong. In any case, I will continue to run my original commentary (see below) until SPX proves me wrong by relapsing decisively below 4820. I have reduced the odds that the low will survive to 50-50 because the continuing rise in long-term rates could make it impossible for the economy to avoid a recession. But maybe that trend is about to peter out as well. In any case, it is still much better odds than most economists, the news media and the blogosphere are giving Trump and the economy. RA ]

***

A word of advice if you’re looking for bankable information on the direction of the economy: tune out the mainstream media’s cavalcade of Trump-deranged bozos and focus on the 4820 target in the SPX chart above. Think of it as Trump’s lucky number, but also a very good place for these all-too-interesting times to find temporary equilibrium. That is my worst-case target for a bear market that many believe is only just getting started. As a die-hard permabear myself, I’ve been eagerly anticipating the Mother of All Bears since, like, 2010. The global economy was badly in need of a reset and still is. It will happen, but not now. Instead, it looks like Trump is about to achieve the impossible, averting a catastrophic debt deflation while also staving off recession. Even the already certain collapse of commercial real estate will have to wait.

You cannot get to this happy place, psychologically speaking. if you stay tuned to the MSM morons who invent the news. You might as well listen to Whoopi Goldberg as to the “experts” who cover tariff news for MSNBC, The New York P.O.S. Times and Bloomberg. Bloomberg is probably the worst offender, since they literally live to kick Trump in the balls at every opportunity. (Don’t they know he’s wearing a Kevlar cup?) The latest Bloomberg teaser headline sums up the mainstream media’s knee-jerk reaction to the Orange Man: Trump’s Bear Market. Leave it to Bloomberg’s sniveling lightweights to discover and attempt to exploit a bear market just as it’s ending. Indeed, the storm surge is due to blow out to sea before the news editors at Bloomberg, the Times and WAPO have reached the Kleenex phase of their long-running circle jerk.

Christmas Glide Path

Tune them out and trust my 4820 target as a worst-case low for the bear market. To borrow Vizzini’s line, it is ‘INCONCEIVABLE!’ that the S&Ps will fall significantly below it, if at all. And that means Trump, Musk and their intrepid band of budget vigilantes will have put America back on a glide path just in time for Christmas. In other words: no recession, no harmful fallout from the tariffs, and no serious disruptions from lawfare shit-stain Norm Eisen and other treasonous actors hell-bent on destroying the U.S. through the courts. Far from a tariff-induced recession, watch for felicitous stirrings in the Rust Belt, where union workers will be telling a very different story compared to the ‘Orange Man BAD!‘ narrative on MSNBC and CNN.

If you’re interested in precise bear market targets for the ‘lunatic-sector’ stocks, take a free trial to Rick’s Picks and see my post on this in the chat room, or find them in my latest interview on Howe Street. Prepare to have your mind blown three months from now by the precise accuracy of my forecasts for climactic declines in NVDA, TSLA, AAPL, MSFT, GOOG, NFLX, CMG, META and AMZN.