The Morning Line

Round One vs. The Bear Goes to Trump

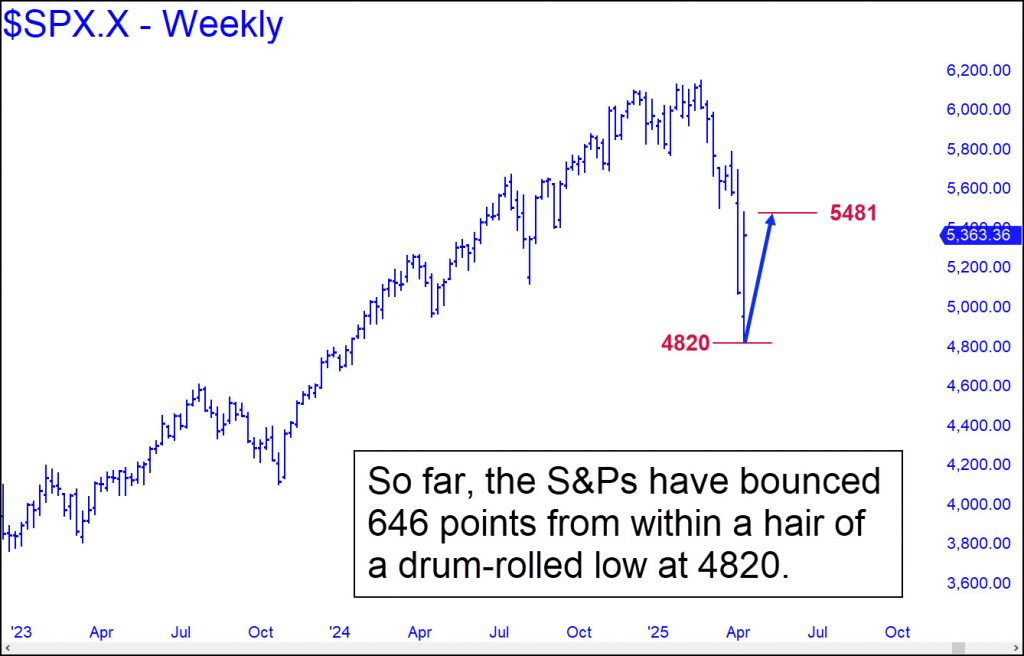

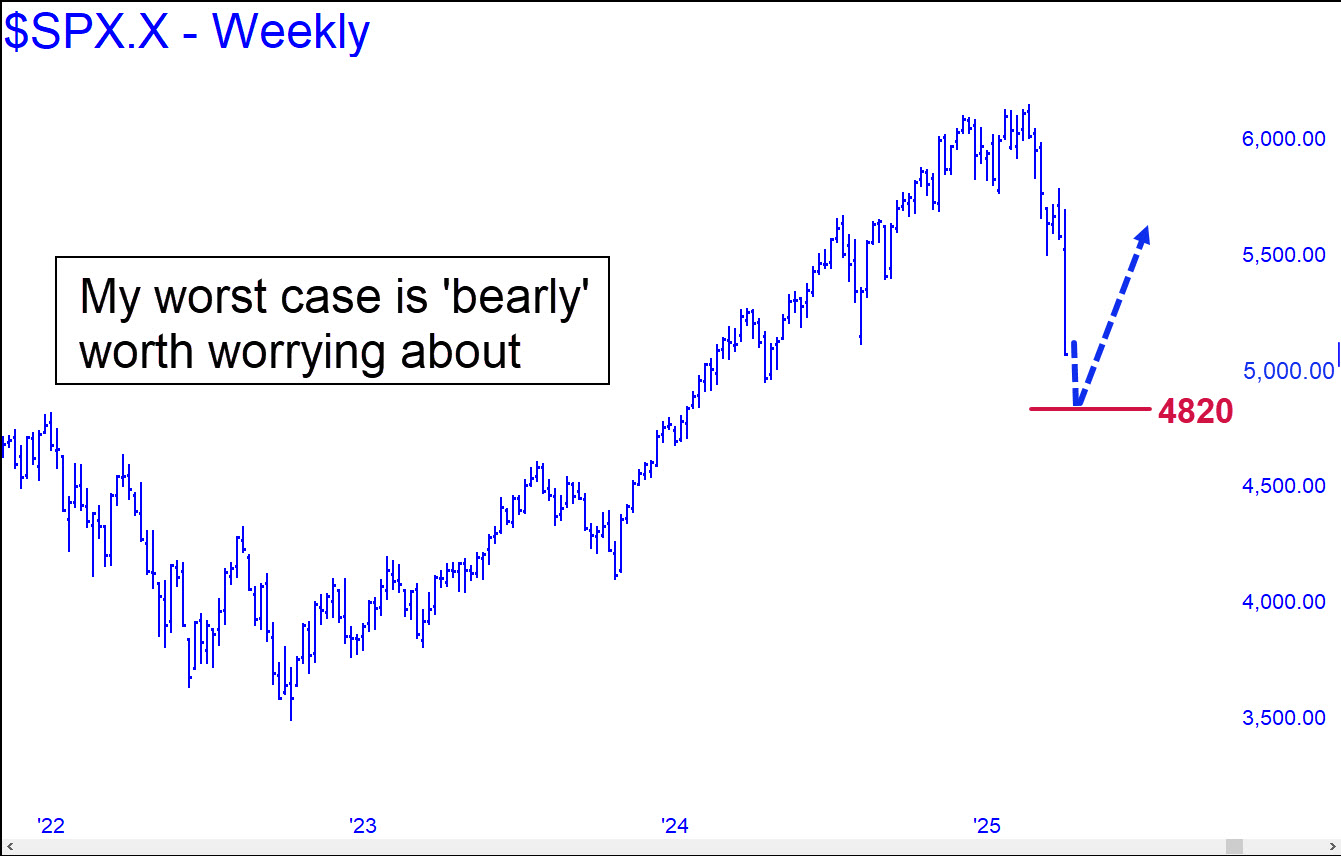

[Just ahead of last Monday’s steep plunge, I predicted here that an S&P reversal from 4820 would mark the end of the bear market. So far, SPX has rallied 646 points off an actual low at 4835. Bulls are not yet out of the woods, however, since a relapse could occur at any time. The stock market remains spooked by Europe’s dumping of Treasury paper in a deliberate attempt to destabilize the U.S. financial system. With the EU economy swirling down the crapper, the globalists are desperate to force Powell to ease in order to rescue big hedge funds that were leveraged up to their eyeballs with Treasury paper. So far, the Fed chairman has stood his ground, and it appears the EU attempt to sabotage the U.S. bond market will fail. In any event, the commentary below will continue to run until such time as the S&Ps crash the 4820 Hidden Pivot and prove me wrong. If you keep my thesis in mind — that as long as 4820 holds, there will be no recession, nor any harmful effects from tariffs — you will be better able to judge the jaw-dropping stupidity of the mainstream media’s coverage of Trump 2.0. Because of their blind hatred of the president, the eggheads, reporters, pundits and benighted editorialists will continue to get everything wrong until stocks are once again soaring to new all-time highs. RA]

***

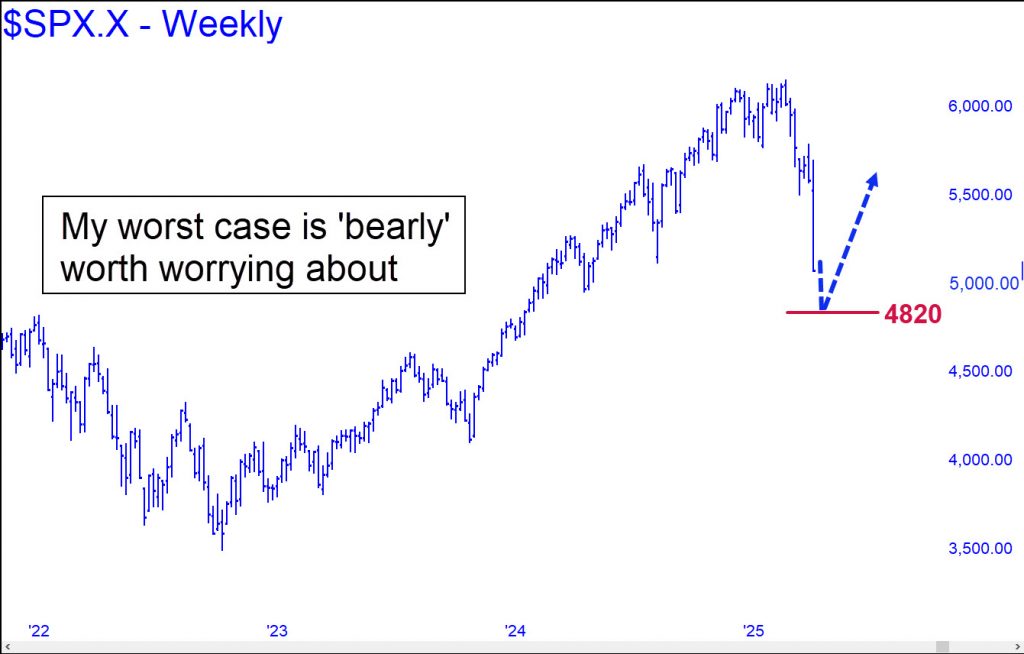

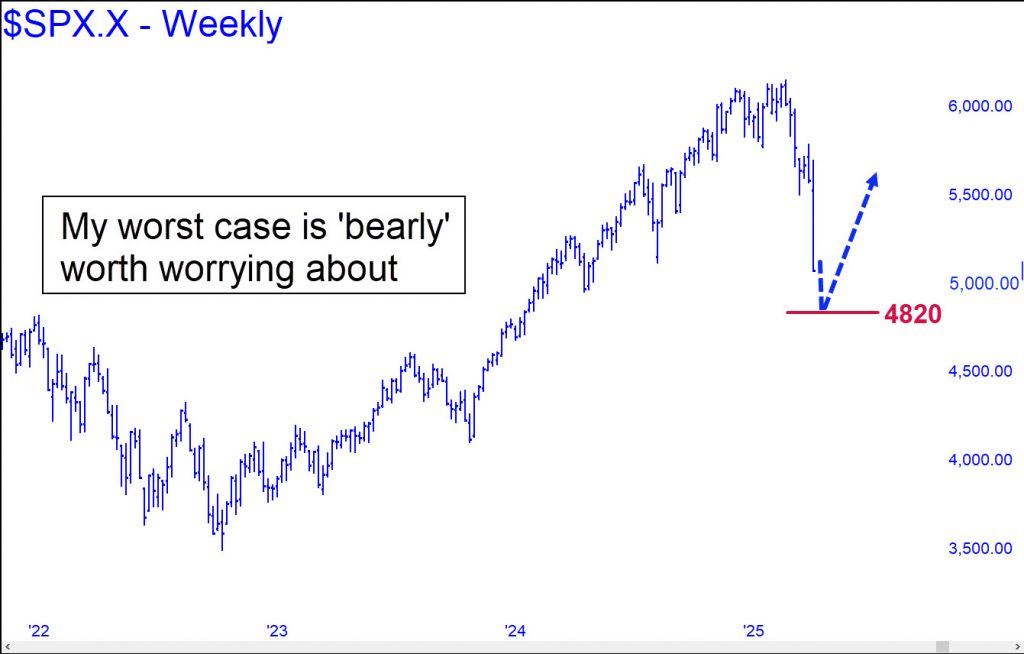

A word of advice if you’re looking for bankable information on the direction of the economy: tune out the mainstream media’s cavalcade of Trump-deranged bozos and focus on the 4820 target in the SPX chart above. Think of it as Trump’s lucky number, but also a very good place for these all-too-interesting times to find temporary equilibrium. That is my worst-case target for a bear market that many believe is only just getting started. As a die-hard permabear myself, I’ve been eagerly anticipating the Mother of All Bears since, like, 2010. The global economy was badly in need of a reset and still is. It will happen, but not now. Instead, it looks like Trump is about to achieve the impossible, averting a catastrophic debt deflation while also staving off recession. Even the already certain collapse of commercial real estate will have to wait.

You cannot get to this happy place, psychologically speaking. if you stay tuned to the MSM morons who invent the news. You might as well listen to Whoopi Goldberg as to the “experts” who cover tariff news for MSNBC, The New York P.O.S. Times and Bloomberg. Bloomberg is probably the worst offender, since they literally live to kick Trump in the balls at every opportunity. (Don’t they know he’s wearing a Kevlar cup?) The latest Bloomberg teaser headline sums up the mainstream media’s knee-jerk reaction to the Orange Man: Trump’s Bear Market. Leave it to Bloomberg’s sniveling lightweights to discover and attempt to exploit a bear market just as it’s ending. Indeed, the storm surge is due to blow out to sea before the news editors at Bloomberg, the Times and WAPO have reached the Kleenex phase of their long-running circle jerk.

Christmas Glide Path

Tune them out and trust my 4820 target as a worst-case low for the bear market. To borrow Vizzini’s line, it is ‘INCONCEIVABLE!’ that the S&Ps will fall significantly below it, if at all. And that means Trump, Musk and their intrepid band of budget vigilantes will have put America back on a glide path just in time for Christmas. In other words: no recession, no harmful fallout from the tariffs, and no serious disruptions from lawfare shit-stain Norm Eisen and other treasonous actors hell-bent on destroying the U.S. through the courts. Far from a tariff-induced recession, watch for felicitous stirrings in the Rust Belt, where union workers will be telling a very different story compared to the ‘Orange Man BAD!‘ narrative on MSNBC and CNN.

If you’re interested in precise bear market targets for the ‘lunatic-sector’ stocks, take a free trial to Rick’s Picks and see my post on this in the chat room, or find them in my latest interview on Howe Street. Prepare to have your mind blown three months from now by the precise accuracy of my forecasts for climactic declines in NVDA, TSLA, AAPL, MSFT, GOOG, NFLX, CMG, META and AMZN.

Round One vs. The Bear Goes to Trump

[Just ahead of last Monday’s steep plunge, I predicted here that an S&P reversal from 4820 would mark the end of the bear market. So far, SPX has rallied 646 points off an actual low at 4835. Bulls are not yet out of the woods, however, since a relapse could occur at any time. The stock market remains spooked by Europe’s dumping of Treasury paper in a deliberate attempt to destabilize the U.S. financial system. With the EU economy swirling down the crapper, the globalists are desperate to force Powell to ease in order to rescue big hedge funds that were leveraged up to their eyeballs with Treasury paper. So far, the Fed chairman has stood his ground, and it appears the EU attempt to sabotage the U.S. bond market will fail. In any event, the commentary below will continue to run until the S&Ps crash the 4820 Hidden Pivot and prove me wrong. If you keep my thesis in mind — that as long as 4820 holds, there will be no recession, nor any harmful effects from Trump’s tariffs — you will be better able to judge the jaw-dropping stupidity of the mainstream media’s coverage of Trump 2.0. Because of their blind hatred of the president, the eggheads and benighted editorialists will continue to get everything wrong until stocks are once again soaring to new all-time highs. RA]

***

A word of advice if you’re looking for bankable information on the direction of the economy: tune out the mainstream media’s cavalcade of Trump-deranged bozos and focus on the 4820 target in the SPX chart above. Think of it as Trump’s lucky number, but also a very good place for these all-too-interesting times to find temporary equilibrium. That is my worst-case target for a bear market that many believe is only just getting started. As a die-hard permabear myself, I’ve been eagerly anticipating the Mother of All Bears since, like, 2010. The global economy was badly in need of a reset and still is. It will happen, but not now. Instead, it looks like Trump is about to achieve the impossible, averting a catastrophic debt deflation while also staving off recession. Even the already certain collapse of commercial real estate will have to wait.

You cannot get to this happy place, psychologically speaking. if you stay tuned to the MSM morons who invent the news. You might as well listen to Whoopi Goldberg as to the “experts” who cover tariff news for MSNBC, The New York P.O.S. Times and Bloomberg. Bloomberg is probably the worst offender, since they literally live to kick Trump in the balls at every opportunity. (Don’t they know he’s wearing a Kevlar cup?) The latest Bloomberg teaser headline sums up the mainstream media’s knee-jerk reaction to the Orange Man: Trump’s Bear Market. Leave it to Bloomberg’s sniveling lightweights to discover and attempt to exploit a bear market just as it’s ending. Indeed, the storm surge is due to blow out to sea before the news editors at Bloomberg, the Times and WAPO have reached the Kleenex phase of their long-running circle jerk.

Christmas Glide Path

Tune them out and trust my 4820 target as a worst-case low for the bear market. To borrow Vizzini’s line, it is ‘INCONCEIVABLE!’ that the S&Ps will fall significantly below it, if at all. And that means Trump, Musk and their intrepid band of budget vigilantes will have put America back on a glide path just in time for Christmas. In other words: no recession, no harmful fallout from the tariffs, and no serious disruptions from lawfare shit-stain Norm Eisen and other treasonous actors hell-bent on destroying the U.S. through the courts. Far from a tariff-induced recession, watch for felicitous stirrings in the Rust Belt, where union workers will be telling a very different story compared to the ‘Orange Man BAD!‘ narrative on MSNBC and CNN.

If you’re interested in precise bear market targets for the ‘lunatic-sector’ stocks, take a free trial to Rick’s Picks and see my post on this in the chat room, or find them in my latest interview on Howe Street. Prepare to have your mind blown three months from now by the precise accuracy of my forecasts for climactic declines in NVDA, TSLA, AAPL, MSFT, GOOG, NFLX, CMG, META and AMZN.

Round One vs. The Bear Goes to Trump

[Just ahead of last Monday’s plunge, Rick’s Picks predicted that an S&P reversal at 4820 would mark the end of the bear market. Here’s a chart that shows the 661-point rally that occurred off an actual low at 4835. Bulls are not yet out of the woods, however, since a relapse could occur at any time. The stock market remains spooked by Europe’s dumping of Treasury paper in a deliberate attempt to destabilize the U.S. financial system. With the EU economy swirling down the crapper, the globalists are desperate to force Powell to ease, ostensibly to rescue big hedge funds that were leveraged up to their eyeballs with Treasury paper. So far, the Fed chairman has stood his ground, and it appears the EU attempt to sabotage the U.S. bond market will fail. In any event, the commentary below will continue to run until the S&Ps crash the 4820 Hidden Pivot and prove me wrong. If you keep my thesis in mind — that as long as 4820 holds, there will be no recession, nor any harmful effects from Trump’s tariffs — you will be better able to judge the head-slapping ignorance of the mainstream media’s coverage of Trump 2.0. Because of their blind hatred of the president, these clowns will continue to get everything wrong until stocks are once again soaring to new all-time highs. RA]

***

A word of advice if you’re looking for bankable information on the direction of the economy: tune out the mainstream media’s cavalcade of Trump-deranged bozos and focus on the 4820 target in the SPX chart above. Think of it as Trump’s lucky number, but also a very good place for these all-too-interesting times to find temporary equilibrium. That is my worst-case target for a bear market that many believe is only just getting started. As a die-hard permabear myself, I’ve been eagerly anticipating the Mother of All Bears since, like, 2010. The global economy was badly in need of a reset and still is. It will happen, but not now. Instead, it looks like Trump is about to achieve the impossible, averting a catastrophic debt deflation while also staving off recession. Even the already certain collapse of commercial real estate will have to wait.

You cannot get to this happy place, psychologically speaking. if you stay tuned to the MSM morons who invent the news. You might as well listen to Whoopi Goldberg as to the “experts” who cover tariff news for MSNBC, The New York P.O.S. Times and Bloomberg. Bloomberg is probably the worst offender, since they literally live to kick Trump in the balls at every opportunity. (Don’t they know he’s wearing a Kevlar cup?) The latest Bloomberg teaser headline sums up the mainstream media’s knee-jerk reaction to the Orange Man: Trump’s Bear Market. Leave it to Bloomberg’s sniveling lightweights to discover and attempt to exploit a bear market just as it’s ending. Indeed, the storm surge is due to blow out to sea before the news editors at Bloomberg, the Times and WAPO have reached the Kleenex phase of their long-running circle jerk.

Christmas Glide Path

Tune them out and trust my 4820 target as a worst-case low for the bear market. To borrow Vizzini’s line, it is ‘INCONCEIVABLE!’ that the S&Ps will fall significantly below it, if at all. And that means Trump, Musk and their intrepid band of budget vigilantes will have put America back on a glide path just in time for Christmas. In other words: no recession, no harmful fallout from the tariffs, and no serious disruptions from lawfare shit-stain Norm Eisen and other treasonous actors hell-bent on destroying the U.S. through the courts. Far from a tariff-induced recession, watch for felicitous stirrings in the Rust Belt, where union workers will be telling a very different story compared to the ‘Orange Man BAD!‘ narrative on MSNBC and CNN.

If you’re interested in precise bear market targets for the ‘lunatic-sector’ stocks, take a free trial to Rick’s Picks and see my post on this in the chat room, or find them in my latest interview on Howe Street. Prepare to have your mind blown three months from now by the precise accuracy of my forecasts for climactic declines in NVDA, TSLA, AAPL, MSFT, GOOG, NFLX, CMG, META and AMZN.

Trump About to Kick the Bear Market’s Ass

A word of advice if you’re looking for bankable information on the direction of the economy: tune out the mainstream media’s cavalcade of Trump-deranged bozos and focus on the 4820 target in the SPX chart above. Think of it as Trump’s lucky number, but also a very good place for these all-too-interesting times to find temporary equilibrium. That is my worst-case target for a bear market that many believe is only just getting started. As a die-hard permabear myself, I’ve been eagerly anticipating the Mother of All Bears since, like, 2010. The global economy was badly in need of a reset and still is. It will happen, but not now. Instead, it looks like Trump is about to achieve the impossible, averting a catastrophic debt deflation while also staving off recession. Even the already certain collapse of commercial real estate will have to wait.

A word of advice if you’re looking for bankable information on the direction of the economy: tune out the mainstream media’s cavalcade of Trump-deranged bozos and focus on the 4820 target in the SPX chart above. Think of it as Trump’s lucky number, but also a very good place for these all-too-interesting times to find temporary equilibrium. That is my worst-case target for a bear market that many believe is only just getting started. As a die-hard permabear myself, I’ve been eagerly anticipating the Mother of All Bears since, like, 2010. The global economy was badly in need of a reset and still is. It will happen, but not now. Instead, it looks like Trump is about to achieve the impossible, averting a catastrophic debt deflation while also staving off recession. Even the already certain collapse of commercial real estate will have to wait.

You cannot get to this happy place, psychologically speaking. if you stay tuned to the MSM morons who invent the news. You might as well listen to Whoopi Goldberg as to the “experts” who cover tariff news for MSNBC, The New York P.O.S. Times and Bloomberg. Bloomberg is probably the worst offender, since they literally live to kick Trump in the balls at every opportunity. (Don’t they know he’s wearing a Kevlar cup?) The latest Bloomberg teaser headline sums up the mainstream media’s knee-jerk reaction to the Orange Man: Trump’s Bear Market. Leave it to Bloomberg’s sniveling lightweights to discover and attempt to exploit a bear market just as it’s ending. Indeed, the storm surge is due to blow out to sea before the news editors at Bloomberg, the Times and WAPO have reached the Kleenex phase of their long-running circle-jerk.

Christmas Glide Path

Tune them out and trust my 4820 target as a worst-case low for the bear market. To borrow Vizzini’s line, it is ‘INCONCEIVABLE!’ that the S&Ps will fall significantly below it, if at all. And that means Trump, Musk and their intrepid band of budget vigilantes will have put America back on a glide path just in time for Christmas. In other words: no recession, no harmful fallout from the tariffs, and no serious disruptions from lawfare scumfuck Norm Eisen and other treasonous actors hell-bent on destroying the U.S. through the courts. Far from a tariff-induced recession, watch for felicitous stirrings in the Rust Belt, where union workers will be telling a very different story compared to the ‘Orange Man BAD!‘ narrative on MSNBC and CNN.

If you’re interested in precise bear market targets for the ‘lunatic-sector’ stocks, take a free trial to Rick’s Picks and see my post on this in the chat room, or find them in my latest interview on Howe Street. Prepare to have your mind blown three months from now by the precise accuracy of my forecasts for climactic declines in NVDA, TSLA, AAPL, MSFT, GOOG, NFLX, CMG, META and AMZN.

‘Golden Era’ Could Face a Deep Valley First

Here’s some cold water on the notion that Trump’s radical trade policies could help bring about an economic golden era. I’d written here last week that punitive tariffs might be the only medicine strong enough to jolt the world into doing honest business. Foreign manufacturers would leap to relocate their plants to the U.S. in order to avoid the levies and also greatly reduce delivery costs.

There’s just one problem with this, wrote a subscriber, Ben, who posts regularly on the site. “I don’t think Trump has the time to re-shore to any great extent. He has 3.5 years, but this is something that takes more than two presidential terms to accomplish.” Indeed, as ambitious as Trump’s plans are, there is no political consensus to implement them.” Even some Republicans are resisting the idea of re-shoring.

Bear Threat

An additional problem is that a shake-up of global trade could trip stocks into a bear market, weakening the ability of middle class Americans to cope with the enormous cost of putting America first. High tariffs cannot but dramatically inflate the price of cars, appliances and other big-ticket items that Americans depend on from sources outside the U.S. Is Trump just bluffing? Even if he is, investors don’t have the luxury of counting on it.

A more immediate and intractable problem Trump will face is the ongoing collapse of commercial real estate. In dollar terms it is a huge number, and yet no big cities have taken commensurate writedowns. Instead, they all seem to be hoping that a massive economic upswing brings workers back to their offices. One San Francisco developer bet a hundred million dollars on this, buying an 11-story building for $40 million that had been assessed at $140 million. He plans to put $50 million of improvements into it, but the investment evidently is predicated on the fantasy that AI workers will fill San Francisco’s empty towers.

It’s Time Once Again to Focus on MSFT

I’ve reinstated MSFT as our top market bellwether because other symbols that have served in that role look too punk to count on. The shares of Apple, which couldn’t innovate its way out of a wet paper bag, will be extremely vulnerable when recession hits, while Bitcoin’s canny handlers lack the guts to lead stocks higher. DaBoyz turns the cryptos loose to run wild whenever the broad averages climb sharply, but this is just go-along price action incapable of exciting traders’ animal spirits. ‘Doc’ Copper doesn’t work, either. Although it looks capable of reaching $6.18 a pound, a 20% climb from current levels, that scenario is not believable in the context of a global boom in manufacturing. More likely, it would be a blowoff for the copper-intensive EV story, which has become less compelling as electric-vehicle resale values have plummeted.

For better or worse, we should focus on Microsoft to gauge the strength and staying power of this nascent bear rally. With a little more than $3 trillion capitalization, the software behemoth is the third-largest company in the world, just behind Apple and Nvidia. Unlike those companies, however, Microsoft is not especially vulnerable to an economic downturn, since such a large portion of the firm’s nearly $200 billion in revenues is derived from recurring subscriptions to cloud computing facilities, personal and business software. Microsoft will remain a cash cow in the hardest imaginable times, even if the supply of dollars implodes in a deflationary bust.

A ‘Buy’ Signal

So what does MSFT’s chart say? Last week, a rally tripped a theoretical buy signal at 394.56 that implies the stock will reach a minimum 412.20. We should expect a tradable pullback from that number, but if a nasty relapse follows instead, taking out the March 11 low at 376.91, that would suggest the bear market is about to resume with irresistible force. Alternatively, the most bullish scenario imaginable would be a fist-pump through 412.20 on first contact. If the stock can close for two consecutive days above that Hidden Pivot, the odds of a further run-up to as high as 447.49 would shorten significantly.

Even then, with MSFT lying within easy distance of July’s record 468.35, we’d need to be on our guard against a head-fake that would catch bulls and bears alike with their pants down. Given Microsoft’s exalted status in the corporate world, its chart cannot but tell the truth about the direction of the global economy.

Are New Highs Coming? Here’s How to Tell…

The Trump wild card has made it especially difficult to bet on the stock market. Even cynics can’t say for sure that his radical agenda will not eventually produce an economic golden era capable of pushing the Dow average to 100,000 or higher. In just two short months, the president has crushed wokeness and racial quotas, enabling most Americans to feel good about themselves for the first time since the 1950s. And although fraud and corruption in government will always be with us because that’s where the money is, it’s possible Trump has returned America to a path that will reinvigorate just leadership and honest institutions that we can be proud of. As for the tariffs, they are arguably the only medicine strong enough to jolt the world into doing honest business. The kicker is that they cannot but entice foreign manufacturers to expand their operations in the U.S. (If you have read this far and TDS rage has begun to churn your stomach, here’s some advice: Blow it out your shorts.)

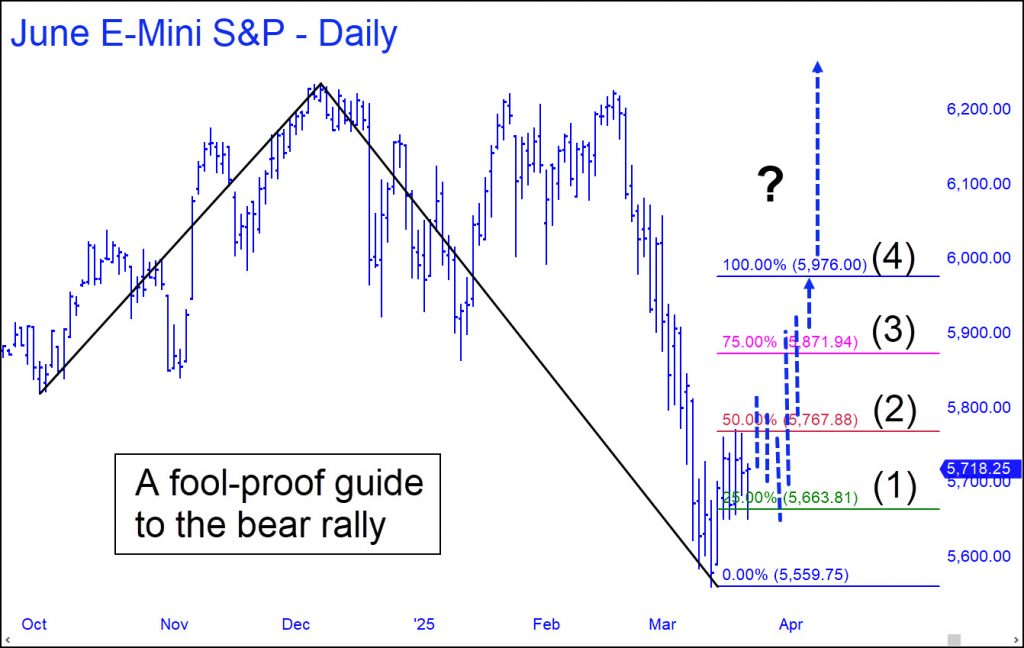

The graph above is intended as a do-it-yourself tool for gauging the power of the bear rally that began on March 13. The implication is that no short-squeeze will exceed the 5976.00 target (4) of the pattern shown. If it does, then permabears had better not get in the way of the thrust to new record highs that is likely to follow. I have drawn the chart according to the proprietary rules of the Hidden Pivot Method. This picture exhibits a ‘reverse ABCD pattern’ that I have watched in action 100,000 times and studied for nearly 30 years. Trust me, it works.

Pattern Is ‘Confirmed’

Its accuracy and reliability were confirmed last week when the booster stage of the presumptive bear rally stalled precisely at 5768 (2), a Hidden Pivot resistance that holds the key to interpreting the graph. If the futures should push decisively past it without dipping beneath the point C low at 5559.75 first, we can confidently infer they are bound for at least 5872 (3), the pattern’s ‘secondary Hidden Pivot’. And if buyers blow past that number, it’s safe to assume they’re locked onto 5976.00 as a minimum upside objective. Alternatively, a relapse this week or next that breaches the 5559.75 low would be a warning to investors to batten the hatches.

You needn’t trust Bloomberg’s talking heads or PhD pundits to tell us whether THE top is in and stocks have embarked on a potentially devastating decline. Simply interpret price movement on the chart in the way I’ve suggested and you’ll have your answer.

One Last Melt-Up?

Will there be one last melt-up before this doddering bull market seeks penance? Some of my fellow gurus believe a final show of bravado is coming, especially those who base their predictions on Elliott Wave Theory. I think the party is over, but I’m forced to admit that if too many traders agree with me, new record highs fueled by short-covering are likely. My skepticism is based more on market psychology than on the charts displayed above. We’ll get to them in a moment, but first let’s consider investors’ state of mind, based on what people we know have been saying.

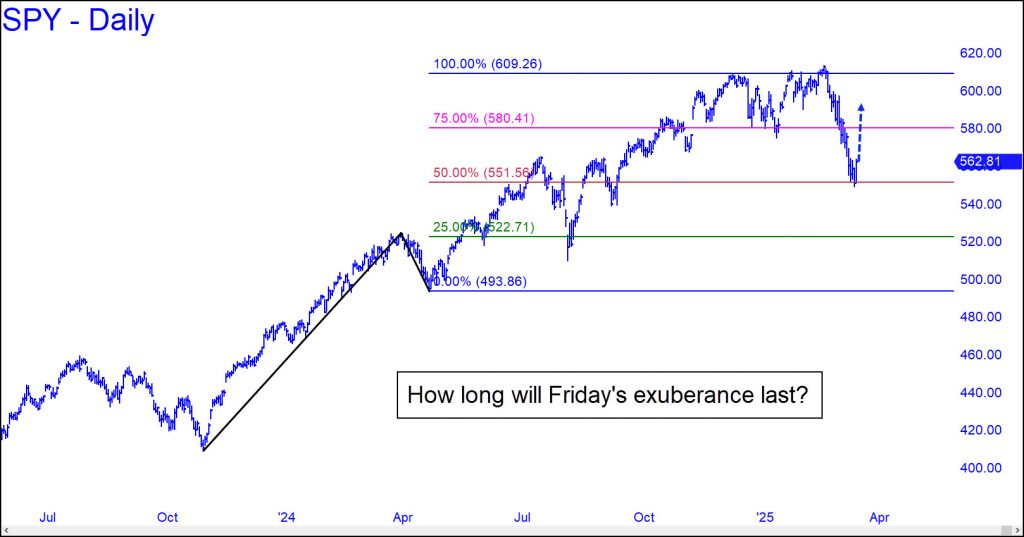

Stocks came down hard in the last month — hard enough for the usually thundering herd to wonder whether it might be time to bail out, or at least lighten up and move into cash. It was not quite a bloodfest, but the megastocks that made 2024 a year to brag about have been hit especially hard. When last week began, the broad averages had given up all of their Trump 2.0 gains and then some. But just when it seemed like stocks were about to go over the cliff, the S&Ps uncorked a 100-point rally on Friday, saving not only the day, but the week.

Come Monday, fear will have turned into nervous hope. I expect Mr Market to encourage this self-deception with more upside. And if Friday’s surge was the start of a bear rally worthy of the name, we should look for it to continue until nervous hope turns into greed. That would imply a run at the old highs.

A Different Kind of Dip

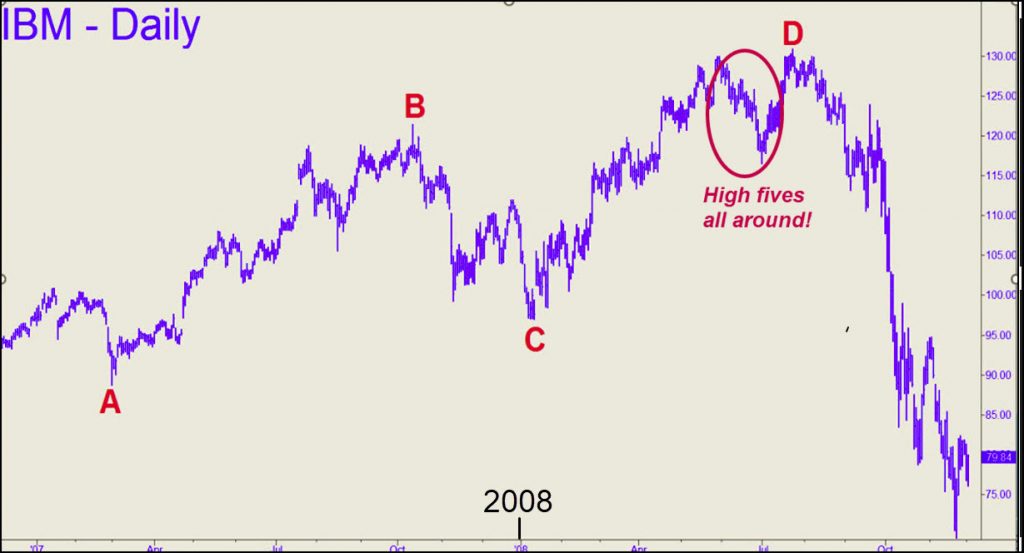

The similarities between the charts are too striking to dismiss, along with their implication that the Mother of All Tops is already in. As summer began in 2008, IBM came within an inch of a Hidden Pivot ‘D’ target, then fell sharply. I was too busy patting myself on the back to notice as it clawed its way back toward a marginal new high that actually touched my target. This time around, the S&P 500 ETF, or SPY, came within a hair of a 609.26 target I’d identified six months earlier. SPY then scuddled sideways for ten weeks, eventually poking slightly above the earlier high. This false promise quickly betrayed enough bulls that they have been unloading stocks for the last month. But the selling has been met with persistent bids, presumably by bulls who have not seen a dip fail to recover quickly since the bear market of 2007-09.

The charts differ mainly in the way I’ve truncated their respective A-B rallies, but the targets are equally valid. The IBM chart shows the devastation that can occur when literally everyone is on board at the top. In this case, the herd was joined by short-covering bears who threw in the towel when Big Blue pushed above the old high near $130. If SPY is about to replicate IBM’s swan song, the bounce that began on Friday should eventually bring it up to around 581, halfway to the top. We’ll be monitoring every feint, thrust and dive closely on the way up, so stick around if you want to be a step ahead.

It’s All About Buying Those Dips

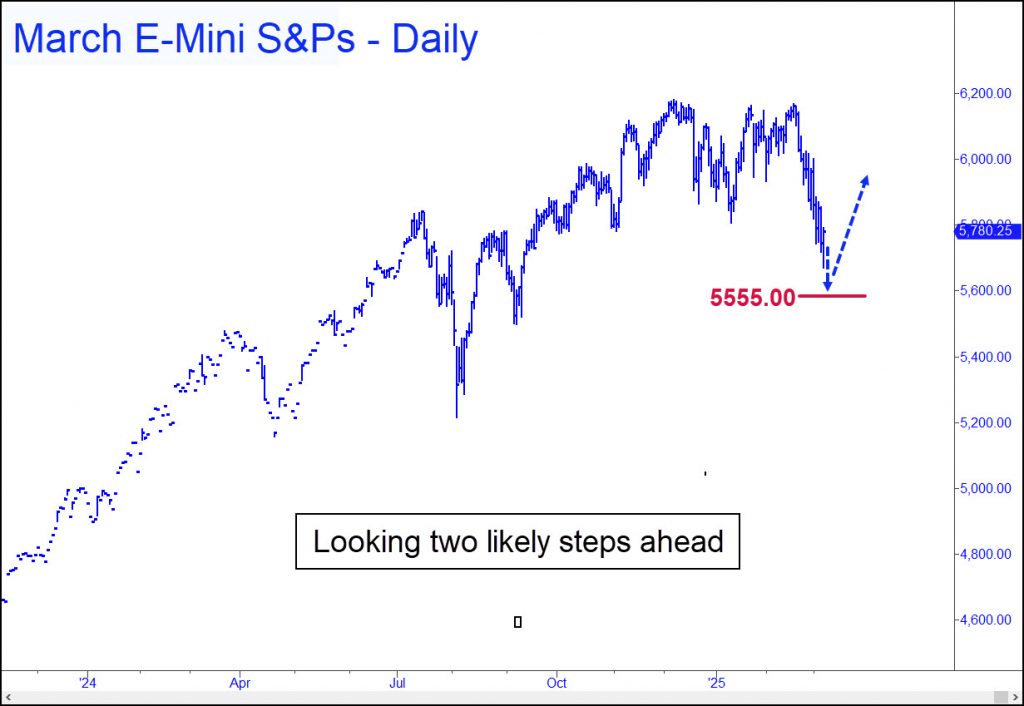

I’ve written here before about how the broad averages have struggled to go lower during what could turn out to be the initial phase of a bear market. Many traders, particularly greenhorns too young to have never experienced a bear market, appear to be buying each step of the way down. They could do so only if they were confident a rally lies just ahead. You can hardly blame them, since this has been more or less true for the last 16 years. The chart shows February’s selloff in graphic form. Notice the series of elongated bars over the last three weeks. Their steep, smooth fall resembles that of a parachute-drop rather than a crash landing. There is no trace of panic or even urgency in the decline, just hard selling that is being met minute-by-minute with serene buying, most of it occurring in the latter half of the day.

A Doge-y Economy

So far, the S&Ps have fallen 8% from the record highs they achieved near 6200 in December. That’s not even a stiff correction, let alone a bear market. But tariff talk and Doge layoffs have begun to unsettle the markets in ways that make a recession thinkable. A few retail analysts have even conceded there is a “small possibility” of a recession in 2025. In Wall Street-speak that’s practically a siren alert telling investors to prepare for Armageddon. But there is barely a hint of a downturn as yet, only two consecutive months of punk consumer spending. It is possible nonetheless to extrapolate a bearish scenario from the chart above. For starters, the S&P 500 will fall to the 5555 target shown. Then, they will rally with sufficient vigor to make tariff worries and the threat of a land war in Europe melt away, at least for a while. (Alternatively, the bounce could come from 5641.50, a proprietary ‘voodoo’ number.)

Although there is no reason to think that a minor mood change will push the broad averages to spectacular new highs, it’s no stretch to imagine the S&P mini-futures poking marginally above December’s record 6178. That would be enough to set the hook, goading bears into a short-covering riot while simultaneously convincing bulls that yet another moon shot is under way. Alternatively, a bear bounce could peter out well shy of the old top. Either way, we’ll be ready.

A ‘Formula’ for Preparedness

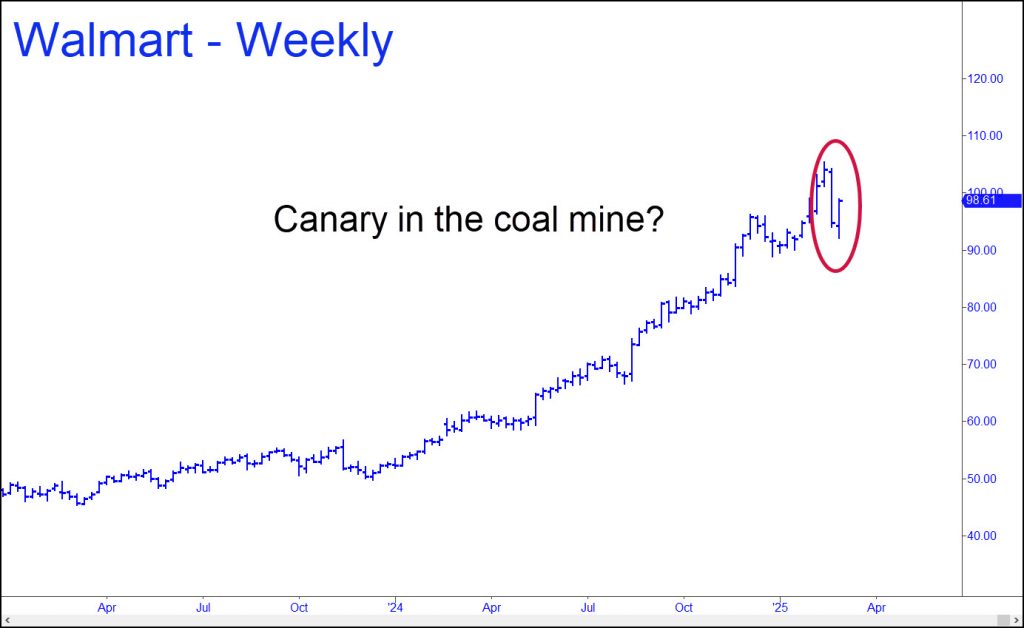

You’ve heard from ‘Formula382’ before. A longtime Rick’ Picks subscriber, he manages wealth in the Ozarks, using puts and calls aggressively, with a dollop of good timing, to keep clients happy. He has also shown uncanny skill at rotating out of sectors just before they peak. In a recent chat room discussion, Formula wondered whether the recent sharp break in the price of Walmart shares might be a harbinger of trouble – and not just minor trouble, either. He is concerned that when the bull market ends, possibly as soon as spring, it will usher in an economic depression worse than the 1930s. I not only share his pessimism, but also believe that a bust of such magnitude is unavoidable. Here’s the discussion thread from the Trading Room, lightly edited:

Formula382: We’ve all been wondering which stock would lead the market higher now that MSFT has fallen out of bed. Is price action in Walmart perhaps the canary in the coal mine? Is the stock not the largest indicator of overall consumer health? WMT’s dive following the recent earnings report was pretty severe — and fascinating. The company’s CFO expects suppliers to “take price” — i.e., suck up costs associated with inflation and/or tariffs. It turns out WMT doesn’t even factor in the effects of potential tariffs on revenue and earnings. Sounds bonkers to me.

The company’s shares have been trading at a 40 multiple, and Costco’s at a nose-bleed 60! These names historically have traded with multiples in and around the mid- to high-teens, much like the S&P. In short, WMT is commanding the multiple of many tech names with just 4-6% same-store sales growth. And not in a hundred Sundays do I believe that the upper crust of the U.S. is now shopping at Walmart. I live in the town they built and can tell you that although we all get our groceries there, I never set foot in a supercenter, not ever!

Cantaloupe Packers

So what’s changed? You can thimble-rig the perceived value of e-commerce by saying that people picking up at curbside is the equivalent of an online purchase; however, it’s merely shifting the work of picking out cantaloupe and cilantro to some high-school kid who does it for you on the company’s dime. Moreover, when customers pre-order, there’s no chance of an impulse purchase of a new salad dressing or hot-sauce.

Crowngas: I think Costco and Amazon are kings, Formula, and I agree with your point about Walmart’s online pickup. I use it religiously (or did when I lived in the states), and I tell my physical-training clients to use it for grocery pickup to avoid going in and buying “unhealthy products.” I am never an impulsive buyer, just the familiar stuff. As far as my stock-picking goes, AI is the future of technology. And one of these days, a small company in the AI business will become a giant like TSLA and Nvidia. A headline writer will ask, “What would $500 invested in this company be worth today?”

‘Too Optimistic’

Formula382: I would love to be that optimistic about anything, Crown, but I’m in the camp that after this market tops, which may be as soon as this spring, we’re headed for a decade-long or longer Greater Depression. Let me outline what I think we’re headed for, and this is also backdated to include a 5th of a 5th of a 5th final completion wave in the S&P and Dow, which is a 5th wave on the shorter term 2020 low until now. A 5th wave from the 2009 low until now and finally, the LONG-term 5th wave completing from the 1932 lows in the Dow. Based on these wave counts that are all converging, the S&P have either topped or will top in the 6250-6500 range. Once a high is established, we should see a drop of 30-40% in the S&P this year, taking them down to 3,500-4,000. We then spend the next couple of years bouncing between the lows and 5000-6000 before the next major move lower, establishing a lower low near 2,700.

Then a lower high again and a lower low once again until we finally find footing between 1,000-1,700 on the S&Ps, which will likely take us until the year 2035-2040 time frame before the ultimate low is struck. Then we can begin the next secular bull that lasts into the 2080 time frame. Might we see the count reset? Sure, anything is possible. But it’s aligning almost too perfectly [to abort]. In 1942, while war was raging, Ralph Nelson Elliott called for the market to go on a 70+ year tear and top sometime after 2012, an amazing call by any measure.

AI Can’t Save Us

My point here is that not even AI can save us from what’s on the horizon. Heck, it might even be a contributor to the deflation that’s likely to set in. Let’s see what happens if/when the SPX carves out a higher high in the aforementioned ranges, and how the market responds. If we visit the 4K level this summer/fall, everyone better start making plans for how they’re going to survive what’s coming.

JoeyJolt: I appreciate these posts, Formula. I’m especially interested in Elliott Wave Theory framing what is likely in the cards for the markets.

Formula 382: Joey, I’ll try to be more ‘vocal’ in here going forward. I think that if we can get the bigger strokes in our favor, with Rick’s precision, it could be a lethal combination. I’m trying to thread a needle with a chainsaw, and I’ve got my own ‘stuff’ to worry about. But I’m equally, if not more, concerned with the $700M+ my clients have entrusted me with.