THE MORNING LINE

‘Golden Era’ Could Face a Deep Valley First

Here’s some cold water on the notion that Trump’s radical trade policies could help bring about an economic golden era. I’d written here last week that punitive tariffs might be the only medicine strong enough to jolt the world into doing honest business. Foreign manufacturers would leap to relocate their plants to the U.S. in order to avoid the levies and also greatly reduce delivery costs.

There’s just one problem with this, wrote a subscriber, Ben, who posts regularly on the site. “I don’t think Trump has the time to re-shore to any great extent. He has 3.5 years, but this is something that takes more than two presidential terms to accomplish.” Indeed, as ambitious as Trump’s plans are, there is no political consensus to implement them.” Even some Republicans are resisting the idea of re-shoring.

Bear Threat

An additional problem is that a shake-up of global trade could trip stocks into a bear market, weakening the ability of middle class Americans to cope with the enormous cost of putting America first. High tariffs cannot but dramatically inflate the price of cars, appliances and other big-ticket items that Americans depend on from sources outside the U.S. Is Trump just bluffing? Even if he is, investors don’t have the luxury of counting on it.

A more immediate and intractable problem Trump will face is the ongoing collapse of commercial real estate. In dollar terms it is a huge number, and yet no big cities have taken commensurate writedowns. Instead, they all seem to be hoping that a massive economic upswing brings workers back to their offices. One San Francisco developer bet a hundred million dollars on this, buying an 11-story building for $40 million that had been assessed at $140 million. He plans to put $50 million of improvements into it, but the investment evidently is predicated on the fantasy that AI workers will fill San Francisco’s empty towers.

Rick's Free Picks

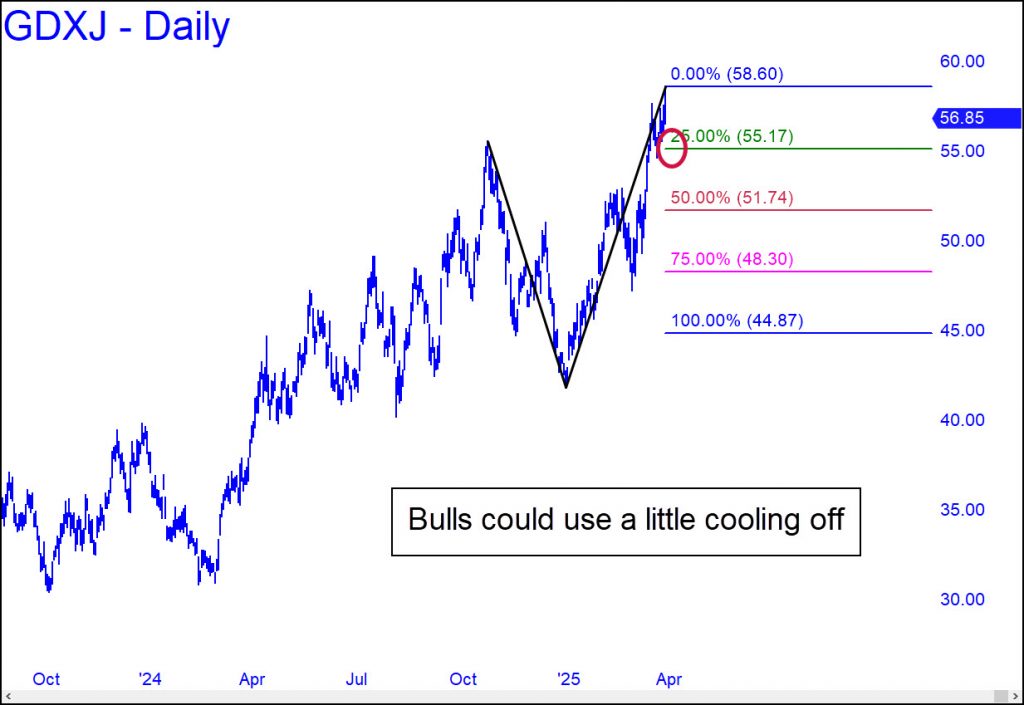

$GDXJ – Junior Gold Miner ETF (Last:56.85)

Because this symbol is overdue for a correction, I’ve arbitrarily drawn a chart that could signal the start of one if GDXJ falls to 55.17. That would trigger a theoretical ‘sell’ signal with downside potential to at least 51.74. An additional ‘hidden’ support at 55.63 could provide a tradable bounce.

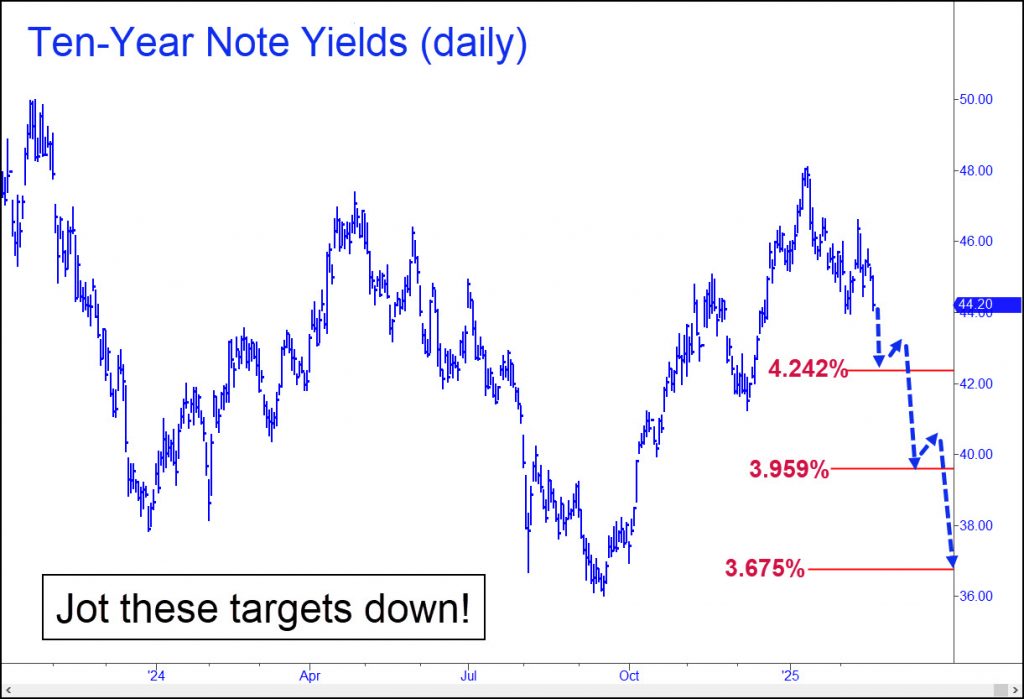

$TNX.X – Ten-Year Note Rate (Last:4.308%)

Expect ten-year rates to continue ratcheting lower, at least to the 3.959% ‘secondary pivot’ shown in the chart. The breach of p=4.242% was not decisive, and rates have yet to close for two consecutive weekly bars below it. However, the initial downside penetration reached the ‘sweet spot’ between p and

$DXY – NYBOT Dollar Index (Last:104.15)

Time for a tone change. This is a tough call, since I’ve been a hard-core deflationist since the mid-1970s after reading a persuasive book by the late C.V. Myers, and later another, The Great Reckoning, by James Dale Davidson and Lord William Rees-Mogg. Myers’ thesis was that the endgame for

$TNX.X – Ten-Year Note Rate (Last:4.42%)

Ten-Year yields have been pounding on a ‘hidden’ support at 4.430% for more than two weeks, presumably getting ready for a drop to exactly 4.242%. A tradable rally from that Hidden Pivot support looks like an 80% bet, but if it eventually gives way, look for a further fall to

Rick's work has been featured in

Monthly

Annually

Rick’s Picks Subscription

If you are looking for trading recommendations and forecasts that are precise, detailed and easy to follow, look no further.-

‘Uncannily accurate’ daily trading forecasts

-

Real-time alerts

-

Timely commentary on the predictions of other top gurus

-

Timely links to the world’s top financial analysts and advisors

-

Detailed coverage of stocks, cryptos, bullion,

index futures and ETFs -

A 24/7 chat room where veteran traders from around the world share opportunities and actionable ideas in real time

Rick’s Picks Subscription

If you are looking for trading recommendations and forecasts that are precise, detailed and easy to follow, look no further.-

‘Uncannily accurate’ daily trading forecasts

-

Real-time alerts

-

Timely commentary on the predictions of other top gurus

-

Timely links to the world’s top financial analysts and advisors

-

Detailed coverage of stocks, cryptos, bullion,

index futures and ETFs -

A 24/7 chat room where veteran traders from around the world share opportunities and actionable ideas in real time

Mechanical Trade Course

A very simple set-up that will have you trading profitably quickly even if you have never pulled the trigger before, and even with a small account.-

Leverage violent price action for exceptional gains without stress

-

Select trading vehicles matched to your bank account and appetite for risk

-

Reap fast, easy profits by exploiting the ‘discomfort zone’ where most traders fear to go

-

Enter all trades using limit orders that avoid slippage, even in $2000 stocks

-

Learn how to read the markets so that you no longer have to rely on the judgment of others