THE MORNING LINE

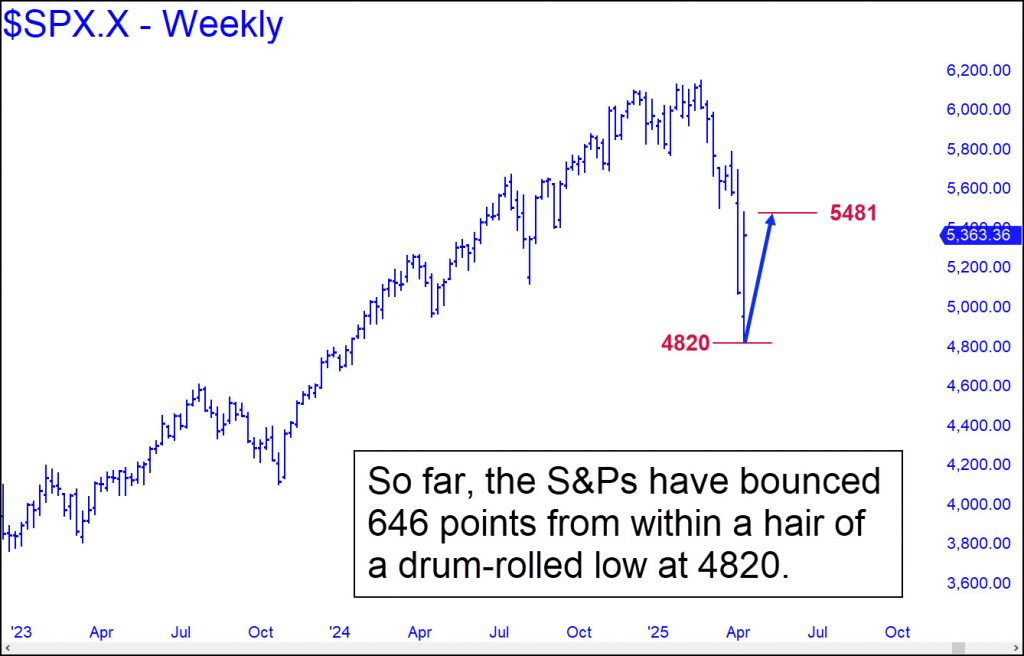

Round One vs. The Bear Goes to Trump

[Just ahead of last Monday’s steep plunge, I predicted here that an S&P reversal from 4820 would mark the end of the bear market. So far, SPX has rallied 646 points off an actual low at 4835. Bulls are not yet out of the woods, however, since a relapse could occur at any time. The stock market remains spooked by Europe’s dumping of Treasury paper in a deliberate attempt to destabilize the U.S. financial system. With the EU economy swirling down the crapper, the globalists are desperate to force Powell to ease in order to rescue big hedge funds that were leveraged up to their eyeballs with Treasury paper. So far, the Fed chairman has stood his ground, and it appears the EU attempt to sabotage the U.S. bond market will fail. In any event, the commentary below will continue to run until such time as the S&Ps crash the 4820 Hidden Pivot and prove me wrong. If you keep my thesis in mind — that as long as 4820 holds, there will be no recession, nor any harmful effects from tariffs — you will be better able to judge the jaw-dropping stupidity of the mainstream media’s coverage of Trump 2.0. Because of their blind hatred of the president, the eggheads, reporters, pundits and benighted editorialists will continue to get everything wrong until stocks are once again soaring to new all-time highs. RA]

***

A word of advice if you’re looking for bankable information on the direction of the economy: tune out the mainstream media’s cavalcade of Trump-deranged bozos and focus on the 4820 target in the SPX chart above. Think of it as Trump’s lucky number, but also a very good place for these all-too-interesting times to find temporary equilibrium. That is my worst-case target for a bear market that many believe is only just getting started. As a die-hard permabear myself, I’ve been eagerly anticipating the Mother of All Bears since, like, 2010. The global economy was badly in need of a reset and still is. It will happen, but not now. Instead, it looks like Trump is about to achieve the impossible, averting a catastrophic debt deflation while also staving off recession. Even the already certain collapse of commercial real estate will have to wait.

You cannot get to this happy place, psychologically speaking. if you stay tuned to the MSM morons who invent the news. You might as well listen to Whoopi Goldberg as to the “experts” who cover tariff news for MSNBC, The New York P.O.S. Times and Bloomberg. Bloomberg is probably the worst offender, since they literally live to kick Trump in the balls at every opportunity. (Don’t they know he’s wearing a Kevlar cup?) The latest Bloomberg teaser headline sums up the mainstream media’s knee-jerk reaction to the Orange Man: Trump’s Bear Market. Leave it to Bloomberg’s sniveling lightweights to discover and attempt to exploit a bear market just as it’s ending. Indeed, the storm surge is due to blow out to sea before the news editors at Bloomberg, the Times and WAPO have reached the Kleenex phase of their long-running circle jerk.

Christmas Glide Path

Tune them out and trust my 4820 target as a worst-case low for the bear market. To borrow Vizzini’s line, it is ‘INCONCEIVABLE!’ that the S&Ps will fall significantly below it, if at all. And that means Trump, Musk and their intrepid band of budget vigilantes will have put America back on a glide path just in time for Christmas. In other words: no recession, no harmful fallout from the tariffs, and no serious disruptions from lawfare shit-stain Norm Eisen and other treasonous actors hell-bent on destroying the U.S. through the courts. Far from a tariff-induced recession, watch for felicitous stirrings in the Rust Belt, where union workers will be telling a very different story compared to the ‘Orange Man BAD!‘ narrative on MSNBC and CNN.

If you’re interested in precise bear market targets for the ‘lunatic-sector’ stocks, take a free trial to Rick’s Picks and see my post on this in the chat room, or find them in my latest interview on Howe Street. Prepare to have your mind blown three months from now by the precise accuracy of my forecasts for climactic declines in NVDA, TSLA, AAPL, MSFT, GOOG, NFLX, CMG, META and AMZN.

Rick's Free Picks

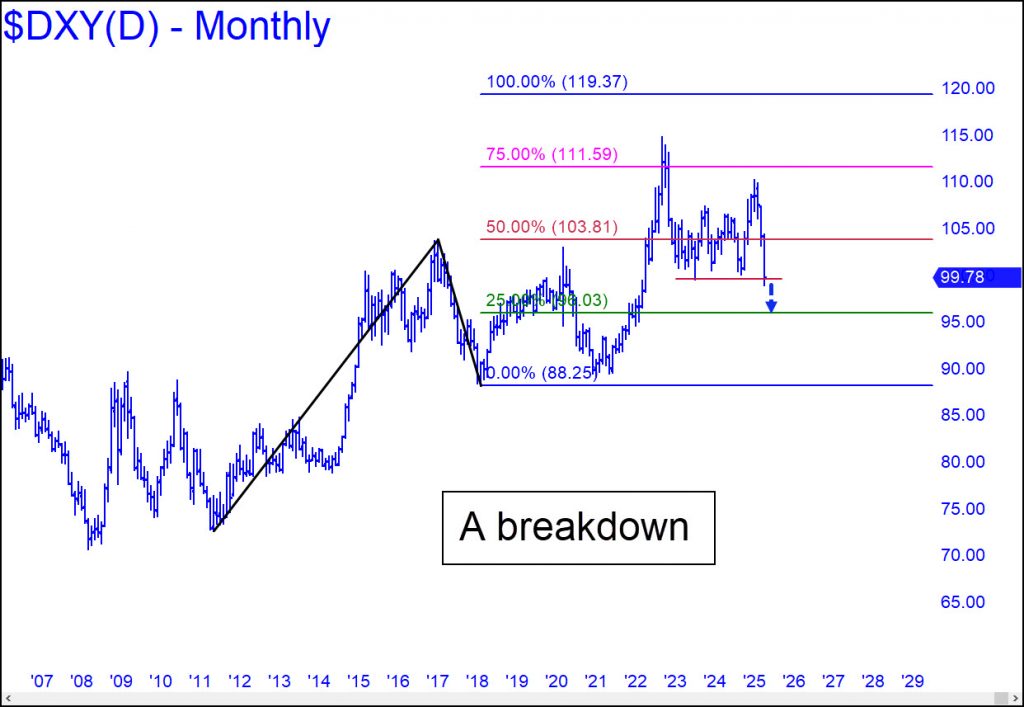

$DXY – NYBOT Dollar Index (Last:99.78)

The Dollar Index has broken down with last week’s penetration of a key low at 99.58 that was recorded in July 2023. Expect more weakness down to the green line (x=96.03), at least, before the greenback can turn around. A dip to the line would trigger a ‘mechanical’ buy predicated

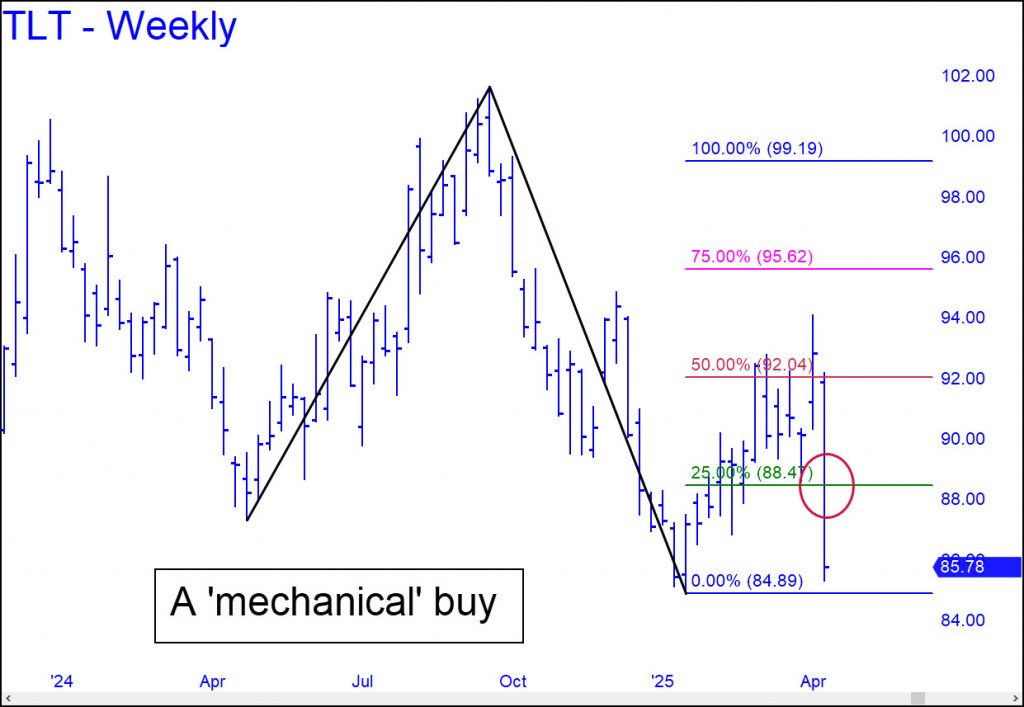

$TLT – Lehman Bond ETF (Last:86.65)

Despite the hellacious dive over the last ten days, TLT is on a double buy signal. The more important of the two is shown in the weekly chart (inset). An 88.47 bid would require a stop-loss at 84.88, just beneath the pattern’s point ‘c’ low. You can see how close

TNX.X – Ten-Year Note Rate (Last:4.49%)

Ten-Year rates have taken a Whoopee Cushion bounce en route to a presumptive bottom at 3.67%. It reportedly was caused by the wholesale dumping of T-Bonds by European banksters intent on disrupting U.S. financial markets. Powell’s tightening regimen is making it difficult for them to open up the credit spigot,

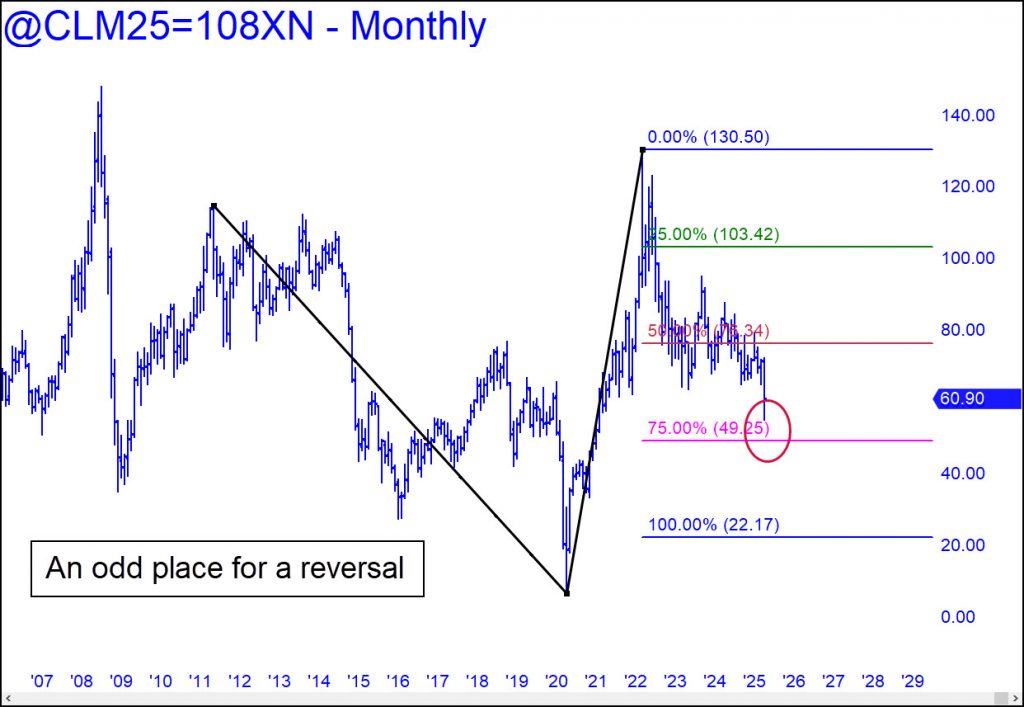

$CLM25 – June Crude (Last:60.90)

Quotes for crude have turned up from an odd place, just shy of a ‘secondary’ Hidden Pivot support at 49.25. Odds of a relapse will depend on how bulls fare pushing past a minor Hidden Pivot resistance at 62.22, and another at 65.68 (60-min, A=56.42 on 4/9). If both of

Rick's work has been featured in

Monthly

Annually

Rick’s Picks Subscription

If you are looking for trading recommendations and forecasts that are precise, detailed and easy to follow, look no further.-

‘Uncannily accurate’ daily trading forecasts

-

Real-time alerts

-

Timely commentary on the predictions of other top gurus

-

Timely links to the world’s top financial analysts and advisors

-

Detailed coverage of stocks, cryptos, bullion,

index futures and ETFs -

A 24/7 chat room where veteran traders from around the world share opportunities and actionable ideas in real time

Rick’s Picks Subscription

If you are looking for trading recommendations and forecasts that are precise, detailed and easy to follow, look no further.-

‘Uncannily accurate’ daily trading forecasts

-

Real-time alerts

-

Timely commentary on the predictions of other top gurus

-

Timely links to the world’s top financial analysts and advisors

-

Detailed coverage of stocks, cryptos, bullion,

index futures and ETFs -

A 24/7 chat room where veteran traders from around the world share opportunities and actionable ideas in real time

Mechanical Trade Course

A very simple set-up that will have you trading profitably quickly even if you have never pulled the trigger before, and even with a small account.-

Leverage violent price action for exceptional gains without stress

-

Select trading vehicles matched to your bank account and appetite for risk

-

Reap fast, easy profits by exploiting the ‘discomfort zone’ where most traders fear to go

-

Enter all trades using limit orders that avoid slippage, even in $2000 stocks

-

Learn how to read the markets so that you no longer have to rely on the judgment of others