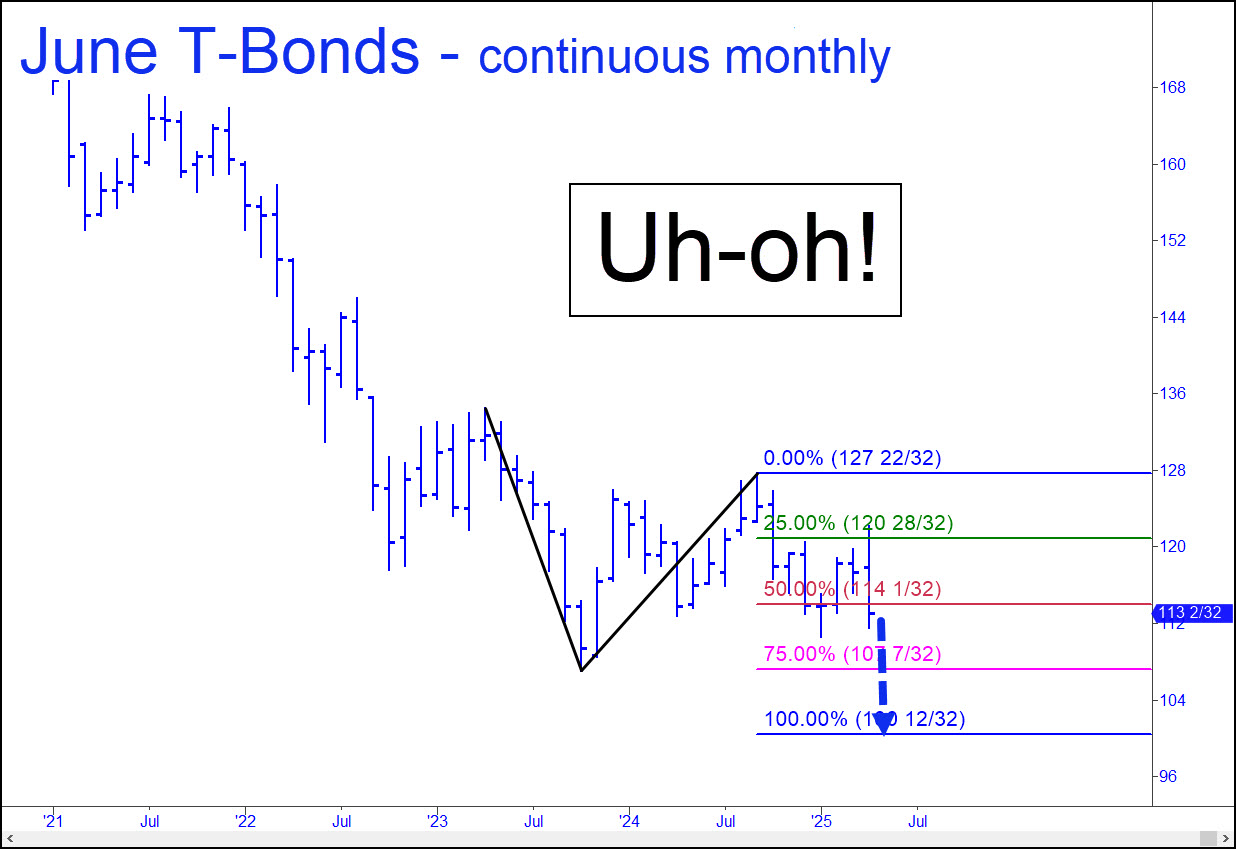

T-Bonds and stocks came down so hard today that I now give my ‘outrageously bullish scenario’ (see above) no better than a 50% chance of surviving. Putting aside gold’s globally unnerving price surge, June T-Bond futures bulldozed a path down to as low as 100^12. If that were to happen, the implied rise in interest rates would be sufficient to tip the U.S. and global economies into deepest recession.

T-Bonds and stocks came down so hard today that I now give my ‘outrageously bullish scenario’ (see above) no better than a 50% chance of surviving. Putting aside gold’s globally unnerving price surge, June T-Bond futures bulldozed a path down to as low as 100^12. If that were to happen, the implied rise in interest rates would be sufficient to tip the U.S. and global economies into deepest recession.

A reported $7.5 trillion in Treasury debt needs to be refinanced over the next three years, with much of it due in 2025. It is therefore a particularly bad time for the Masters of the Universe to lose control of long-term rates. Beleaguered consumers will struggle even harder, and an already tottering commercial real estate market will finally give up the ghost. Residential real estate is about to deflate as well, putting a potentially economically rejuvenating refinancing cycle so far out of reach that Baby Boomers might not see another in their lifetime. Trump will get the blame, and deservedly so. Usually, economic cycles of boom and bust are much bigger than the presidency, but in this case, if stocks continue to fall, Trump will surely have been the catalyst.

USM25 – June T-Bonds (Last:113^02)

Posted on April 21, 2025, 6:33 pm EDT

Last Updated April 21, 2025, 6:33 pm EDT

Posted on April 21, 2025, 6:33 pm EDT

Last Updated April 21, 2025, 6:33 pm EDT