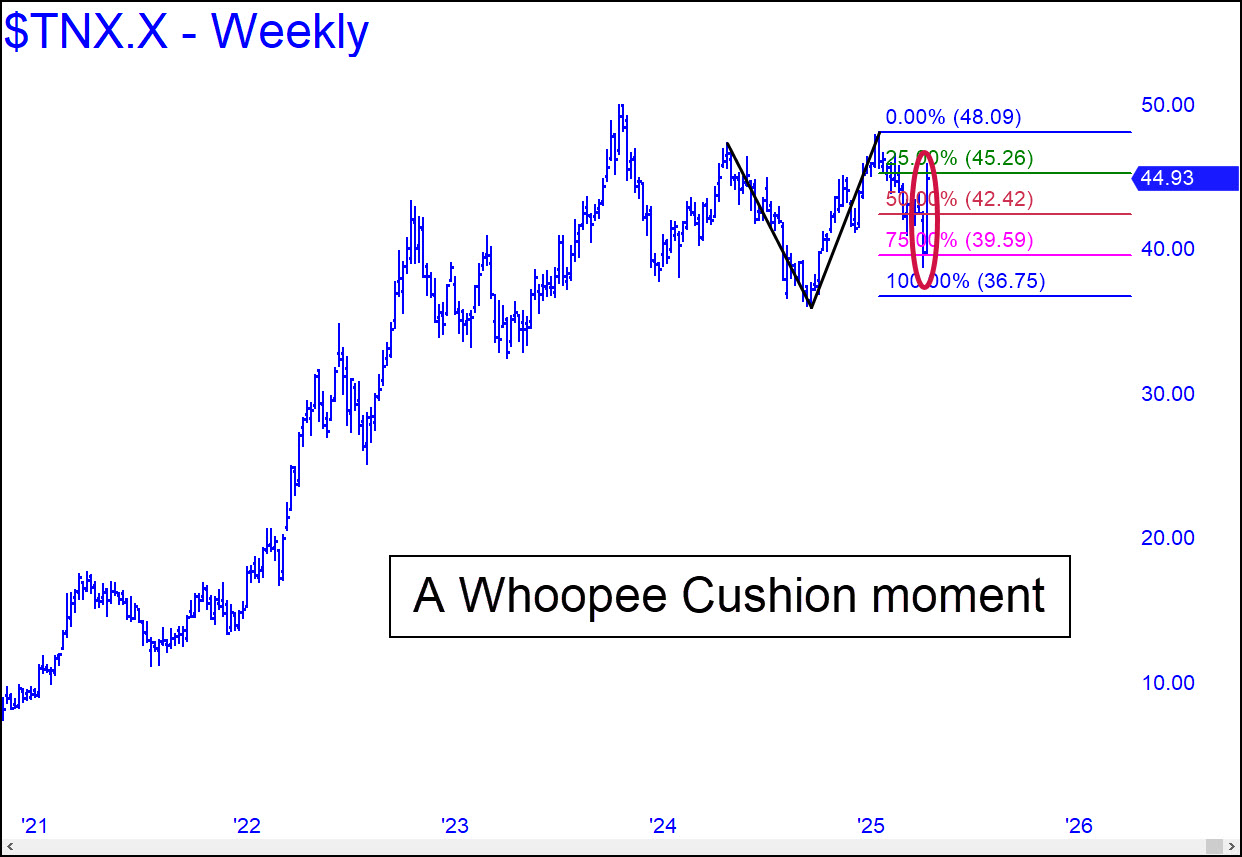

Ten-Year rates have taken a Whoopee Cushion bounce en route to a presumptive bottom at 3.67%. It reportedly was caused by the wholesale dumping of T-Bonds by European banksters intent on disrupting U.S. financial markets. Powell’s tightening regimen is making it difficult for them to open up the credit spigot, and so they have desperately tried to force his hand. The survival of some large American hedge funds could be at stake, since they were leveraged up to the eyeballs with a spread that required a bullish position in bonds. With Powell standing his ground, my gut feeling is that the panic will subside shortly and that rates will not break out above January’s 4.81% high.

Ten-Year rates have taken a Whoopee Cushion bounce en route to a presumptive bottom at 3.67%. It reportedly was caused by the wholesale dumping of T-Bonds by European banksters intent on disrupting U.S. financial markets. Powell’s tightening regimen is making it difficult for them to open up the credit spigot, and so they have desperately tried to force his hand. The survival of some large American hedge funds could be at stake, since they were leveraged up to the eyeballs with a spread that required a bullish position in bonds. With Powell standing his ground, my gut feeling is that the panic will subside shortly and that rates will not break out above January’s 4.81% high.

TNX.X – Ten-Year Note Rate (Last:4.49%)

Posted on April 13, 2025, 5:16 pm EDT

Last Updated April 12, 2025, 4:45 pm EDT

Posted on April 13, 2025, 5:16 pm EDT

Last Updated April 12, 2025, 4:45 pm EDT