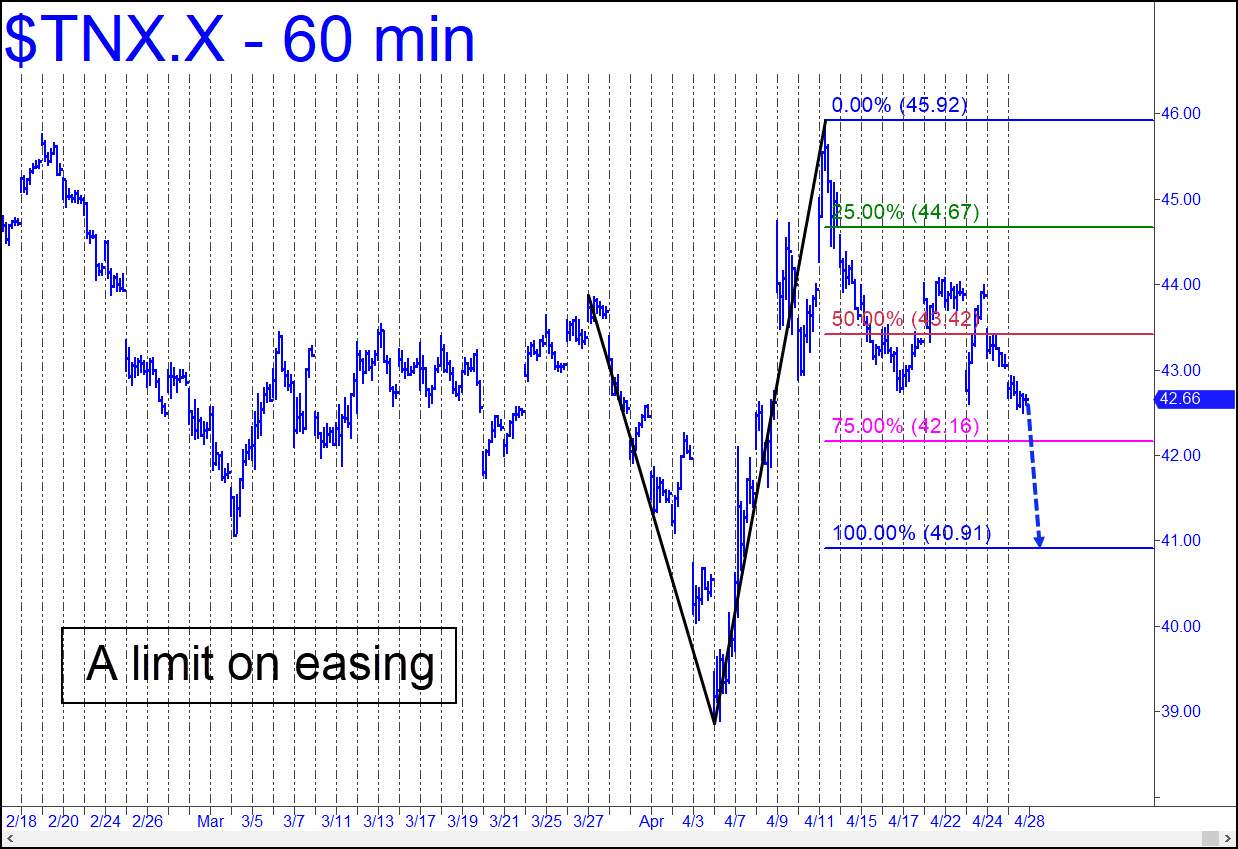

As last week began, rates on the Ten-Year Note looked ready to jump to 4.58% from an already uncomfortable 4.40%. Instead, they eased sufficiently to suggest the trend will continue down to 4.09%, the ‘d’ target shown in the chart. That might be the most we can hope for, but if the weakness penetrates the ‘hidden’ support at that level, it could portend more slippage to 4.07%, or even 3.90%. These are somewhat different from the potential lows we were tracking earlier, but the graph looks equally capable of giving us an accurate read over the next 3-5 weeks.

As last week began, rates on the Ten-Year Note looked ready to jump to 4.58% from an already uncomfortable 4.40%. Instead, they eased sufficiently to suggest the trend will continue down to 4.09%, the ‘d’ target shown in the chart. That might be the most we can hope for, but if the weakness penetrates the ‘hidden’ support at that level, it could portend more slippage to 4.07%, or even 3.90%. These are somewhat different from the potential lows we were tracking earlier, but the graph looks equally capable of giving us an accurate read over the next 3-5 weeks.

TNX.X – Ten-Year Note Rate (Last:4.26%)

Posted on April 27, 2025, 5:17 pm EDT

Last Updated April 25, 2025, 10:17 pm EDT

Posted on April 27, 2025, 5:17 pm EDT

Last Updated April 25, 2025, 10:17 pm EDT