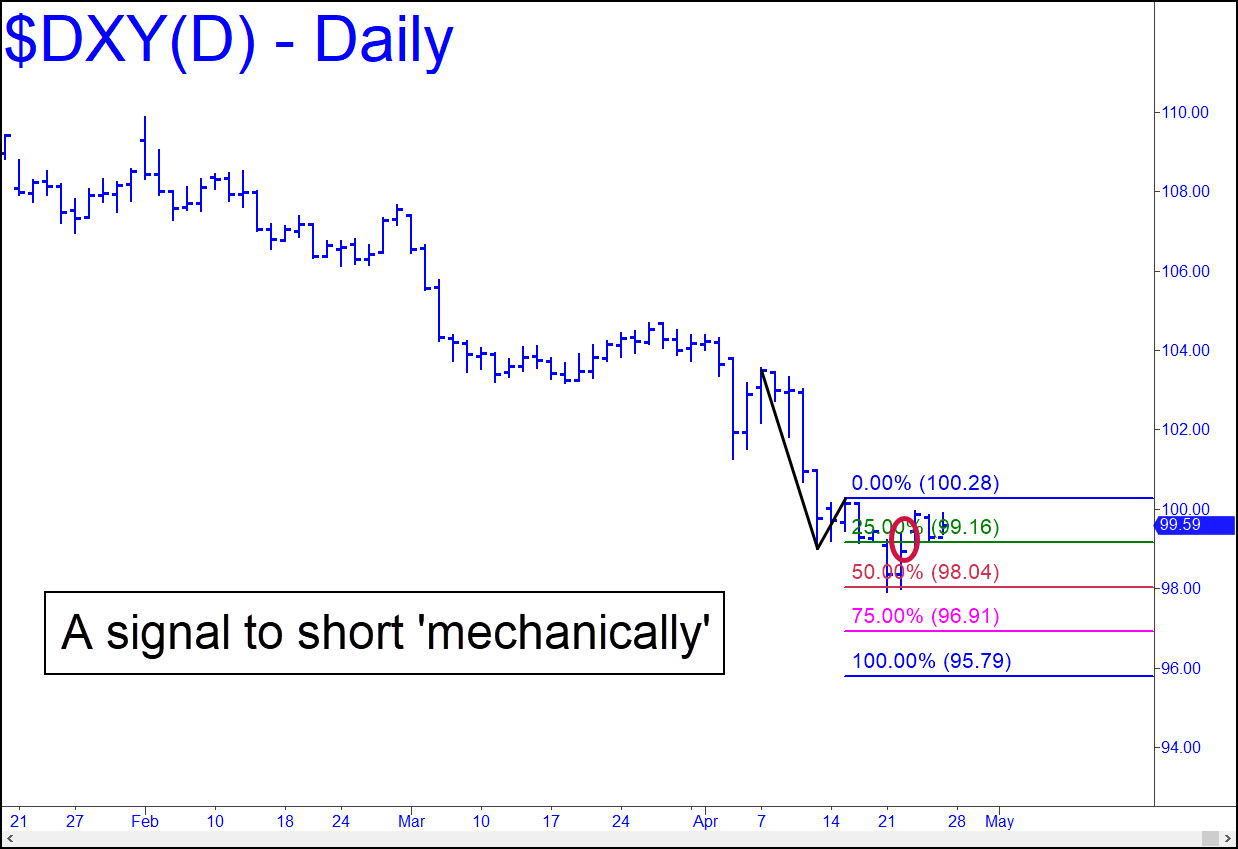

The Dollar Index triggered a ‘mechanical’ short when it rallied to the green line as the week began. The signal would rate a 6.0 out of 10, since the low that preceded the rally was distant from our sweet spot, even if it did touch the red line. I am leaning bearish, but if DXY blows past C=100.28 toward the beginning of the week, we should give the move the attention it deserves. The greenback is long overdue for a rally, and there’s nothing to say it can’t start here. Worst case for the near term is 95.79, the ‘D’ target of the pattern shown.

The Dollar Index triggered a ‘mechanical’ short when it rallied to the green line as the week began. The signal would rate a 6.0 out of 10, since the low that preceded the rally was distant from our sweet spot, even if it did touch the red line. I am leaning bearish, but if DXY blows past C=100.28 toward the beginning of the week, we should give the move the attention it deserves. The greenback is long overdue for a rally, and there’s nothing to say it can’t start here. Worst case for the near term is 95.79, the ‘D’ target of the pattern shown.

$DXY – NYBOT Dollar Index (Last:99.59)

Posted on April 27, 2025, 5:12 pm EDT

Last Updated April 25, 2025, 9:38 pm EDT

Posted on April 27, 2025, 5:12 pm EDT

Last Updated April 25, 2025, 9:38 pm EDT