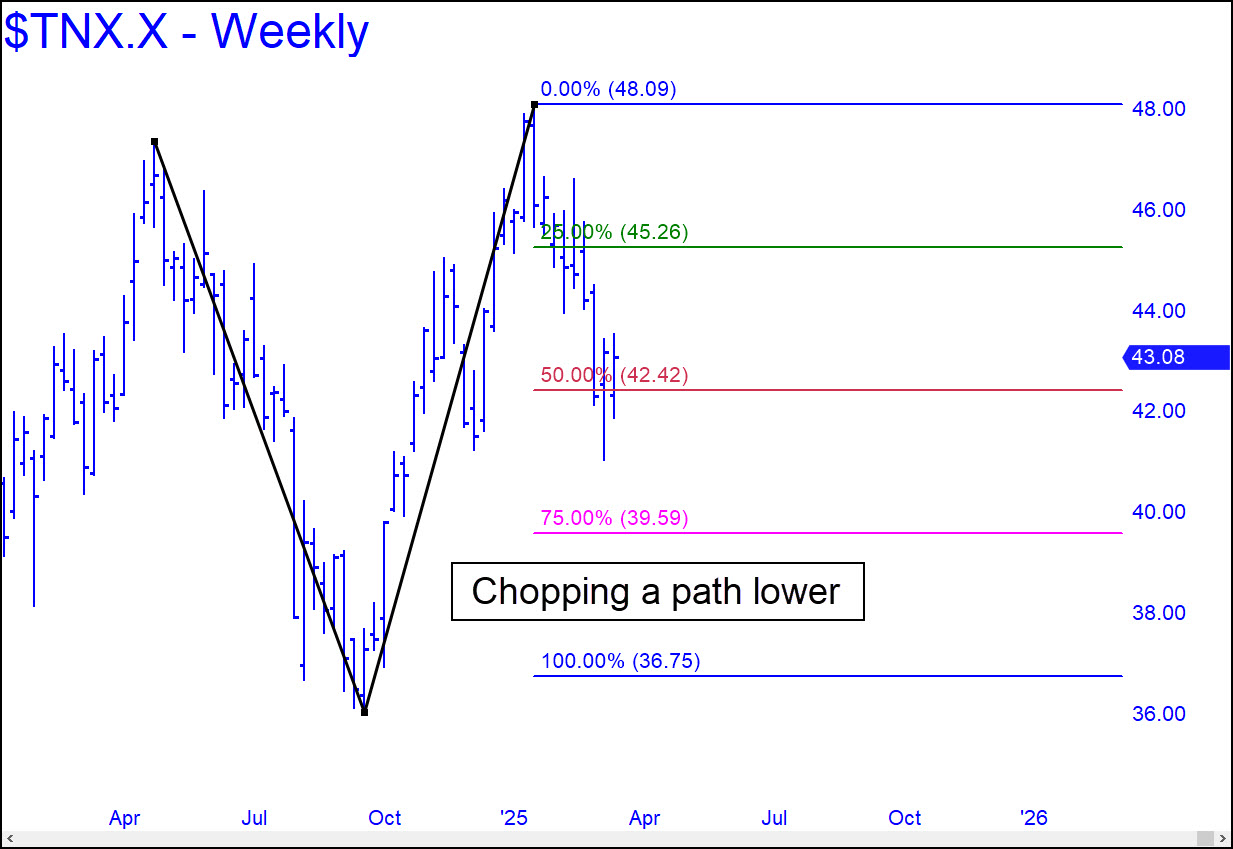

Expect ten-year rates to continue ratcheting lower, at least to the 3.959% ‘secondary pivot’ shown in the chart. The breach of p=4.242% was not decisive, and rates have yet to close for two consecutive weekly bars below it. However, the initial downside penetration reached the ‘sweet spot’ between p and p2, implying that an uptick in rates to the green line (x=4.526%) would be a short sale. The chart is inconclusive about whether d=3.675% will be achieved, but an overshoot of p2 would shorten the odds. It is my maximum downside target, nonetheless.

Expect ten-year rates to continue ratcheting lower, at least to the 3.959% ‘secondary pivot’ shown in the chart. The breach of p=4.242% was not decisive, and rates have yet to close for two consecutive weekly bars below it. However, the initial downside penetration reached the ‘sweet spot’ between p and p2, implying that an uptick in rates to the green line (x=4.526%) would be a short sale. The chart is inconclusive about whether d=3.675% will be achieved, but an overshoot of p2 would shorten the odds. It is my maximum downside target, nonetheless.

$TNX.X – Ten-Year Note Rate (Last:4.308%)

Posted on March 16, 2025, 5:16 pm EDT

Last Updated March 14, 2025, 11:17 pm EDT

Posted on March 16, 2025, 5:16 pm EDT

Last Updated March 14, 2025, 11:17 pm EDT