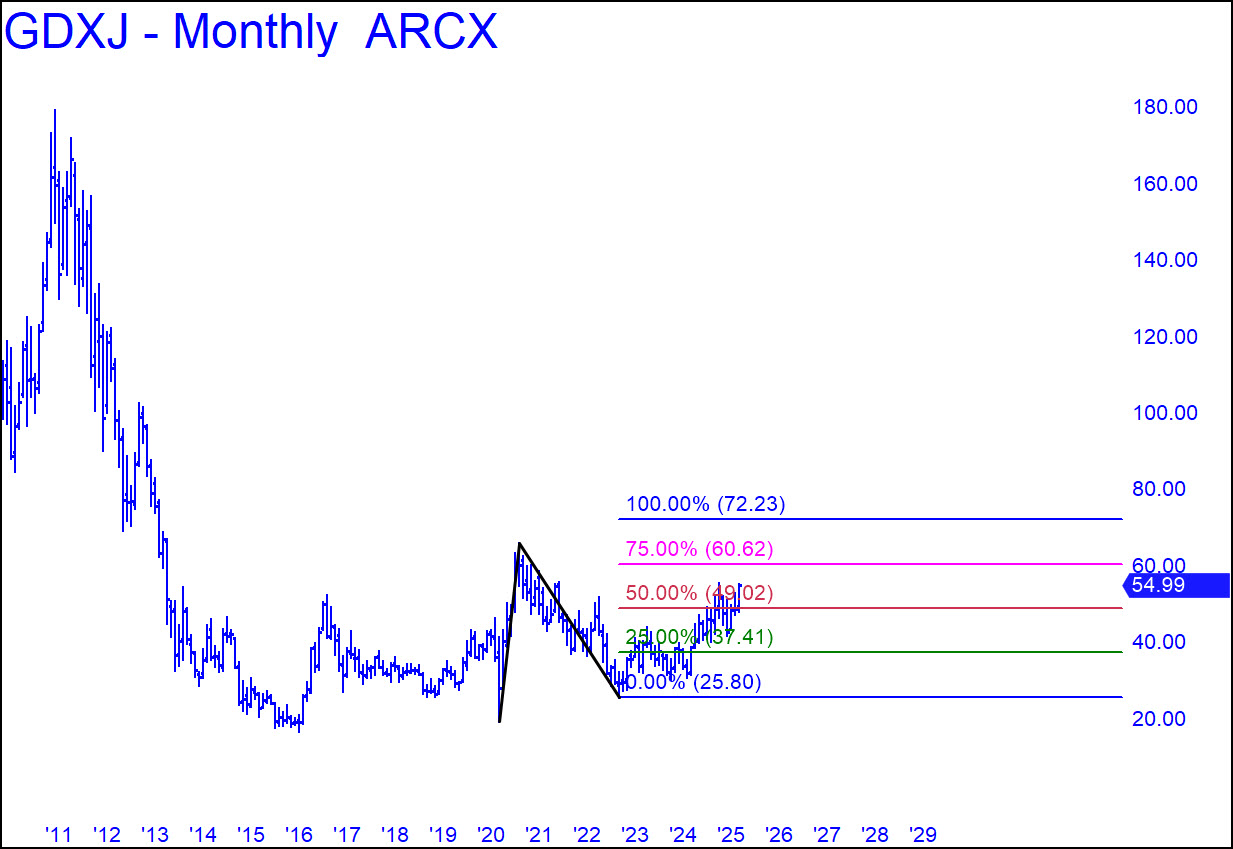

There is little doubt GDXJ will soon achieve the 57.17 target shown. Is that all there is, some might ask. Not by a longshot. Here’s a bigger picture that shows upside potential to as high as 72.73. More immediately, the 60.62 ‘secondary’ pivot looks like a solid bet to get hit. A puzzle, though, is what could happen after 72.23, a number that would exhaust conventional targets. It turns out that a reverse pattern begun from 84.72 in Feb 2010 allows for upside to as high as 111.59 (!) The corresponding midpoint resistance lies at 64.23, and it roughly coincides with a peak at 65.95 recorded in August 2020, implying double resistance at that level. That is a good thing, since it will create a ‘magnetic’ challenge for bulls to overcome.

There is little doubt GDXJ will soon achieve the 57.17 target shown. Is that all there is, some might ask. Not by a longshot. Here’s a bigger picture that shows upside potential to as high as 72.73. More immediately, the 60.62 ‘secondary’ pivot looks like a solid bet to get hit. A puzzle, though, is what could happen after 72.23, a number that would exhaust conventional targets. It turns out that a reverse pattern begun from 84.72 in Feb 2010 allows for upside to as high as 111.59 (!) The corresponding midpoint resistance lies at 64.23, and it roughly coincides with a peak at 65.95 recorded in August 2020, implying double resistance at that level. That is a good thing, since it will create a ‘magnetic’ challenge for bulls to overcome.

$GDXJ – Junior Gold Miner ETF (Last:54.99)

Posted on March 16, 2025, 5:22 pm EDT

Last Updated March 15, 2025, 2:13 pm EDT

Posted on March 16, 2025, 5:22 pm EDT

Last Updated March 15, 2025, 2:13 pm EDT