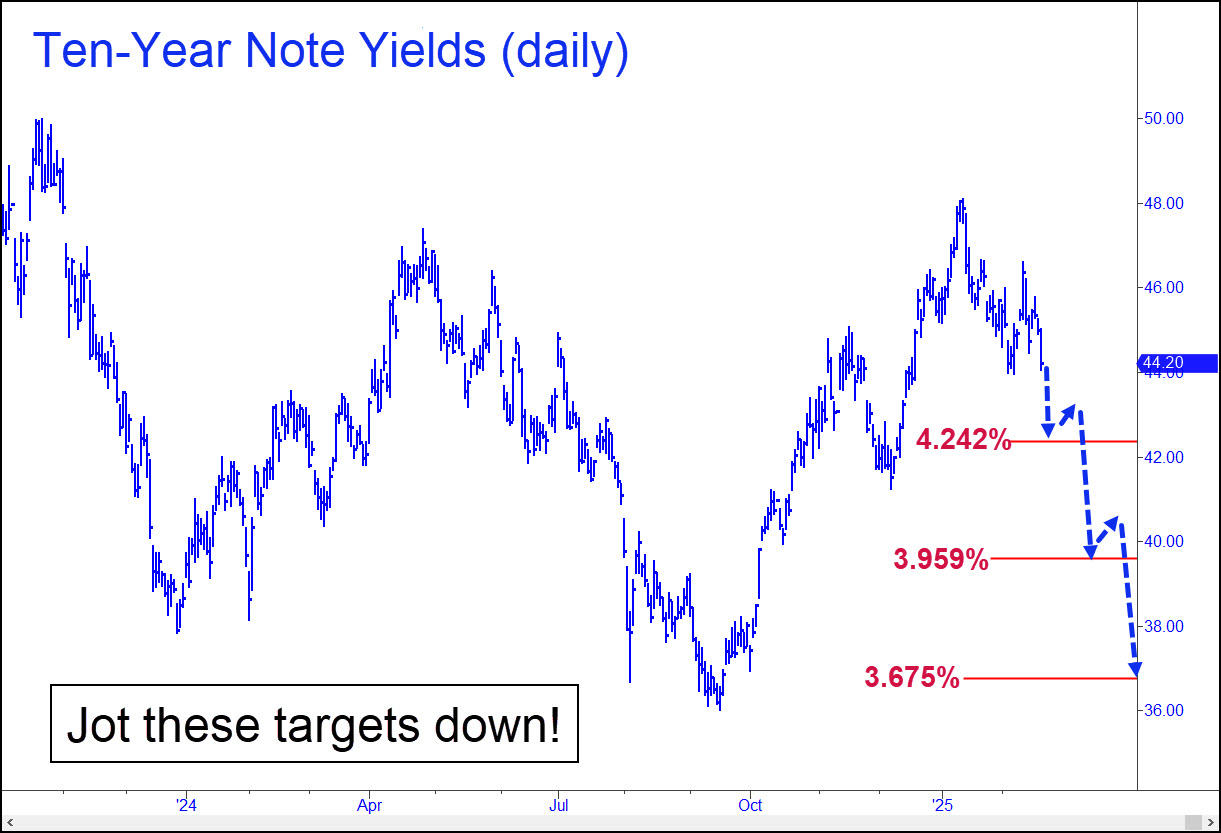

Ten-Year yields have been pounding on a ‘hidden’ support at 4.430% for more than two weeks, presumably getting ready for a drop to exactly 4.242%. A tradable rally from that Hidden Pivot support looks like an 80% bet, but if it eventually gives way, look for a further fall to 3.959% or even 3.675%. By all means, jot these numbers down if you care about where long-term interest rates are headed, since charts can predict them far more accurately than the dartboard guesses you’ll get from Bloomberg’s talking heads, The Economist, The Wall Street Journal, the punditry, Fox Business News, MSNBC et al.

Ten-Year yields have been pounding on a ‘hidden’ support at 4.430% for more than two weeks, presumably getting ready for a drop to exactly 4.242%. A tradable rally from that Hidden Pivot support looks like an 80% bet, but if it eventually gives way, look for a further fall to 3.959% or even 3.675%. By all means, jot these numbers down if you care about where long-term interest rates are headed, since charts can predict them far more accurately than the dartboard guesses you’ll get from Bloomberg’s talking heads, The Economist, The Wall Street Journal, the punditry, Fox Business News, MSNBC et al.

$TNX.X – Ten-Year Note Rate (Last:4.42%)

Posted on February 23, 2025, 5:23 pm EST

Last Updated March 1, 2025, 3:29 pm EST

Posted on February 23, 2025, 5:23 pm EST

Last Updated March 1, 2025, 3:29 pm EST

- March 3, 2025, 11:56 am

Manufacturing Prices are rising. Tariffs seal the deal. Stagflation is the next stop. Isolationism and trade war with the world isn’t a prescription for lower interest rates. Firing key personnel in key industries making sure abuses and cheating thrive. No longer is there a watchdog. The banking crisis is small potatoes compared to the current environment. Insane Wall Street assumptions like the Pandemic wouldn’t cause any major disruption. that lasted 5 weeks till just one death on our soil resulted in a crash. Debt to GDP as high as the start of WW II. Watch the data carefully. First Manufacturing costs spike then… Already happening. 10 Year at 4.19 as we speak. We will see 4.5% before we see 4.1% Should start now. I know the assumptions and I am going against the tide here.