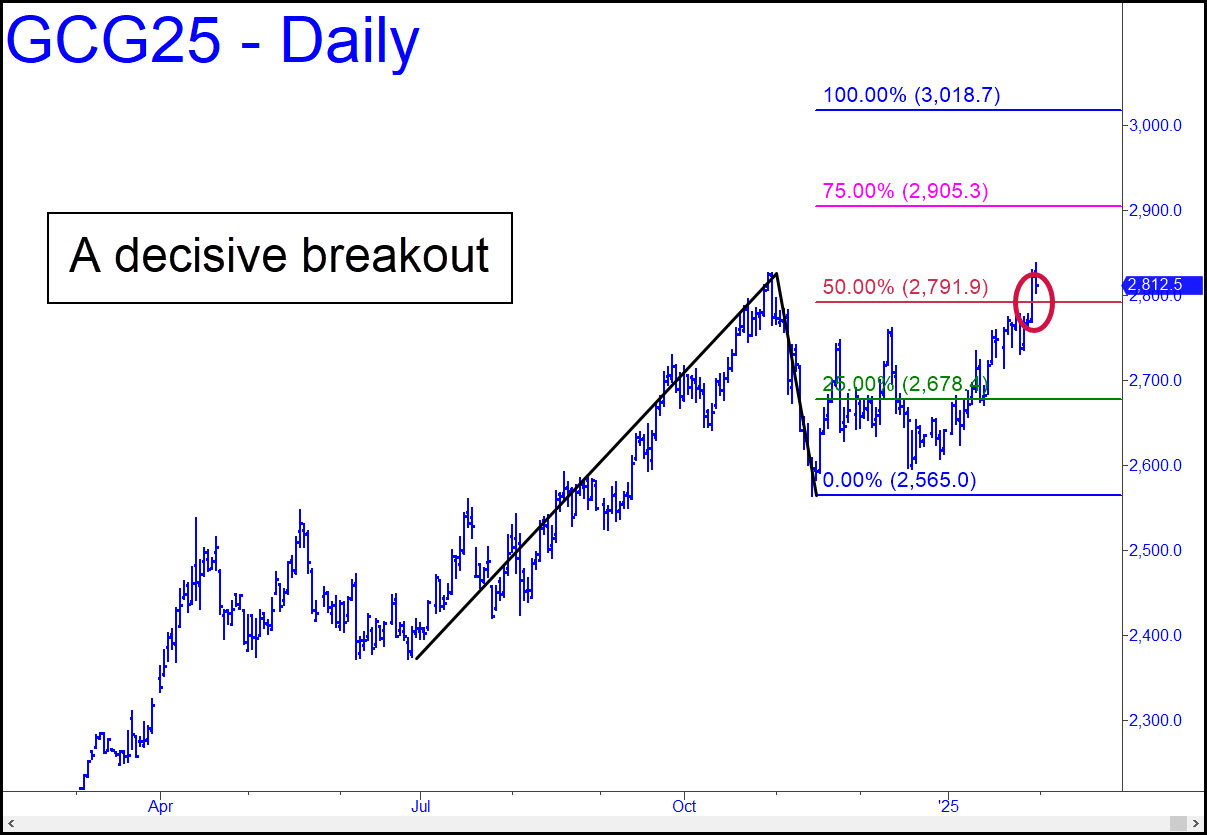

Last week’s decisive breakout above the 2791.90 midpoint Hidden Pivot shown in the chart all but clinches a follow-through to at least p2=2905.30, and thence to an almost as likely D target at 3018.70. (The April equivalents are, respectively, 2927.40 and 3040.90.) A pullback in the meantime to the green line (x=2678, or 2700.30, basis April), however unlikely, would offer the juiciest ‘mechanical’ buying opportunity we’ve seen in a long while. More immediately, you should expect a potentially tradable stall at 2854.80 (2883, basis April), my minimum upside target for the near term.

Last week’s decisive breakout above the 2791.90 midpoint Hidden Pivot shown in the chart all but clinches a follow-through to at least p2=2905.30, and thence to an almost as likely D target at 3018.70. (The April equivalents are, respectively, 2927.40 and 3040.90.) A pullback in the meantime to the green line (x=2678, or 2700.30, basis April), however unlikely, would offer the juiciest ‘mechanical’ buying opportunity we’ve seen in a long while. More immediately, you should expect a potentially tradable stall at 2854.80 (2883, basis April), my minimum upside target for the near term.

The usual imbeciles are attributing the breakout to Trump’s tariff plans, whatever they might be, but also to a run on London bullion inventories by presumptive buyers in China and India, and to many other sovereign entities that evidently want to be prepared if this already-too-interesting world should turn still more interesting. There is as yet little evidence that the spike in demand for gold has fed into Bitcoin. True disbelievers in the latter’s value and potential should consider betting the spread will widen, but don’t expect Michael Saylor and his ilk to fade you till their heads cave in.