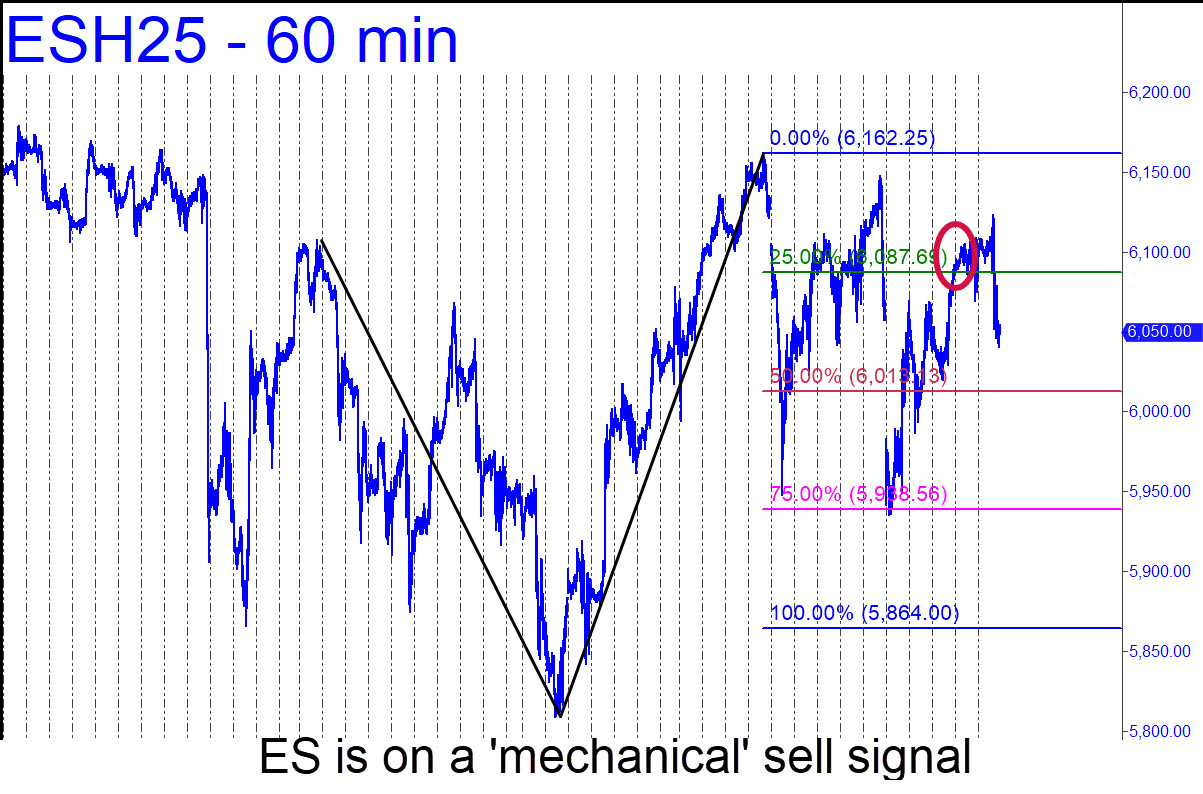

The week ended with the futures on a ‘mechanical’ sell signal that is showing a nice profit, but I doubt whether the downtrend will reach the ‘D’ target at 5864. This is the second such signal in two weeks, the first having produced a theoretical gain of as much as $4,000 per contract. The subsequent bounce made up the lost ground and then some, demonstrating that bulls are not about to roll over quietly when the occasional barrage of selling hits. Look for the current weakness to find at least temporary support, potentially tradable, at 6014.25 (60m, A=.6147.75 on 1/31). A decisive penetration of that Hidden Pivot support on first contact would imply further slippage to at least 5961.25. _______ UPDATE (Feb 10, 7:40 a.m. EST): The futures have taken a so-far 68-point bounce from within a single tick of the 6014.25 Hidden Pivot support I’d suggested using for bottom-fishing. A single contract purchased there when the futures began trading Sunday could have reaped a profit of as much as $3800.

The week ended with the futures on a ‘mechanical’ sell signal that is showing a nice profit, but I doubt whether the downtrend will reach the ‘D’ target at 5864. This is the second such signal in two weeks, the first having produced a theoretical gain of as much as $4,000 per contract. The subsequent bounce made up the lost ground and then some, demonstrating that bulls are not about to roll over quietly when the occasional barrage of selling hits. Look for the current weakness to find at least temporary support, potentially tradable, at 6014.25 (60m, A=.6147.75 on 1/31). A decisive penetration of that Hidden Pivot support on first contact would imply further slippage to at least 5961.25. _______ UPDATE (Feb 10, 7:40 a.m. EST): The futures have taken a so-far 68-point bounce from within a single tick of the 6014.25 Hidden Pivot support I’d suggested using for bottom-fishing. A single contract purchased there when the futures began trading Sunday could have reaped a profit of as much as $3800.

ESH25 – March E-Mini S&Ps (Last:6075.00)

Posted on February 9, 2025, 5:18 pm EST

Last Updated February 10, 2025, 7:38 am EST

Posted on February 9, 2025, 5:18 pm EST

Last Updated February 10, 2025, 7:38 am EST