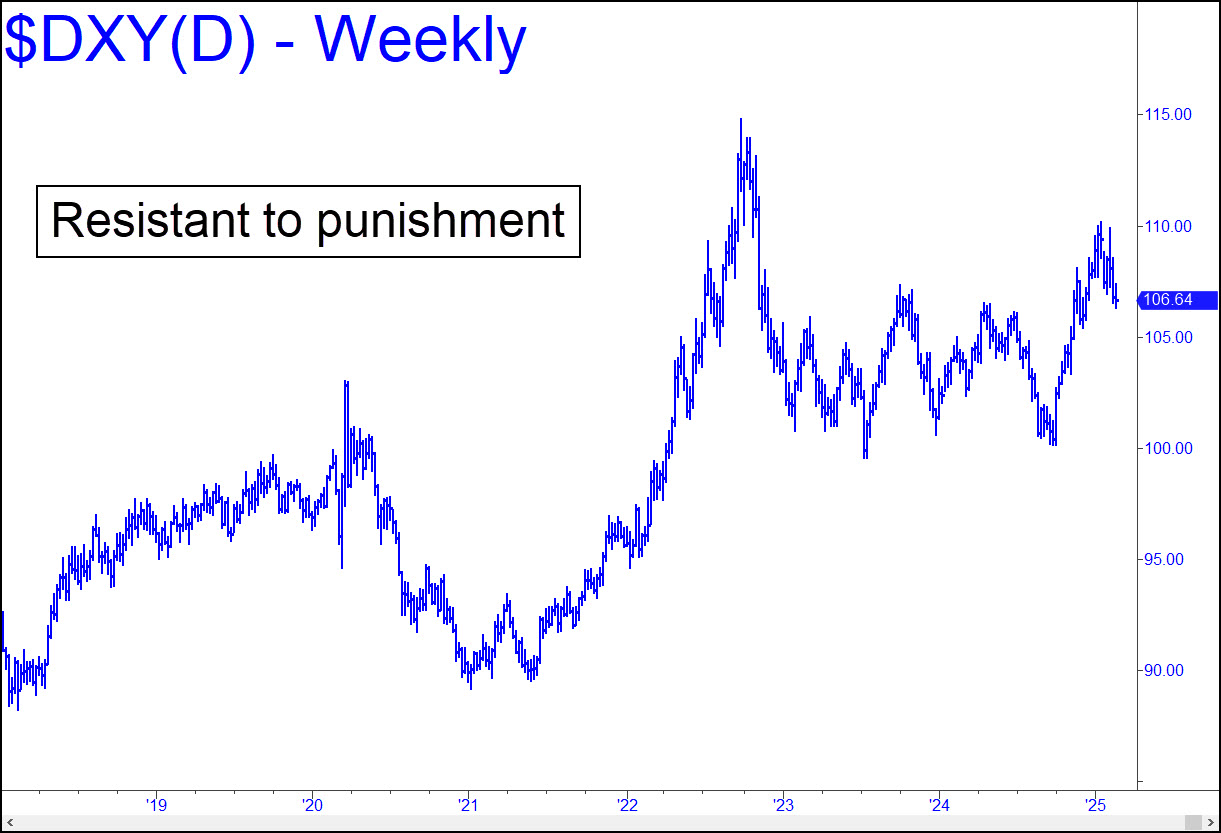

Time for a tone change. This is a tough call, since I’ve been a hard-core deflationist since the mid-1970s after reading a persuasive book by the late C.V. Myers, and later another, The Great Reckoning, by James Dale Davidson and Lord William Rees-Mogg. Myers’ thesis was that the endgame for the epic credit blowout of the last 40 years would feature a dollar so strong that all who owed them would be crushed by imploding debt. The implied tsunami of bankruptcies would be even more devastating than the 1930s experience, wiping a dozen zeroes from the global balance sheet. The resulting shortage of dollars would become the catalyst for a Second Great Depression from which it would take a generation or longer to emerge. I still believe this is how things must end. But not now. Trump, who is verging on political omnipotence, clearly favors a weak dollar, and this will hold the coming bust at bay for a while. But the chart suggests the dollar is tough enough to stand up to such moderate debasement as Trump’s patriotism and nationalistic pride can abide. I have adjusted my outlook for the dollar accordingly: Look for weakness down to the range 95-100; then, an explosive rally that will end inflation for 60 years. _______ UPDATE (March 14): The Dollar Index has come down hard to the 102.99 ‘d’ support of this pattern. It is sufficiently clear and compelling that we ‘should’ see a tradable bounce. If there is none, that would darken my outlook significantly. _______ UPDATE (Mar 21): DXY has bounced 2% from within 20 cents of the 102.99 ‘hidden’ support furnished above. The rally would be more persuasive, however, if it exceeds several ‘external’ peaks ranging from 104.32 to 104.67 recorded in the first week of March. Here’s the chart.

Time for a tone change. This is a tough call, since I’ve been a hard-core deflationist since the mid-1970s after reading a persuasive book by the late C.V. Myers, and later another, The Great Reckoning, by James Dale Davidson and Lord William Rees-Mogg. Myers’ thesis was that the endgame for the epic credit blowout of the last 40 years would feature a dollar so strong that all who owed them would be crushed by imploding debt. The implied tsunami of bankruptcies would be even more devastating than the 1930s experience, wiping a dozen zeroes from the global balance sheet. The resulting shortage of dollars would become the catalyst for a Second Great Depression from which it would take a generation or longer to emerge. I still believe this is how things must end. But not now. Trump, who is verging on political omnipotence, clearly favors a weak dollar, and this will hold the coming bust at bay for a while. But the chart suggests the dollar is tough enough to stand up to such moderate debasement as Trump’s patriotism and nationalistic pride can abide. I have adjusted my outlook for the dollar accordingly: Look for weakness down to the range 95-100; then, an explosive rally that will end inflation for 60 years. _______ UPDATE (March 14): The Dollar Index has come down hard to the 102.99 ‘d’ support of this pattern. It is sufficiently clear and compelling that we ‘should’ see a tradable bounce. If there is none, that would darken my outlook significantly. _______ UPDATE (Mar 21): DXY has bounced 2% from within 20 cents of the 102.99 ‘hidden’ support furnished above. The rally would be more persuasive, however, if it exceeds several ‘external’ peaks ranging from 104.32 to 104.67 recorded in the first week of March. Here’s the chart.

DXY – NYBOT Dollar Index (Last:104.15)

Posted on February 23, 2025, 5:28 pm EST

Last Updated March 21, 2025, 11:49 pm EDT

Posted on February 23, 2025, 5:28 pm EST

Last Updated March 21, 2025, 11:49 pm EDT

Dear Rick,

Can you please explain why you became negative on the dollar?

You previously indicated that a determining factor would be how DXY would respond to the midpoint HP of 105.99. I don’t think we have gone lower than approximately 106.08 yet

Thank you