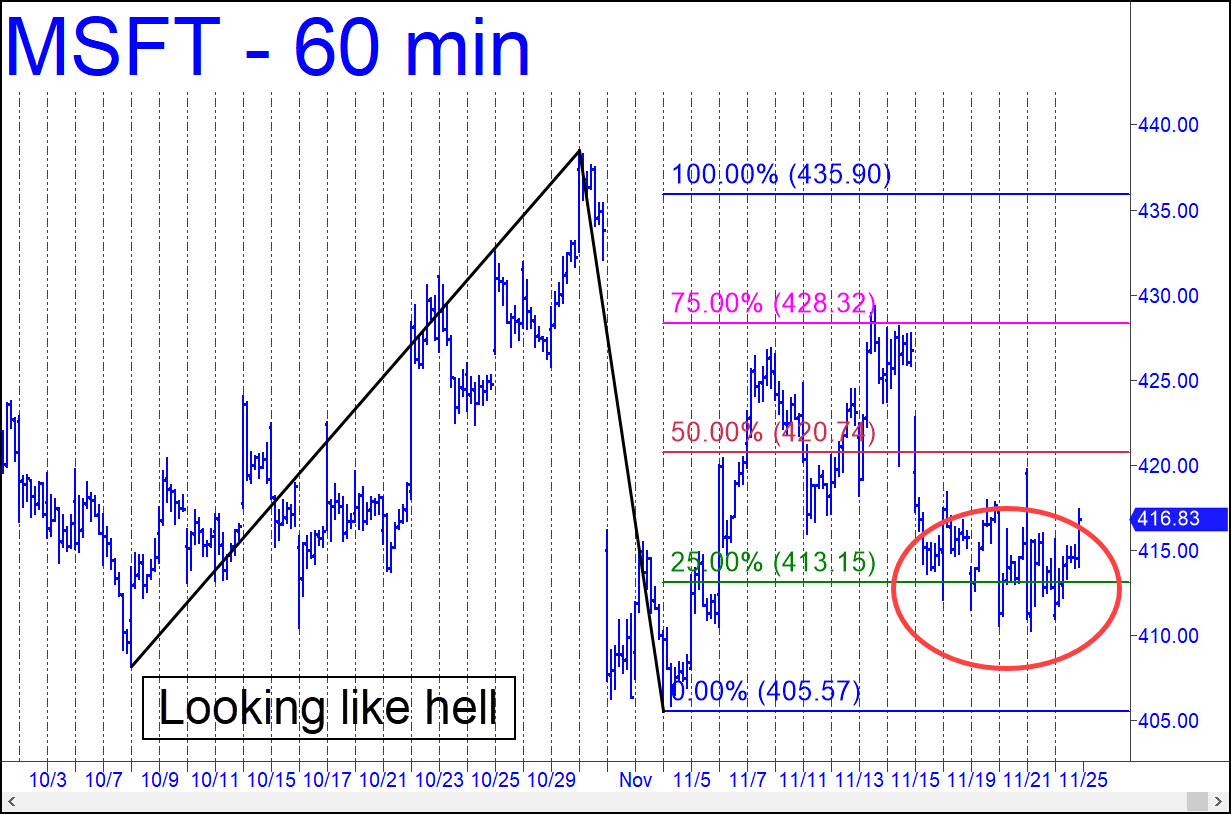

I’ve always treated MSFT as an infallible bellwether. My narrow, if not to say obsessive, focus has served us well, since MSFT has stayed consistently a step ahead of the broad averages, and even ahead of other stocks in the lunatic sector (i.e., the atrociously misnamed Magnificent Seven). But the long bull market has not conditioned us to think that when MSFT acts like crap for an entire year, as it has, that it is signaling a possible end to the bull market. This I will infer, however, implying that the failure to produce an easy ‘mechanical’ winner after falling to the green line on November 18 is further evidence of a waning bull. This observation would be strengthened by a dip below C=405.57 without having first achieved D=435.90. The target and pattern will remain viable as long as 405.57 is not breached.

I’ve always treated MSFT as an infallible bellwether. My narrow, if not to say obsessive, focus has served us well, since MSFT has stayed consistently a step ahead of the broad averages, and even ahead of other stocks in the lunatic sector (i.e., the atrociously misnamed Magnificent Seven). But the long bull market has not conditioned us to think that when MSFT acts like crap for an entire year, as it has, that it is signaling a possible end to the bull market. This I will infer, however, implying that the failure to produce an easy ‘mechanical’ winner after falling to the green line on November 18 is further evidence of a waning bull. This observation would be strengthened by a dip below C=405.57 without having first achieved D=435.90. The target and pattern will remain viable as long as 405.57 is not breached.

MSFT – Microsoft (Last:416.83)

Posted on November 24, 2024, 5:17 pm EST

Last Updated November 22, 2024, 6:52 pm EST

Posted on November 24, 2024, 5:17 pm EST

Last Updated November 22, 2024, 6:52 pm EST