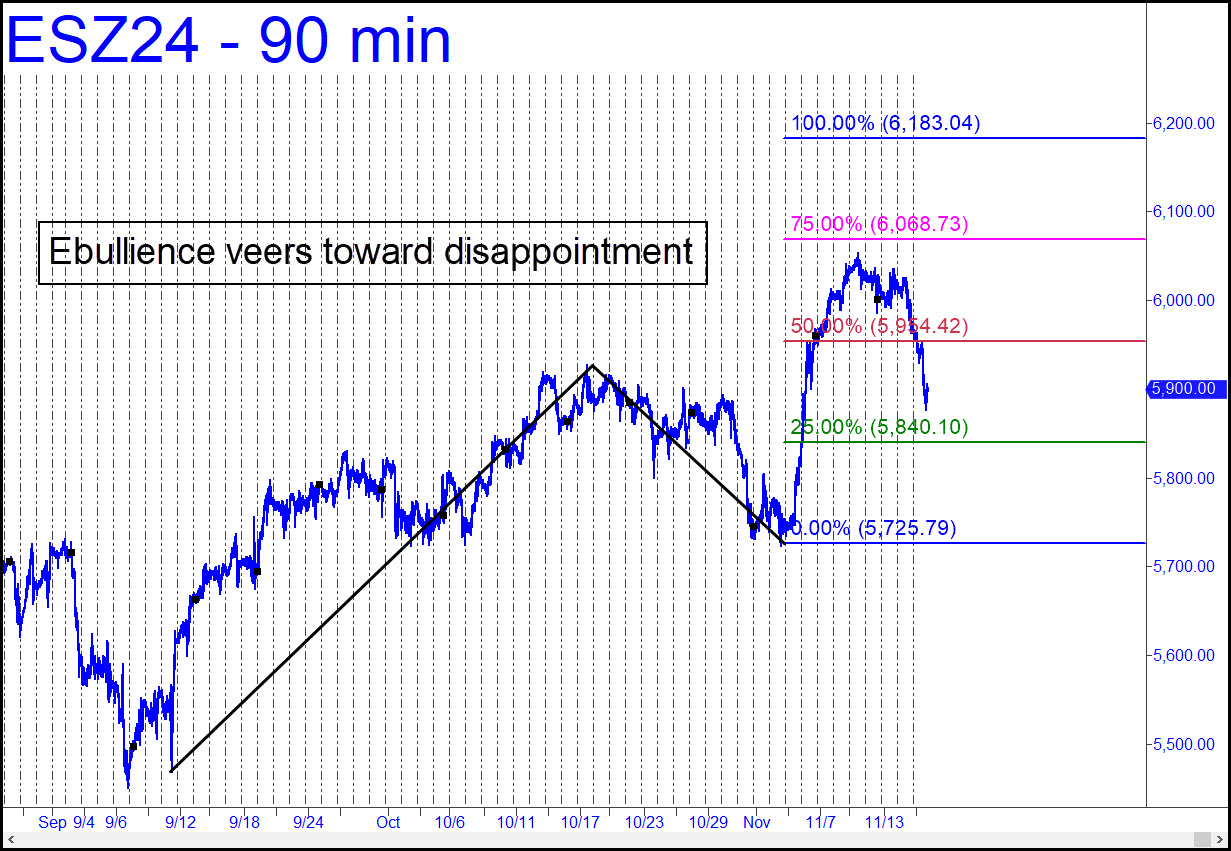

The Trump rally reversed sharply after failing to achieve the secondary pivot (p2=6068.73) of the pattern shown. This is not a healthy sign, even if a ‘mechanical’ buy at the green line, stop 5725.50, looks very likely to produce a profit. That implies the futures will rebound to at least p= 5954.42 after falling to 5840.10, even if they don’t eventually reach the pattern’s ‘D’ target at 6183.04. The foregoing will have no bearing on the viability of the ambitious 7644.50 bull market target featured in last week’s commentary. The E-Mini S&Ps’ fall would have to exceed 3502.00 (!) to invalidate it. However, last week’s developments demand that we pay diligent attention to lesser corrective patterns such as the one currently in progress. If there is a fatal weakness creeping into the long-term bull market, it will show itself first in ABCD patterns of minor degree.

The Trump rally reversed sharply after failing to achieve the secondary pivot (p2=6068.73) of the pattern shown. This is not a healthy sign, even if a ‘mechanical’ buy at the green line, stop 5725.50, looks very likely to produce a profit. That implies the futures will rebound to at least p= 5954.42 after falling to 5840.10, even if they don’t eventually reach the pattern’s ‘D’ target at 6183.04. The foregoing will have no bearing on the viability of the ambitious 7644.50 bull market target featured in last week’s commentary. The E-Mini S&Ps’ fall would have to exceed 3502.00 (!) to invalidate it. However, last week’s developments demand that we pay diligent attention to lesser corrective patterns such as the one currently in progress. If there is a fatal weakness creeping into the long-term bull market, it will show itself first in ABCD patterns of minor degree.

ESZ24 – Dec E-Mini S&Ps (Last:5900.00)

Posted on November 17, 2024, 5:20 pm EST

Last Updated November 15, 2024, 8:51 pm EST

Posted on November 17, 2024, 5:20 pm EST

Last Updated November 15, 2024, 8:51 pm EST