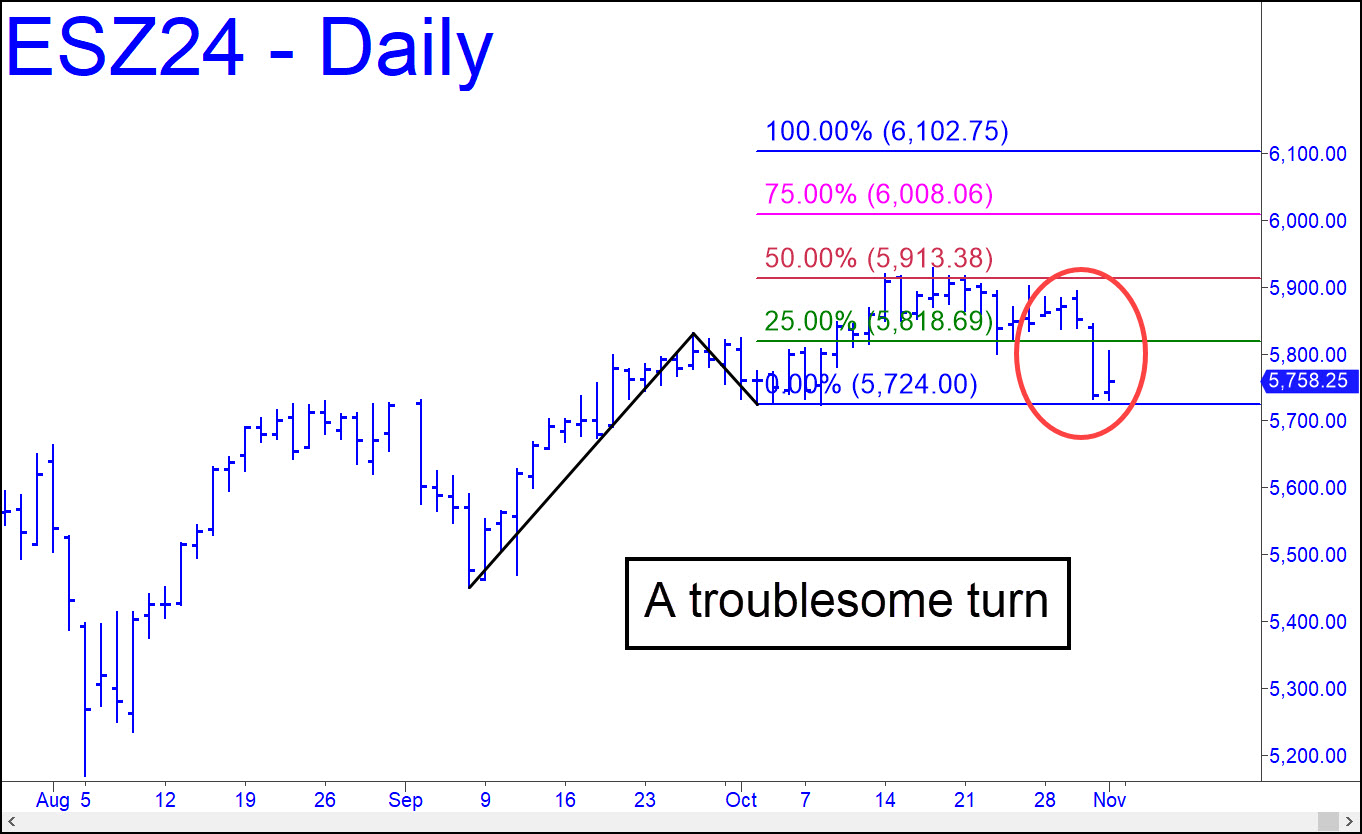

We began last week with an ambitious bull-market target at 6102, but heavy selling on Thursday nearly negated the bullish pattern from which that Hidden Pivot was derived. It is still theoretical viable, but I doubt it will survive. That would imply a trend failure at a midpoint of daily-chart degree [p=5913), a usually reliable indicator of an important trend change. Now, if minor ‘D’ corrective targets start giving way easily, we would have reason to infer the long-term bull cycle begun in March 2020 is over. I will be tracking this closely, so keep your email ‘Notifications’ switched on and stay close to the chat room if you want to stay apprised in real time. ______ UPDATE (Nov 6, 6:25 p.m.): There are numerous ABCD patterns projecting significantly higher, but here’s one I especially like that all but guarantees minimum upside to 6084.00. This Hidden Pivot resistance lies 122 points above, a 2% move. This assumes that another promising target at 5961.75 discussed in the chat room gets swept away before dawn by Trump fever, as appears likely. The futures are head-butting this obscure ‘hidden’ resistance in after-hours trading. Short the higher target using as tight a stop-loss as you can craft, preferably with a small-degree rABC trigger (aka ‘camouflage’), but your trading bias should be bullish until the futures get there. _______ UPDATE (Nov 8, 12:04 p.m.): The futures are now bound for at least 6200.25. That’s 178 points, or 3%, above the current 6022. My high confidence in this target is based on the way the Trump waft has impaled the 5962.25 ‘midpoint Hidden Pivot resistance’ (p) shown in this chart. Price action at ‘p’ is a reliable and accurate indicator of trend strength. Please note as well that a sharp pullback to the green line (x=5843.25), however unlikely, would trigger a salacious ‘mechanical’ buying opportunity, stop 5724.00. In practice, we would use a small-degree entry trigger to cut initial, theoretical risk by as much as 95%.

We began last week with an ambitious bull-market target at 6102, but heavy selling on Thursday nearly negated the bullish pattern from which that Hidden Pivot was derived. It is still theoretical viable, but I doubt it will survive. That would imply a trend failure at a midpoint of daily-chart degree [p=5913), a usually reliable indicator of an important trend change. Now, if minor ‘D’ corrective targets start giving way easily, we would have reason to infer the long-term bull cycle begun in March 2020 is over. I will be tracking this closely, so keep your email ‘Notifications’ switched on and stay close to the chat room if you want to stay apprised in real time. ______ UPDATE (Nov 6, 6:25 p.m.): There are numerous ABCD patterns projecting significantly higher, but here’s one I especially like that all but guarantees minimum upside to 6084.00. This Hidden Pivot resistance lies 122 points above, a 2% move. This assumes that another promising target at 5961.75 discussed in the chat room gets swept away before dawn by Trump fever, as appears likely. The futures are head-butting this obscure ‘hidden’ resistance in after-hours trading. Short the higher target using as tight a stop-loss as you can craft, preferably with a small-degree rABC trigger (aka ‘camouflage’), but your trading bias should be bullish until the futures get there. _______ UPDATE (Nov 8, 12:04 p.m.): The futures are now bound for at least 6200.25. That’s 178 points, or 3%, above the current 6022. My high confidence in this target is based on the way the Trump waft has impaled the 5962.25 ‘midpoint Hidden Pivot resistance’ (p) shown in this chart. Price action at ‘p’ is a reliable and accurate indicator of trend strength. Please note as well that a sharp pullback to the green line (x=5843.25), however unlikely, would trigger a salacious ‘mechanical’ buying opportunity, stop 5724.00. In practice, we would use a small-degree entry trigger to cut initial, theoretical risk by as much as 95%.

ESZ24 – Dec E-Mini S&Ps (Last:6022.00)

Posted on November 3, 2024, 5:20 pm EST

Last Updated November 8, 2024, 12:04 pm EST

Posted on November 3, 2024, 5:20 pm EST

Last Updated November 8, 2024, 12:04 pm EST