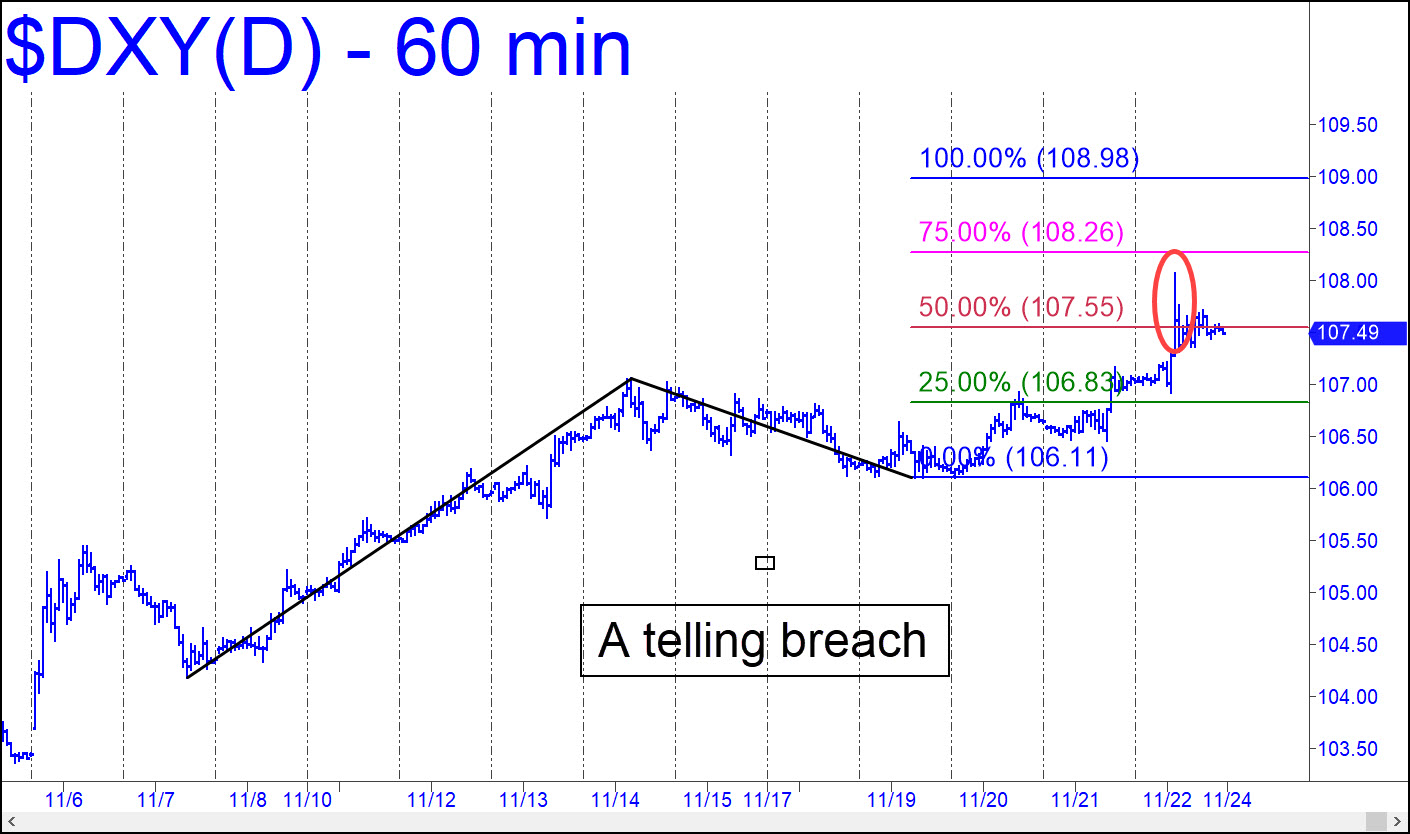

DXY’s sharp poke on Friday through p=107.55, the midpoint Hidden Pivot, implies the rally is very likely to reach the pattern’s 108.98 target. This symbol is not optionable, but you can trade the futures contract by interpolating my targets. It is encouraging to see bullion strengthen with the dollar rampaging higher. Its potential on DXY’s long-term chart is to 119.37, or 124.82 if any higher (monthly chart, A= 89.54 on 5/31/21). A move of that magnitude would put enormous strain on all who owe dollars, and a ruinous deflation would likely be the result. This would occur irrespective of the level of nominal interest rates, since it is the real (i.e., inflation-adjusted) burden of debt that matters, not the marquee number.

DXY’s sharp poke on Friday through p=107.55, the midpoint Hidden Pivot, implies the rally is very likely to reach the pattern’s 108.98 target. This symbol is not optionable, but you can trade the futures contract by interpolating my targets. It is encouraging to see bullion strengthen with the dollar rampaging higher. Its potential on DXY’s long-term chart is to 119.37, or 124.82 if any higher (monthly chart, A= 89.54 on 5/31/21). A move of that magnitude would put enormous strain on all who owe dollars, and a ruinous deflation would likely be the result. This would occur irrespective of the level of nominal interest rates, since it is the real (i.e., inflation-adjusted) burden of debt that matters, not the marquee number.

DXY – NYBOT Dollar Index (Last:107.49)

Posted on November 24, 2024, 5:21 pm EST

Last Updated November 24, 2024, 6:14 pm EST

Posted on November 24, 2024, 5:21 pm EST

Last Updated November 24, 2024, 6:14 pm EST