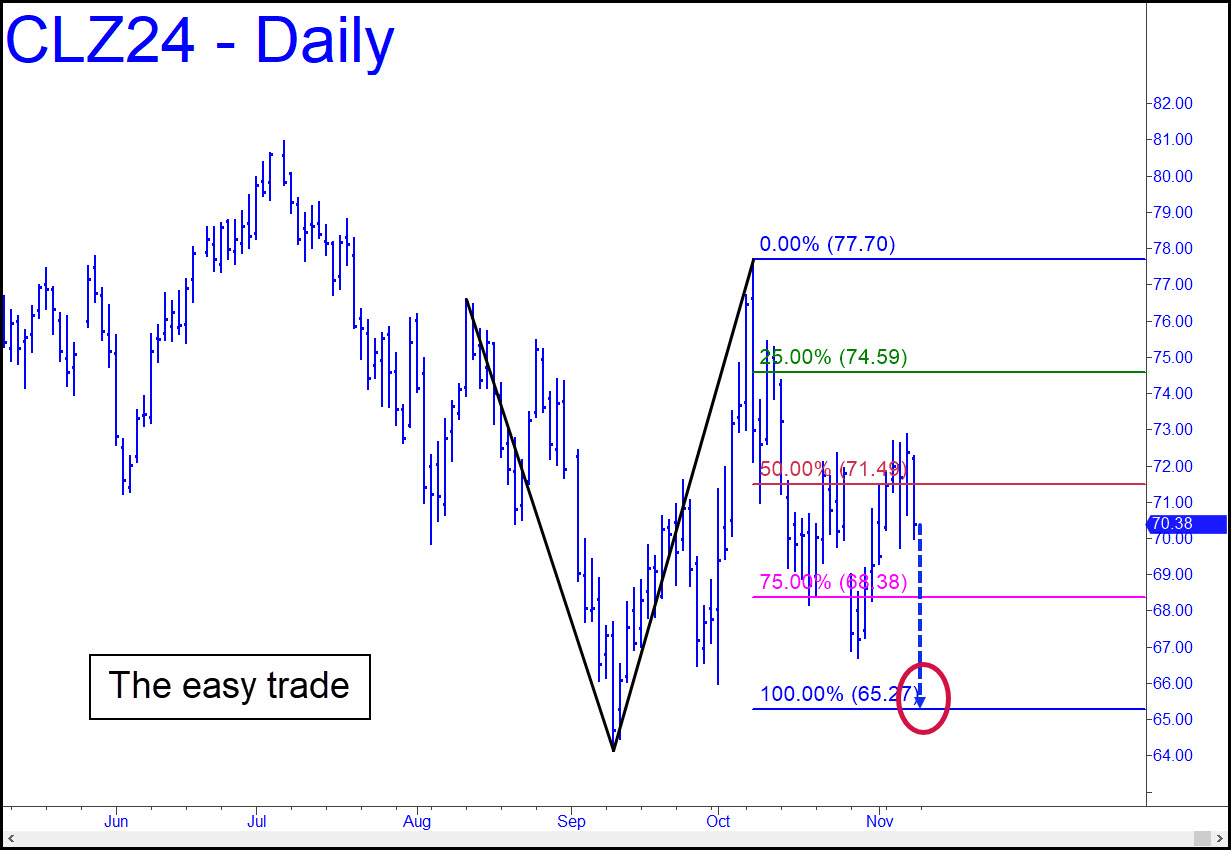

The futures rallied somewhat higher than we might have preferred last week, generating a bullish impulse leg in the process. This implies that any sequence of trading strategies we employ should have a bullish component. That would take work, however, requiring us to pay attention to a vehicle that is painful to watch. Crude’s price action is animated almost solely by clowns and thieves, so I suggest opting for the no-brainer trade, even if it takes a while to set up with a drop to 65.27 (see inset). That might not occur, but it is still the only trade we should be interested in at the moment — a no-brainer with excellent odds and risk under very tight control. Plus, it will enable us to avoid taking crude’s freakish price action seriously. Considering that this is the biggest commodity market in the world, its rigged behavior is a disgrace to civilization itself.

The futures rallied somewhat higher than we might have preferred last week, generating a bullish impulse leg in the process. This implies that any sequence of trading strategies we employ should have a bullish component. That would take work, however, requiring us to pay attention to a vehicle that is painful to watch. Crude’s price action is animated almost solely by clowns and thieves, so I suggest opting for the no-brainer trade, even if it takes a while to set up with a drop to 65.27 (see inset). That might not occur, but it is still the only trade we should be interested in at the moment — a no-brainer with excellent odds and risk under very tight control. Plus, it will enable us to avoid taking crude’s freakish price action seriously. Considering that this is the biggest commodity market in the world, its rigged behavior is a disgrace to civilization itself.

CLZ24 – December Crude (Last:70.38)

Posted on November 10, 2024, 10:16 pm EST

Last Updated November 22, 2024, 7:54 pm EST

Posted on November 10, 2024, 10:16 pm EST

Last Updated November 22, 2024, 7:54 pm EST