I continue to believe the bull market’s fate can be divined simply by paying close attention to price action in Microsoft shares. The company is not only the second-largest in the world by capitalization, slightly behind Apple; it is also the most important. That’s because its huge stream of recurring subscription revenues from Windows and the Office suite is all but impervious to economic downturns. This is not true of Apple, whose iPhone sales will plunge in the next recession.

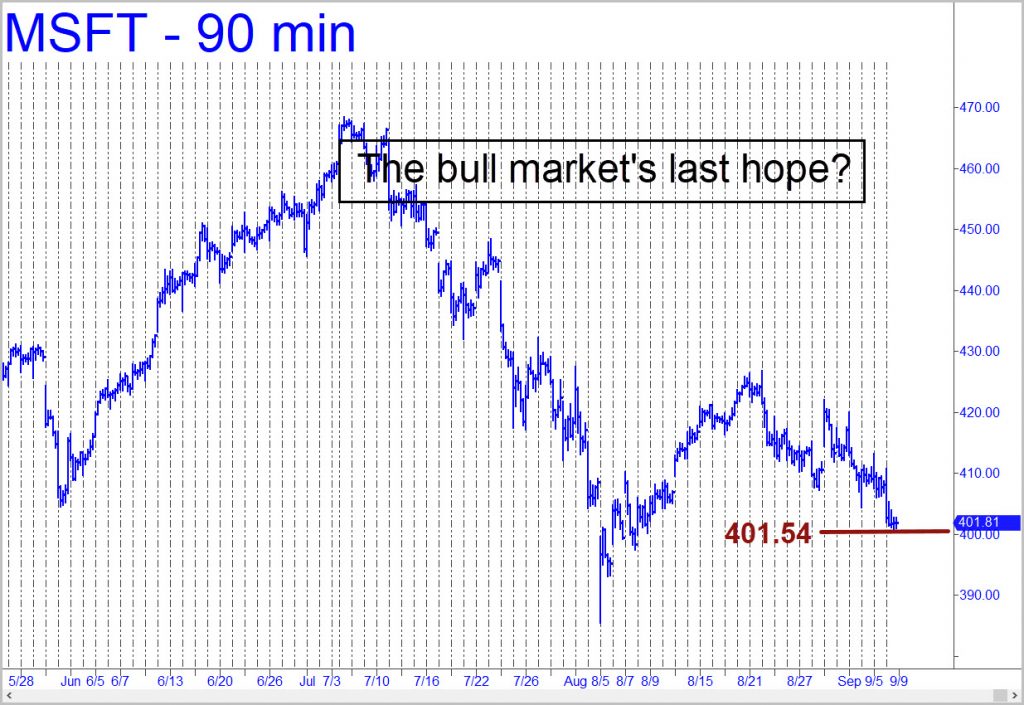

So what is Microsoft saying? We’ve been expecting the stock to hit 449.42 for more than a month. Although that would be well shy of the record 468.35 achieved on July 5, it would mark a secondary top corresponding to the one that ushered in the 1929 Crash and the Great Depression. There remains the possibility the implied rally from Friday’s low could head into the wild blue yonder after achieving 449.42, but we’ll consider this scenario more seriously if and when the stock blows past the target.

One thing that makes the wild-blue-yonder prospect somewhat less likely is that the E-Mini S&Ps on Friday breached a key support decisively enough to imply they are headed significantly lower, to at least 5189 from a current 5403. We should know by no later than midweek whether they are about to drag MSFT lower, rather than the S&Ps being pulled higher by a resurgent MSFT.

Whoopee Cushion Bounce

In the meantime, some Rick’s Picks subscribers may have taken long positions in MSFT over the weekend, since I’d proffered 401.56 as a perfect place to back up the truck and buy ’em hand-over-fist. When the stock plummeted on Friday ahead of the opening, it kissed that number and Whoopee Cushioned $10 higher before giving it all back by the closing bell. If the relapse continues, taking out the 385.58 low shown in the chart, I’d infer that the bull market that began in 2009 is over.

Price action in Bitcoin somewhat corroborates this. I’d drum-rolled 54,701 as a correction target when it was trading around 60,000. On Friday, however, my proxy for Bitcoin, BRTI, knifed through the target like a boning knife through a raw chicken breast. This implies a further fall to at least 49,543, but possibly as low as 44,386. This matters because bitcoin is a good indicator of speculative activity in the markets. Crush the spirits of those who trade it, and the markets in general will become less feisty. The good news for Bitcoin speculators is that a plunge to 44,386 will have been carefully scripted by its deep-pocketed handlers. They are looking for a safe place to park and augment their holdings while they wait patiently for the next outbreak of fever. _______ UPDATE (Sep 13): My back-up-the-truck number in MSFT at 401.56 caught the actual low at 400.80 within 76 cents. The subsequent rally hit 431.83 by week’s end, a $31 gain. I am projecting additional upside to at least 449.52, a longstanding target. Here’s a chart that shows the stock’s trampoline bottom, which was replicated by rallies in the Nasdaq 100 index and the S&Ps..