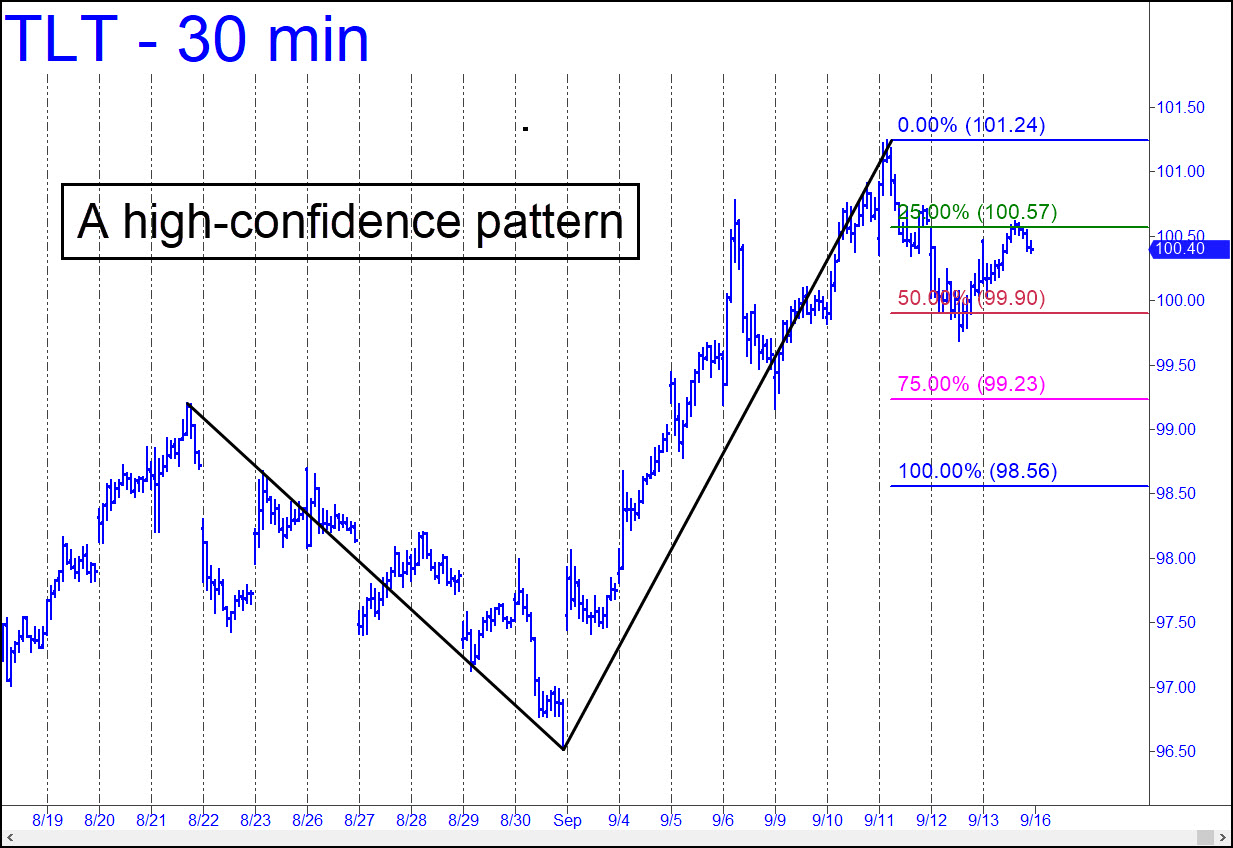

My confidence in the pattern shown is high. It is that pretty, and the ‘mechanical’ short triggered on Friday when a two-day bounce touched the green line is therefore likely to fall to at least 99.90 before TLT could find traction. However, a decisive breach of the red line would imply more slippage over the near term to as low as 98.56. The bigger picture remains bullish and points to 105.49 over the near-to-intermediate term, with long-term potential to as high as 150.12 (!). The much lower interest rates this implies should not be regarded as good news, since yields could fall to those levels only in the throes of a very deep recession or a depression.

My confidence in the pattern shown is high. It is that pretty, and the ‘mechanical’ short triggered on Friday when a two-day bounce touched the green line is therefore likely to fall to at least 99.90 before TLT could find traction. However, a decisive breach of the red line would imply more slippage over the near term to as low as 98.56. The bigger picture remains bullish and points to 105.49 over the near-to-intermediate term, with long-term potential to as high as 150.12 (!). The much lower interest rates this implies should not be regarded as good news, since yields could fall to those levels only in the throes of a very deep recession or a depression.

TLT – Lehman Bond ETF (Last:100.40)

Posted on September 15, 2024, 5:11 pm EDT

Last Updated September 14, 2024, 2:00 pm EDT

Posted on September 15, 2024, 5:11 pm EDT

Last Updated September 14, 2024, 2:00 pm EDT