Do new record highs lie just ahead? There are three possibilities I broached here and in the Rick’s Picks chat room over the last several months: 1) the supposed dog days of summer produce a powerful bear rally that fails to exceed any record peaks achieved in June or July; 2) the rally achieves a marginal new high similar to IBM’s take-no-prisoners trap in 2008; or, 3) after a brief pause, the endless buying stampede gives way to yet another manic surge. At the moment, number two seems the most likely to me: new highs are coming. However, and as I have implied, this should make us more cautious rather than more bullish when the next breakout occurs.

Do new record highs lie just ahead? There are three possibilities I broached here and in the Rick’s Picks chat room over the last several months: 1) the supposed dog days of summer produce a powerful bear rally that fails to exceed any record peaks achieved in June or July; 2) the rally achieves a marginal new high similar to IBM’s take-no-prisoners trap in 2008; or, 3) after a brief pause, the endless buying stampede gives way to yet another manic surge. At the moment, number two seems the most likely to me: new highs are coming. However, and as I have implied, this should make us more cautious rather than more bullish when the next breakout occurs.

As for the two other scenarios, the more likely in my estimation would be #3, a ballistic launch into the wild blue yonder. The permabear in me could puke just thinking about so ridiculous an outcome, since there are zero good reasons for the aging bull to keep chugging along indefinitely. But as we know, having ‘zero good reasons’ is reason enough for the rampage to continue. This is contrarian logic you won’t hear from the punditry’s army of navel-gazing shills, let alone from demon-possessed, midway barkers like Jim Cramer. But it is nonetheless true: stocks are climbing not because of the economy, or corporate earnings, or the election cycle, or the prospect of Fed easing, but because investors are out of their greedy fucking minds. Nor would it be the first time mass insanity has persisted for much longer than any of us could have imagined.

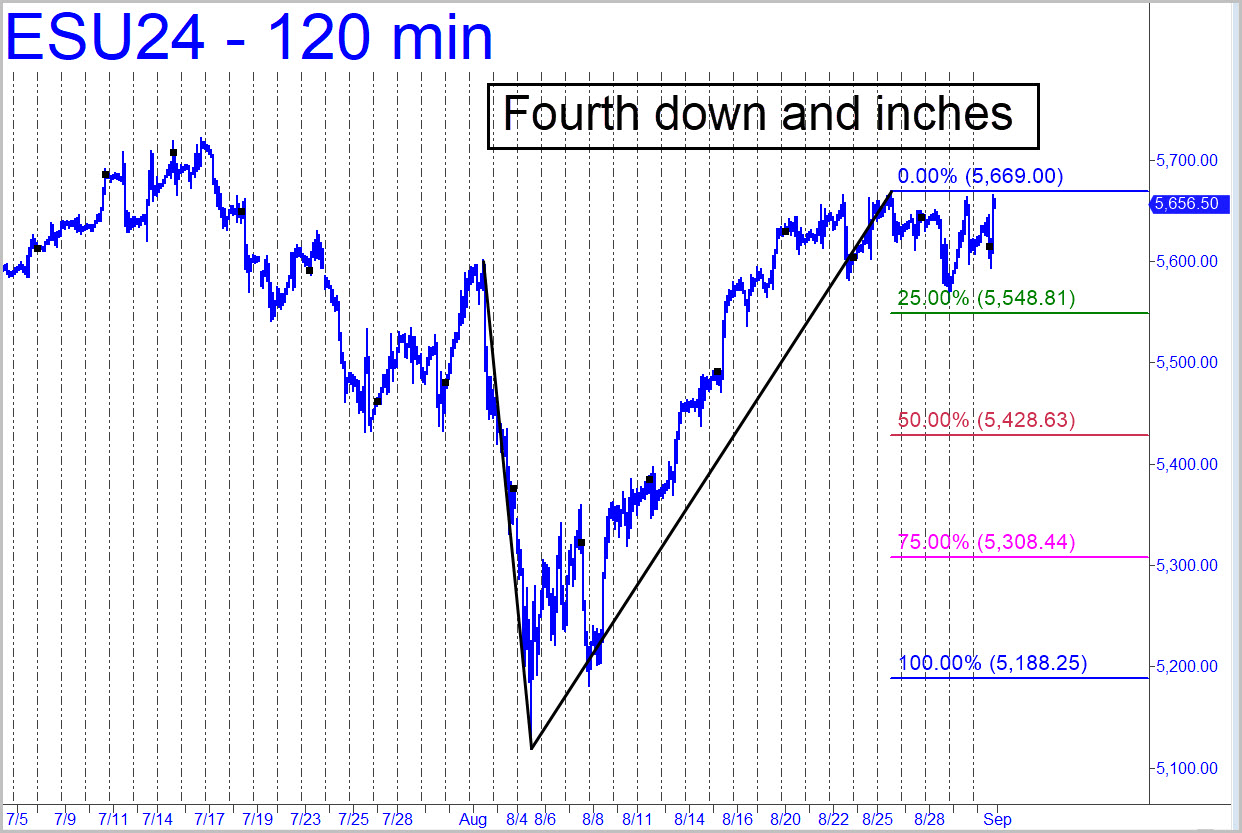

As for the remaining scenario (#1), which implies last week’s secondary peak will replicate the fatal top that occurred in August of 1929, it looks like it is about to come a cropper. If so, and the September contract falls from last week’s high to breach the green line (x=5548, shown in the thumbnail chart), I’d expect more downside to at least p=5429.38. Price action at this Hidden Pivot midpoint support can tell us with clarity, precision, and high confidence what is likely to happen next. Stay tuned to the chat room and your email ‘Notifications’ if you want to stay closely apprised. _______ UPDATE (Sep 3, 6:28 p.m.): An interesting day for scenario #1, which pulled up to within a neck of scenario #2 with today’s refreshing plunge. The futures are headed most immediately to at least p=5429.38, a Hidden Pivot midpoint support shown in this chart. You Pivoteeers know what to do.