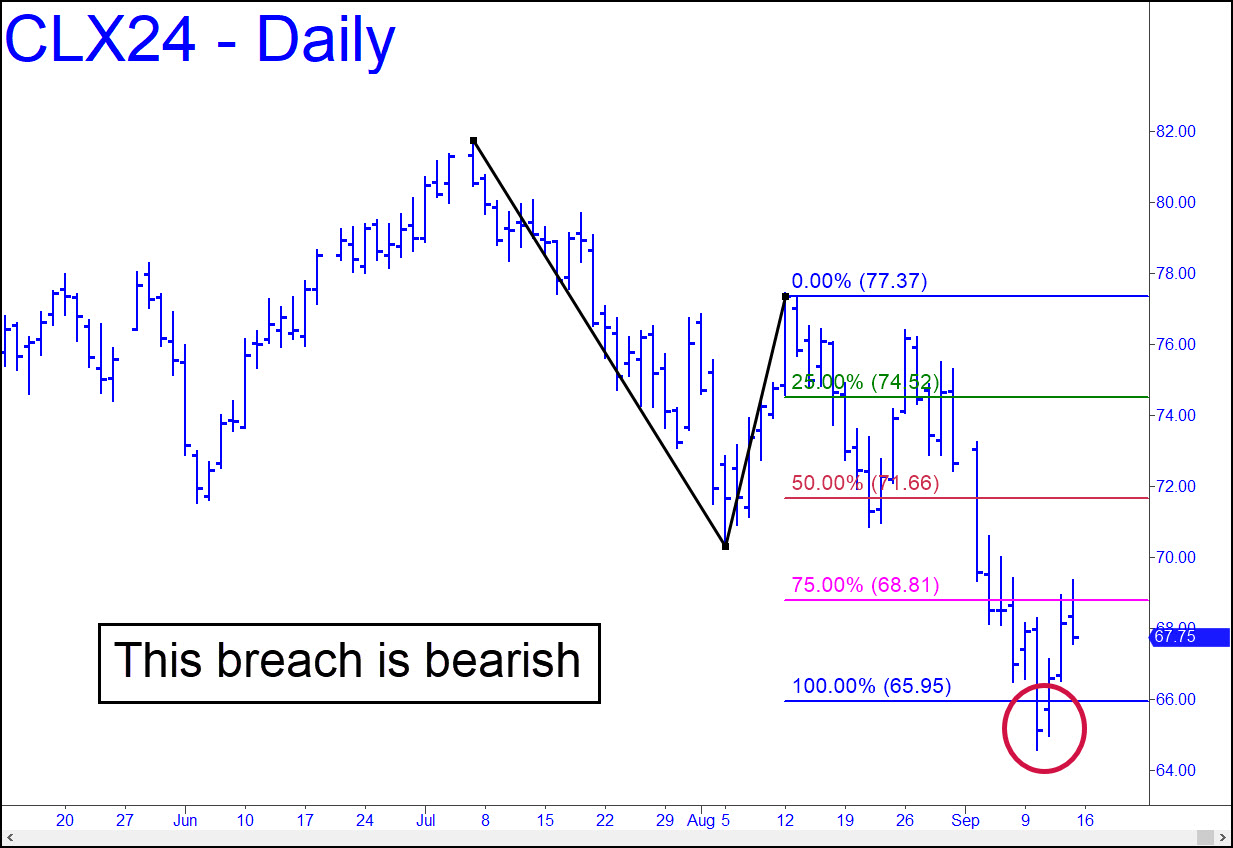

The 65.95 downside target of the pattern shown is sufficiently clear and compelling that we might have expected it to contain the powerful bear cycle begun in early July from around $85. Instead, the futures breached the Hidden Pivot support by a not insignificant $1.34. This implies the nearly $5 bounce that has occurred so far is likely to sputter out without surpassing any significant prior peaks on the daily chart (the nearest of which lies at 76.40). For now, I can offer a rally target at 69.76 as a minimum upside projection (30m, A= 64.99 on 9/11), or at 71.94 if any higher. These Hidden Pivot resistance points will obtain as long as 67.58, the pattern’s point ‘C’ low, is not violated first.

The 65.95 downside target of the pattern shown is sufficiently clear and compelling that we might have expected it to contain the powerful bear cycle begun in early July from around $85. Instead, the futures breached the Hidden Pivot support by a not insignificant $1.34. This implies the nearly $5 bounce that has occurred so far is likely to sputter out without surpassing any significant prior peaks on the daily chart (the nearest of which lies at 76.40). For now, I can offer a rally target at 69.76 as a minimum upside projection (30m, A= 64.99 on 9/11), or at 71.94 if any higher. These Hidden Pivot resistance points will obtain as long as 67.58, the pattern’s point ‘C’ low, is not violated first.

CLX24 – Nov Crude (Last:68.29)

Posted on September 15, 2024, 5:10 pm EDT

Last Updated September 14, 2024, 1:47 pm EDT

Posted on September 15, 2024, 5:10 pm EDT

Last Updated September 14, 2024, 1:47 pm EDT