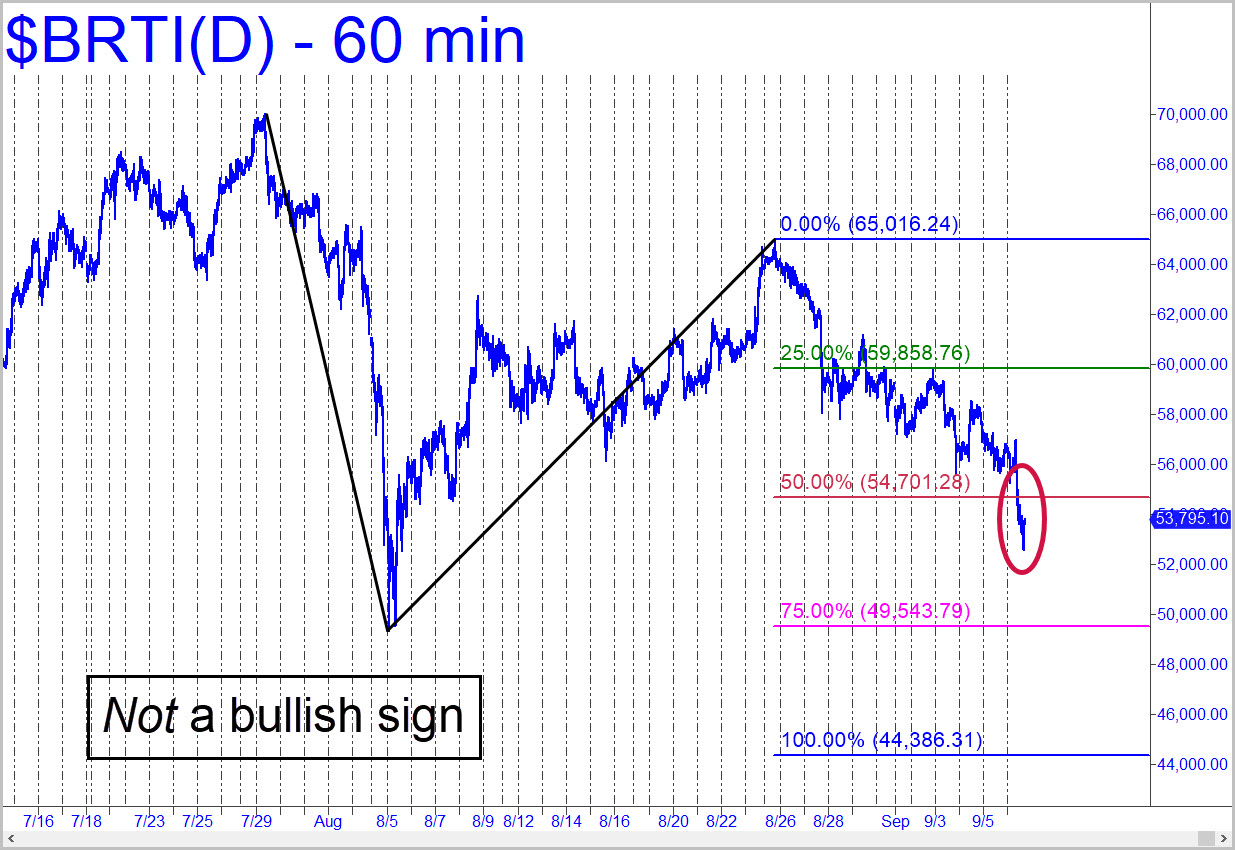

Two weeks ago, we said this bitcoin proxy would fall to at least 54,701 from around 60,000. And so it has, although the tradable reversal we might have looked for at that Hidden Pivot support failed to materialize on Friday under hard selling. That will have bearish implications for the near-term. Specifically, it implies a further fall to at least 49,543, the pattern’s ‘secondary’ Hidden Pivot support. Odds are about 80% this will happen. However, they are no worse than 70% that there will be further slippage to D=44,386 in order to fully correct this hype-driven, fire-breathing dragon. Although that might sound like a painful outcome for investors deeply immersed in bitcoin, it is in fact scripted to bring cryptos down to levels where it can be safely accumulated more or less indefinitely. It helps that there are no real sellers in bitcoin, let alone shorts; and that its biggest boosters, the money center banks, have precious little skin in the game. They have helped huckster bitcoin mainly because their clients like the stuff, and because it will retain speculative appeal until the inevitable day when cryptos fall to their fair, intrinsic value near zero.

Two weeks ago, we said this bitcoin proxy would fall to at least 54,701 from around 60,000. And so it has, although the tradable reversal we might have looked for at that Hidden Pivot support failed to materialize on Friday under hard selling. That will have bearish implications for the near-term. Specifically, it implies a further fall to at least 49,543, the pattern’s ‘secondary’ Hidden Pivot support. Odds are about 80% this will happen. However, they are no worse than 70% that there will be further slippage to D=44,386 in order to fully correct this hype-driven, fire-breathing dragon. Although that might sound like a painful outcome for investors deeply immersed in bitcoin, it is in fact scripted to bring cryptos down to levels where it can be safely accumulated more or less indefinitely. It helps that there are no real sellers in bitcoin, let alone shorts; and that its biggest boosters, the money center banks, have precious little skin in the game. They have helped huckster bitcoin mainly because their clients like the stuff, and because it will retain speculative appeal until the inevitable day when cryptos fall to their fair, intrinsic value near zero.

BRTI – CME Bitcoin Index (Last:53.795)

Posted on September 8, 2024, 5:17 pm EDT

Last Updated September 7, 2024, 2:04 pm EDT

Posted on September 8, 2024, 5:17 pm EDT

Last Updated September 7, 2024, 2:04 pm EDT