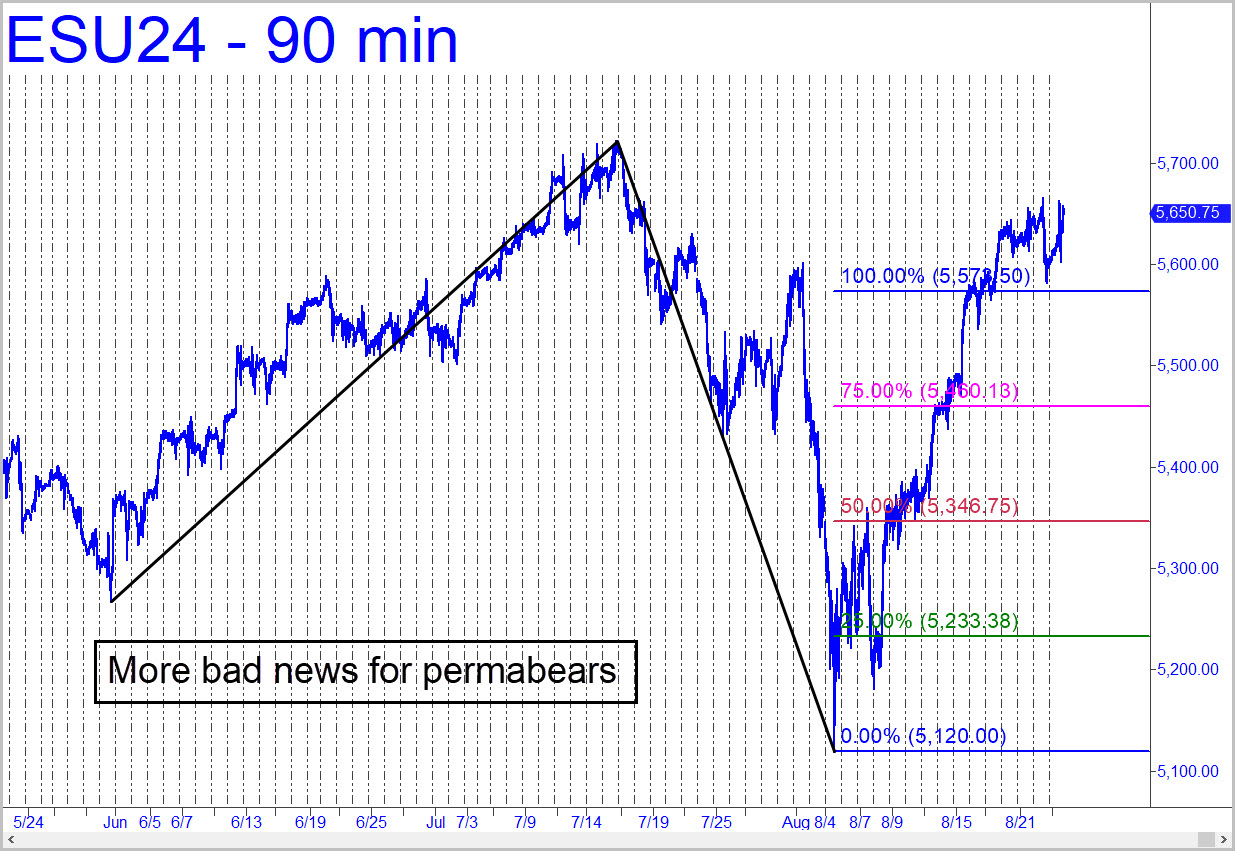

More bad news for permabears, it would seem. At the start of last week, the futures easily pushed past d=5573 of the reverse pattern shown; then they spent the next few days frolicking above it before head-butting a stubborn voodoo resistance to end the week. All of this was doubtless propagated by shorts intent on torturing themselves, and there evidently are way too many for stocks to collapse at the moment. The potentially good news for all you collapsitarians is that my forecasts from months ago foresaw this presumably doomed bounce with a chart of IBM that shows how, just ahead of the Great Financial Crash of 2007-08, Mr Market set the hook. He did this so cleverly that the bear market took everyone, bulls and bears alike, down with it. As you can see, wreaking havoc on investors required a feint to marginal new highs after the broad averages seemingly had topped two months earlier. That is what I foresee now, as autumn approaches. Stay closely tuned to Rick’s Picks if you believe that the stock market is long overdue for the wrenching correction that alone can return investors to sanity and prudence.

More bad news for permabears, it would seem. At the start of last week, the futures easily pushed past d=5573 of the reverse pattern shown; then they spent the next few days frolicking above it before head-butting a stubborn voodoo resistance to end the week. All of this was doubtless propagated by shorts intent on torturing themselves, and there evidently are way too many for stocks to collapse at the moment. The potentially good news for all you collapsitarians is that my forecasts from months ago foresaw this presumably doomed bounce with a chart of IBM that shows how, just ahead of the Great Financial Crash of 2007-08, Mr Market set the hook. He did this so cleverly that the bear market took everyone, bulls and bears alike, down with it. As you can see, wreaking havoc on investors required a feint to marginal new highs after the broad averages seemingly had topped two months earlier. That is what I foresee now, as autumn approaches. Stay closely tuned to Rick’s Picks if you believe that the stock market is long overdue for the wrenching correction that alone can return investors to sanity and prudence.

ESU24 – Sep E-Mini S&P (Last:5650.75)

Posted on August 25, 2024, 5:20 pm EDT

Last Updated August 25, 2024, 9:41 pm EDT

Posted on August 25, 2024, 5:20 pm EDT

Last Updated August 25, 2024, 9:41 pm EDT