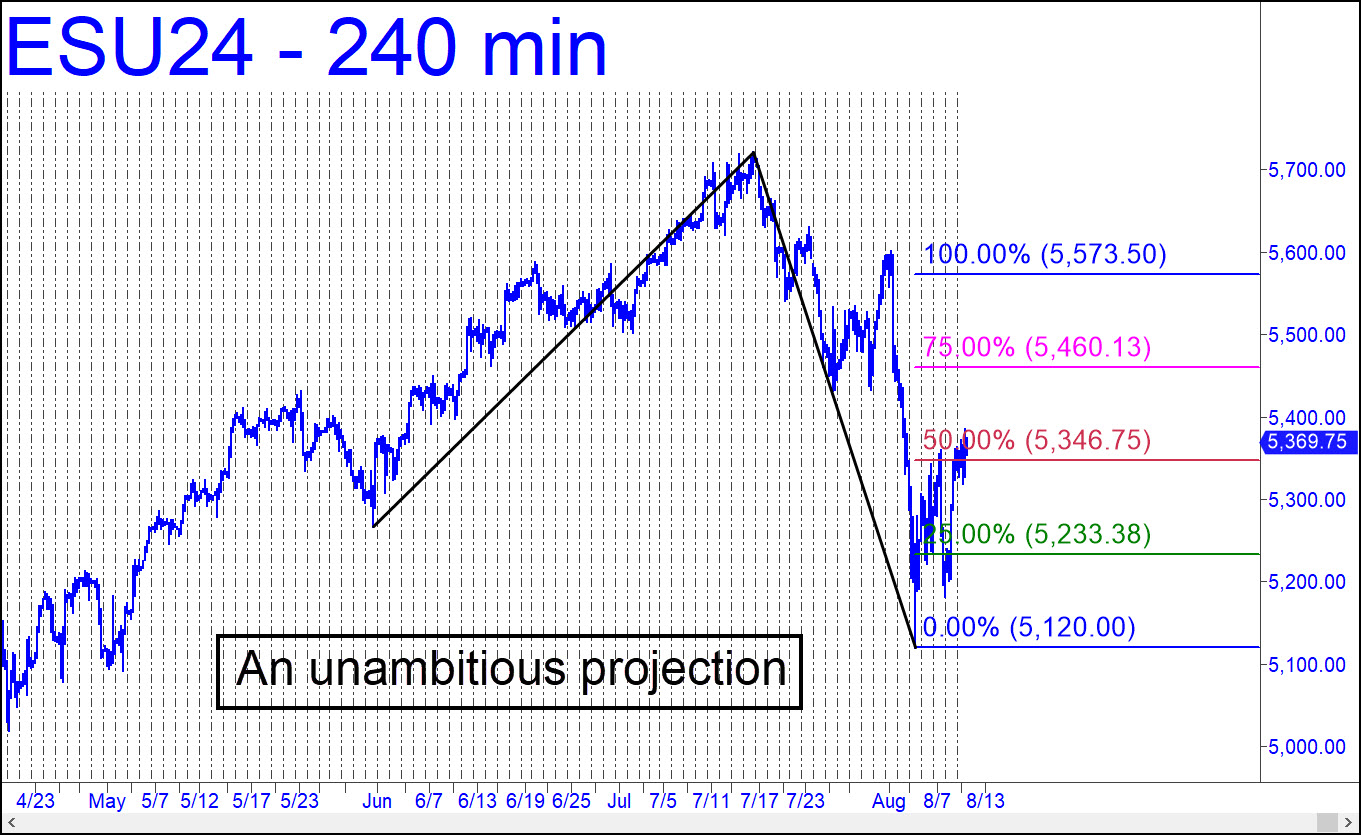

The modest pattern shown would cap this squirrelly bounce somewhat below new record highs, although I don’t mean to suggest that new highs are necessarily unlikely, let alone impossible. However, my gut feeling is that the bull market is over, and even a thrust to marginal new highs would not change my mind. The burden of proof is on bulls as far as I’m concerned, and we should guard against getting sucked in by a heavily engineered, last-gasp rally. The reverse pattern in the thumbnail chart is sufficiently gnarly to work for our purposes, whatever they be. It has already generated a profitable ‘mechanical’ buy at the red line, as well as a one-level short from it. Tightly stopped shorts at p2=5460.13 and d=5573.50 can be attempted, especially if you are familiar with the reverse-pattern ‘camo’ triggers that we use to significantly limit entry risk. ______ UPDATE (Aug 16, 2:58 a.m.): The futures pulled back a very modest 14 points from 5571.75, but that was all the opportunity we got to cover any shorts before a relentless squeeze took hold in after-hours trading. Just a little higher and the September contract should be presumed headed to the 5749.25 target, on the daily chart, of A=5092.00 on 5/2.

The modest pattern shown would cap this squirrelly bounce somewhat below new record highs, although I don’t mean to suggest that new highs are necessarily unlikely, let alone impossible. However, my gut feeling is that the bull market is over, and even a thrust to marginal new highs would not change my mind. The burden of proof is on bulls as far as I’m concerned, and we should guard against getting sucked in by a heavily engineered, last-gasp rally. The reverse pattern in the thumbnail chart is sufficiently gnarly to work for our purposes, whatever they be. It has already generated a profitable ‘mechanical’ buy at the red line, as well as a one-level short from it. Tightly stopped shorts at p2=5460.13 and d=5573.50 can be attempted, especially if you are familiar with the reverse-pattern ‘camo’ triggers that we use to significantly limit entry risk. ______ UPDATE (Aug 16, 2:58 a.m.): The futures pulled back a very modest 14 points from 5571.75, but that was all the opportunity we got to cover any shorts before a relentless squeeze took hold in after-hours trading. Just a little higher and the September contract should be presumed headed to the 5749.25 target, on the daily chart, of A=5092.00 on 5/2.

ESU24 – Sep E-Mini S&P (Last:5581.00)

Posted on August 11, 2024, 5:20 pm EDT

Last Updated August 16, 2024, 3:05 am EDT

Posted on August 11, 2024, 5:20 pm EDT

Last Updated August 16, 2024, 3:05 am EDT