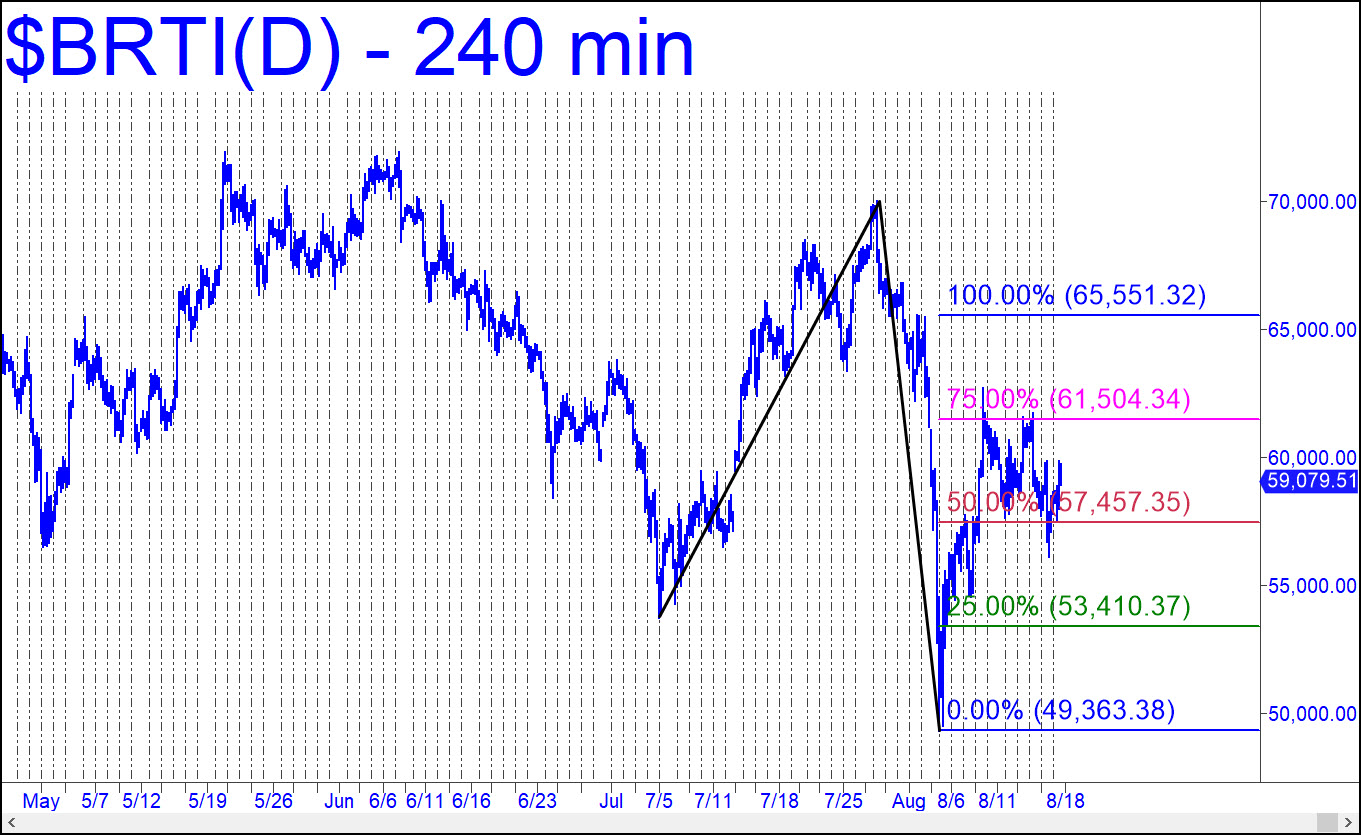

For all of its rude, gratuitous violence, Bertie’s swings are as predictable as any symbol we track. It is bound for 65,551, notwithstanding last week’s annoying histrionics and evasions. I don’t track it diligently enough to call every turn in the chat room, but I’m willing to put more effort into it if there is strong interest. Last week’s payoff would have been a heads-up for a ‘mechanical’ buy at the red line, a gambit that went nicely in the black as the week ended. ______UPDATE (August 24): Just a few more inches to go before this deftly-managed hoax reaches my target with yet another gratuitous spasm. It will have rallied 30% in less than three weeks, adding a modest contribution to the global ‘wealth’ effect. Here’s a new, slightly corrected target for subscribers seeking to manage crypto positions precisely: 65,597.76. _______ UPDATE (Aug 28, 8:37 a.m. EDT): Talk about easy pickings! Bitcoin plunged $7,000 after topping just 0.6% from my 65,597 target. Here’s a new chart that implies it could fall a further $5,400 from current levels to p=54,701 before it finds solid footing. If you are new to Rick’s Picks and skeptical about technical analysis, or just tired of having to rely on bumblers, shills and charlatans for bitcoin price forecasts, I’d suggest following these updates closely. I will continue to make this continuously updated tout freely accessible to everybody — including Robin Hoodies, BlackRock thugs, crypto hypemongers and hack journalists on deadline. _______ UPDATE (Sep 5, 11:55 a.m.): Bertie is closing on my 54,701.28 target. As noted with more than a little hubris in my tout, this vehicle is “easy pickings”. Let’s see if the Robin Hoodies and bitcoin dupes are paying attention.

For all of its rude, gratuitous violence, Bertie’s swings are as predictable as any symbol we track. It is bound for 65,551, notwithstanding last week’s annoying histrionics and evasions. I don’t track it diligently enough to call every turn in the chat room, but I’m willing to put more effort into it if there is strong interest. Last week’s payoff would have been a heads-up for a ‘mechanical’ buy at the red line, a gambit that went nicely in the black as the week ended. ______UPDATE (August 24): Just a few more inches to go before this deftly-managed hoax reaches my target with yet another gratuitous spasm. It will have rallied 30% in less than three weeks, adding a modest contribution to the global ‘wealth’ effect. Here’s a new, slightly corrected target for subscribers seeking to manage crypto positions precisely: 65,597.76. _______ UPDATE (Aug 28, 8:37 a.m. EDT): Talk about easy pickings! Bitcoin plunged $7,000 after topping just 0.6% from my 65,597 target. Here’s a new chart that implies it could fall a further $5,400 from current levels to p=54,701 before it finds solid footing. If you are new to Rick’s Picks and skeptical about technical analysis, or just tired of having to rely on bumblers, shills and charlatans for bitcoin price forecasts, I’d suggest following these updates closely. I will continue to make this continuously updated tout freely accessible to everybody — including Robin Hoodies, BlackRock thugs, crypto hypemongers and hack journalists on deadline. _______ UPDATE (Sep 5, 11:55 a.m.): Bertie is closing on my 54,701.28 target. As noted with more than a little hubris in my tout, this vehicle is “easy pickings”. Let’s see if the Robin Hoodies and bitcoin dupes are paying attention.