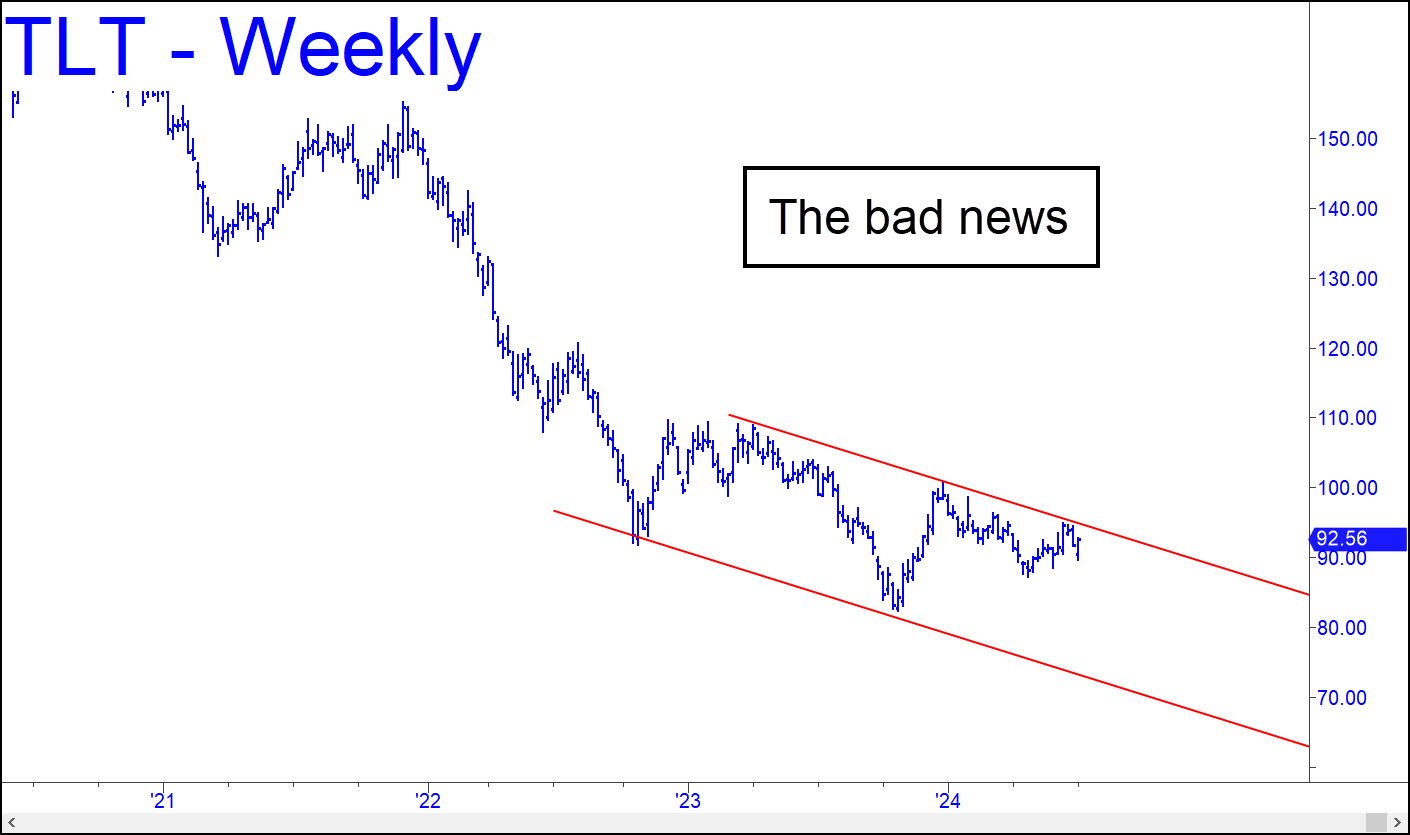

If T-Bonds continue their hellish slide into the abyss, this ETF proxy for long-dated Treasurys should be hitting 70 around election time. So much for Wall Street’s misplaced “hopes” for a helping hand from the Federal Reserve. That won’t stop speculation, every time the Open Market Committee meets, that perhaps a smidgen of easing is coming toward the end of 2024. Will they never learn? Europe’s moribund economies desperately need a global monetary blowout to revive the illusion of growth, but Powell isn’t playing ball. Tom Luongo thinks they will stir up a banking crisis this fall in order to scare Powell into complicity. Under the circumstances, it’s hard to imagine that they won’t try this. If the crisis is scary enough to cause Powell to capitulate, the Davos crowd may regret getting what they wished for,

If T-Bonds continue their hellish slide into the abyss, this ETF proxy for long-dated Treasurys should be hitting 70 around election time. So much for Wall Street’s misplaced “hopes” for a helping hand from the Federal Reserve. That won’t stop speculation, every time the Open Market Committee meets, that perhaps a smidgen of easing is coming toward the end of 2024. Will they never learn? Europe’s moribund economies desperately need a global monetary blowout to revive the illusion of growth, but Powell isn’t playing ball. Tom Luongo thinks they will stir up a banking crisis this fall in order to scare Powell into complicity. Under the circumstances, it’s hard to imagine that they won’t try this. If the crisis is scary enough to cause Powell to capitulate, the Davos crowd may regret getting what they wished for,

TLT – Lehman Bond ETF (Last:92.56)

Posted on July 7, 2024, 5:12 pm EDT

Last Updated July 6, 2024, 7:22 pm EDT

Posted on July 7, 2024, 5:12 pm EDT

Last Updated July 6, 2024, 7:22 pm EDT