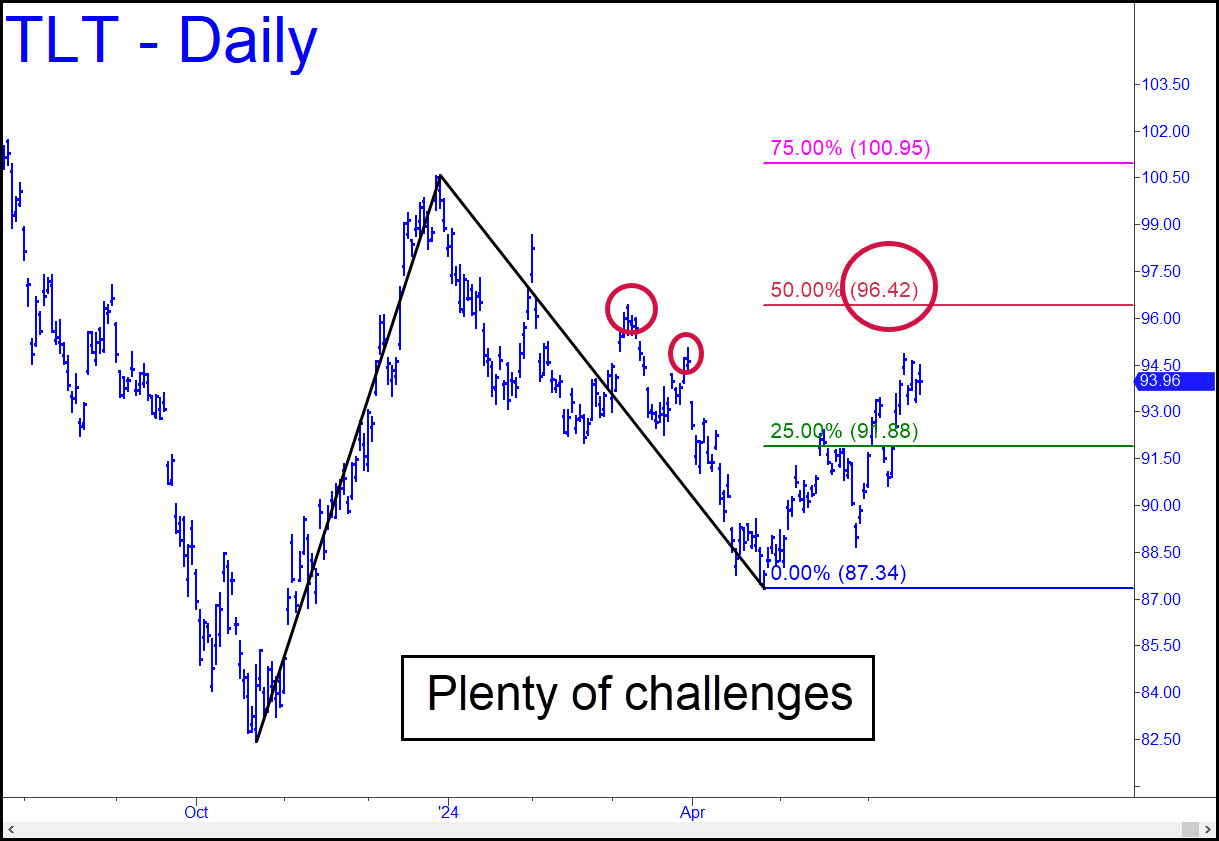

TLT has a long way to go to recoup losses since 2020. The chart shows three daunting resistance numbers at relatively lowly levels that eventually will give way. However, we should be grateful that this ETF proxy for Treasury Bonds is unlikely to approach covid-era highs near 180, since that could only imply a world in deep economic depression. The recovery of U.S. Bonds has unfolded slowly since TLT bottomed at 82.42 eight months ago. The gain off the lows is about 14%, and while that might not seem like much, it is impressive considering the staggering amount of U.S. paper dumped on the market in the past year by sovereign holders, particularly China and Russia. Although the dollar and its unbreakable lock on seignorage may stir up the envy of other nations, they cannot remain players in a financialized world if they stray too far from the greenback. That’s why last October’s lows for T-Bonds may yet endure, even as forecasts of their demise and the bankruptcy of the U.S. persist. Even in bankruptcy, the U.S. will still look like a safe haven to the rest of this blighted, godforsaken world.

TLT has a long way to go to recoup losses since 2020. The chart shows three daunting resistance numbers at relatively lowly levels that eventually will give way. However, we should be grateful that this ETF proxy for Treasury Bonds is unlikely to approach covid-era highs near 180, since that could only imply a world in deep economic depression. The recovery of U.S. Bonds has unfolded slowly since TLT bottomed at 82.42 eight months ago. The gain off the lows is about 14%, and while that might not seem like much, it is impressive considering the staggering amount of U.S. paper dumped on the market in the past year by sovereign holders, particularly China and Russia. Although the dollar and its unbreakable lock on seignorage may stir up the envy of other nations, they cannot remain players in a financialized world if they stray too far from the greenback. That’s why last October’s lows for T-Bonds may yet endure, even as forecasts of their demise and the bankruptcy of the U.S. persist. Even in bankruptcy, the U.S. will still look like a safe haven to the rest of this blighted, godforsaken world.

TLT – Lehman Bond ETF (Last:105.83)

Posted on June 23, 2024, 5:22 pm EDT

Last Updated June 23, 2024, 5:54 pm EDT

Posted on June 23, 2024, 5:22 pm EDT

Last Updated June 23, 2024, 5:54 pm EDT