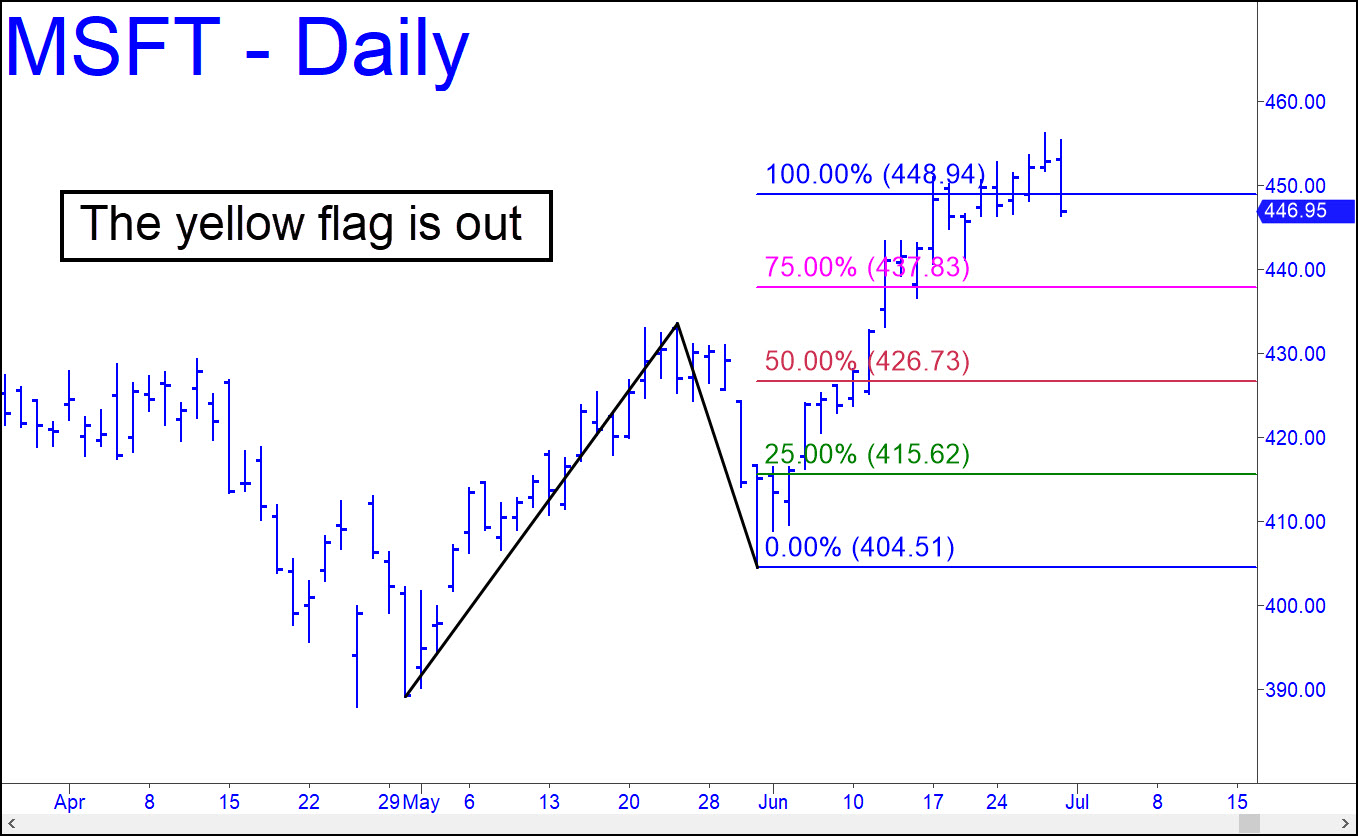

Microsoft apexed last week just 71 cents (0.1%) below a long-term target at 456.88 I’d billboarded here. It happened on Thursday, but on Friday the stock plunged to 446.41, most of it coming in the final 30 minutes of the session. This put the previous day’s record high in sharper relief, increasing its potential importance. It also wiped out the entire week’s gains, presumably creating a layer of urgent supply of a kind that this stock’s handlers are not accustomed to coping with. Expect more backing and filling in the week ahead and a test of lows at 441.27 and 436.72 recorded on the way up during the last two weeks. _______ UPDATE (Jul 2): There was no backing and filling whatsoever. Instead, MSFT turned Friday’s criminally rigged plunge into a v-shaped swoon powered by short-covering. The 456.88 target ‘should’ still contain bulls, albeit imprecisely, given the obviousness of the pattern. If it doesn’t, don’t count on 462.80, the ‘D’ target associated with the sucky marquee ‘A’ at 213.43, to do the job precisely either. An ‘extension’ target derived solely from the C-D leg lies at D=509.40, where A=309.45 on 9/29/23. p2=479.06 for that pattern, and don’t think it would be impossibly cute for the final top to occur at 494.23, midway between p2 and D. That is a price point so nicely ensconced in our discomfort zone that no one on earth could be watching it.

Microsoft apexed last week just 71 cents (0.1%) below a long-term target at 456.88 I’d billboarded here. It happened on Thursday, but on Friday the stock plunged to 446.41, most of it coming in the final 30 minutes of the session. This put the previous day’s record high in sharper relief, increasing its potential importance. It also wiped out the entire week’s gains, presumably creating a layer of urgent supply of a kind that this stock’s handlers are not accustomed to coping with. Expect more backing and filling in the week ahead and a test of lows at 441.27 and 436.72 recorded on the way up during the last two weeks. _______ UPDATE (Jul 2): There was no backing and filling whatsoever. Instead, MSFT turned Friday’s criminally rigged plunge into a v-shaped swoon powered by short-covering. The 456.88 target ‘should’ still contain bulls, albeit imprecisely, given the obviousness of the pattern. If it doesn’t, don’t count on 462.80, the ‘D’ target associated with the sucky marquee ‘A’ at 213.43, to do the job precisely either. An ‘extension’ target derived solely from the C-D leg lies at D=509.40, where A=309.45 on 9/29/23. p2=479.06 for that pattern, and don’t think it would be impossibly cute for the final top to occur at 494.23, midway between p2 and D. That is a price point so nicely ensconced in our discomfort zone that no one on earth could be watching it.

MSFT – Microsoft (Last:459.28)

Posted on June 30, 2024, 5:19 pm EDT

Last Updated July 2, 2024, 5:05 pm EDT

Posted on June 30, 2024, 5:19 pm EDT

Last Updated July 2, 2024, 5:05 pm EDT