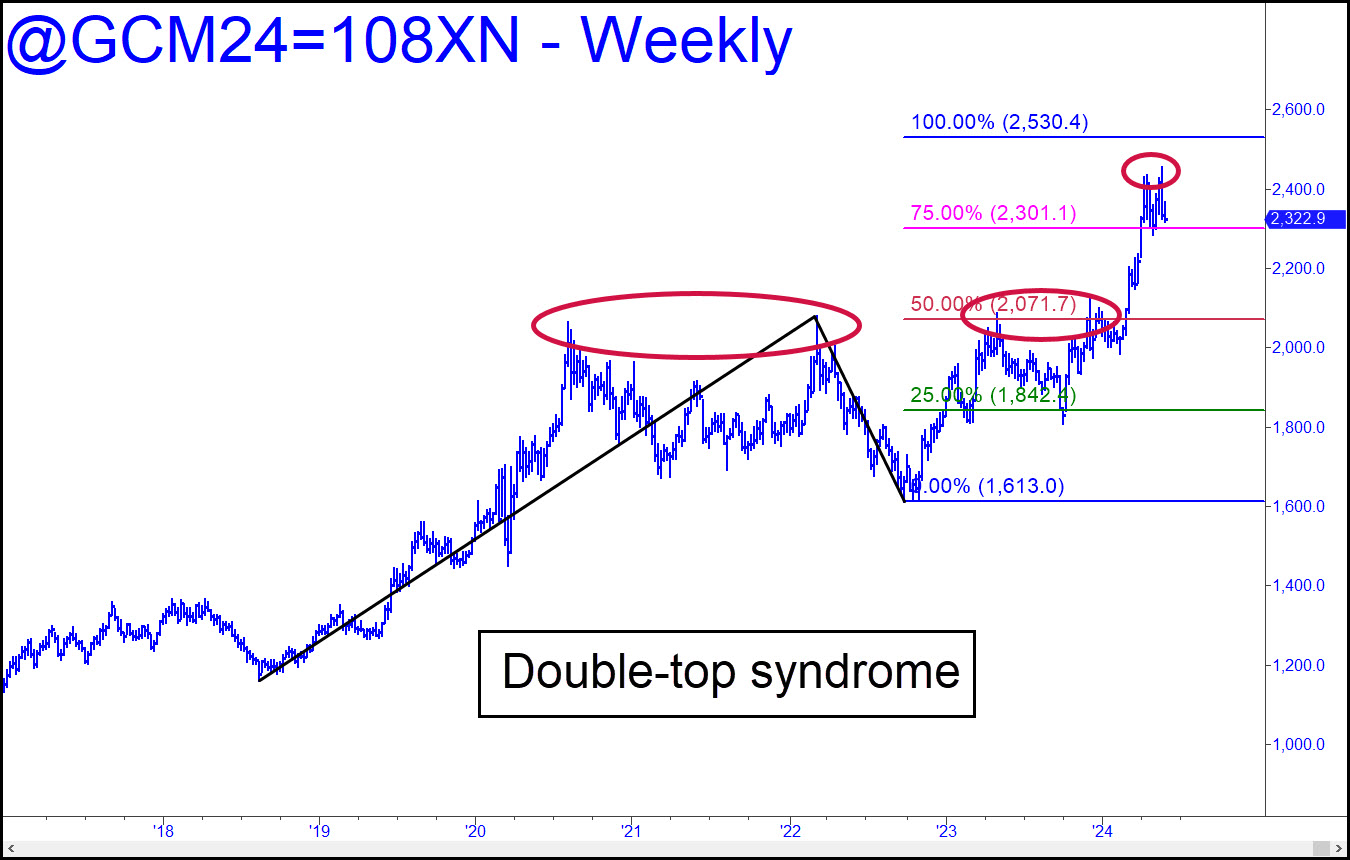

Gold has repeatedly resolved double tops in favor of bulls for many years, but always differently. The current pair of peaks is tightly spaced, giving the impression of weighty distribution. The 2530.40 rally target on this continuous weekly chart is viable nonetheless, and there is no reason to presume it won’t be reached. But that does not preclude a sharp pullback first to the red line (p2=2071.70). It makes a logical target if bulls are to be rebuked yet again for their steadfast belief in the quaint idea of gold’s historical primacy as money. For now, let’s draw our inferences from the lesser charts of August Gold, which currently provide an easy path down to 2300-2320. ______ UPDATE (June 7, 12:15 p.m.): Gold has in fact followed an all-too-‘easy path’ south, to a so-far low today of 2320.20. That is the upper threshold of the corrective range I’d forecast. However, I’d be surprised if the futures did not take out May 3’s 2308.70 low and then diddle 2300 just for good measure.

Gold has repeatedly resolved double tops in favor of bulls for many years, but always differently. The current pair of peaks is tightly spaced, giving the impression of weighty distribution. The 2530.40 rally target on this continuous weekly chart is viable nonetheless, and there is no reason to presume it won’t be reached. But that does not preclude a sharp pullback first to the red line (p2=2071.70). It makes a logical target if bulls are to be rebuked yet again for their steadfast belief in the quaint idea of gold’s historical primacy as money. For now, let’s draw our inferences from the lesser charts of August Gold, which currently provide an easy path down to 2300-2320. ______ UPDATE (June 7, 12:15 p.m.): Gold has in fact followed an all-too-‘easy path’ south, to a so-far low today of 2320.20. That is the upper threshold of the corrective range I’d forecast. However, I’d be surprised if the futures did not take out May 3’s 2308.70 low and then diddle 2300 just for good measure.

GCQ24 – August Gold (Last:2325.60)

Posted on June 2, 2024, 5:15 pm EDT

Last Updated June 7, 2024, 12:15 pm EDT

Posted on June 2, 2024, 5:15 pm EDT

Last Updated June 7, 2024, 12:15 pm EDT