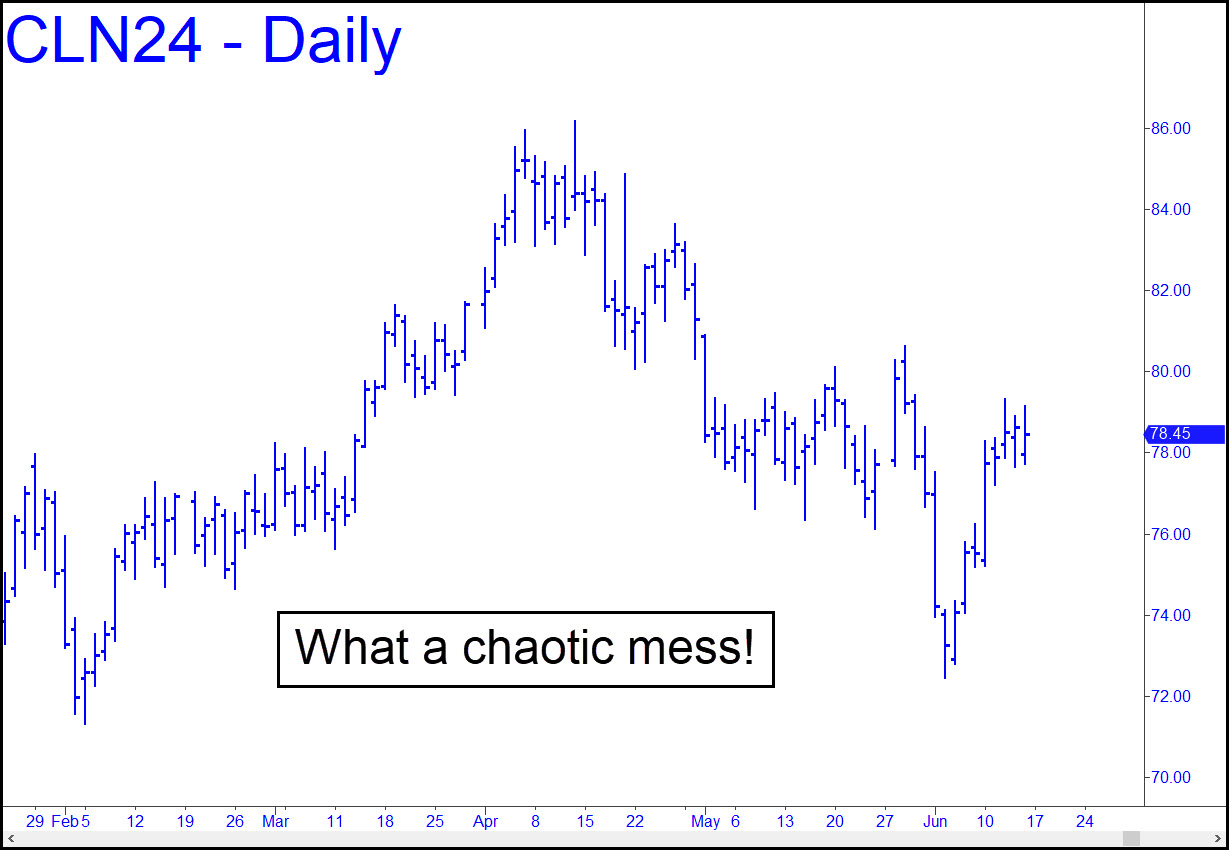

The wild, gratuitous price swings in the world’s biggest commodity market could make energy consumers nostalgic for the 1950s, when U.S. policymakers, CIA hacks and political operatives firmly controlled Saudi Arabia, Kuwait, Iran and other key producers. I’ve kept oil on the touts list nonetheless, but only as a placeholder, since technical analysis no longer gives me a confident basis for forecasting the next big move. I don’t mean to suggest that crude is untradable. Far from it, actually, since the intraday swings are so fraught with duplicity, greed and fear as to have become routinely predictable. Nudge me in the chat room if you have a trading idea you’d like vetted. But don’t ask me where I think oil will be trading in a month or two, or at year’s end, since there is really no way of knowing. My best guess for the very near-term is that the July contract is bound for 80.21, predicated on the June 11 low at 77.22 not being violated first.

The wild, gratuitous price swings in the world’s biggest commodity market could make energy consumers nostalgic for the 1950s, when U.S. policymakers, CIA hacks and political operatives firmly controlled Saudi Arabia, Kuwait, Iran and other key producers. I’ve kept oil on the touts list nonetheless, but only as a placeholder, since technical analysis no longer gives me a confident basis for forecasting the next big move. I don’t mean to suggest that crude is untradable. Far from it, actually, since the intraday swings are so fraught with duplicity, greed and fear as to have become routinely predictable. Nudge me in the chat room if you have a trading idea you’d like vetted. But don’t ask me where I think oil will be trading in a month or two, or at year’s end, since there is really no way of knowing. My best guess for the very near-term is that the July contract is bound for 80.21, predicated on the June 11 low at 77.22 not being violated first.

CLN24 – July Crude (Last:78.45)

Posted on June 16, 2024, 5:07 pm EDT

Last Updated June 15, 2024, 2:44 pm EDT

Posted on June 16, 2024, 5:07 pm EDT

Last Updated June 15, 2024, 2:44 pm EDT