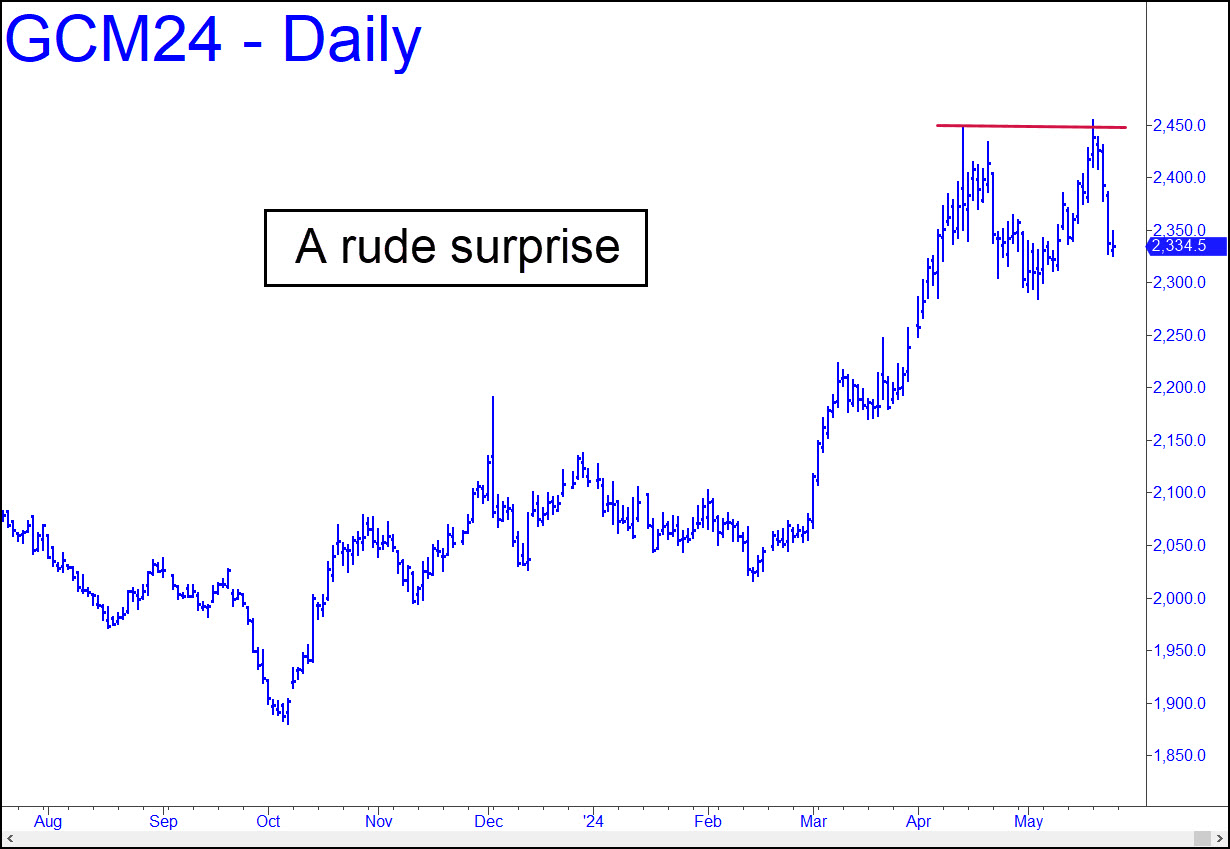

The drubbing that gold received last week after having slightly exceeded the 2449 high from mid-April was a rude shock. It created a series of impulse legs on the hourly chart, even if it missed being impulsive on the daily chart by a mile. The most troubling aspect of May 20’s false breakout is that the rally fell $34 shy of the 2588 target I’d identified earlier, a Hidden Pivot related to a chart of higher degree. This trend failure will have taken enough bulls by surprise to add the weight of their shock and disappointment to current selling. It points most immediately to a test of the 2285 low recorded on May 3, so let’s make that our minimum downside objective for now. It would take a print all the way down at 2170.70 to generate a bearish impulse leg on this chart, but that is a prospect we needn’t worry about at the moment.

The drubbing that gold received last week after having slightly exceeded the 2449 high from mid-April was a rude shock. It created a series of impulse legs on the hourly chart, even if it missed being impulsive on the daily chart by a mile. The most troubling aspect of May 20’s false breakout is that the rally fell $34 shy of the 2588 target I’d identified earlier, a Hidden Pivot related to a chart of higher degree. This trend failure will have taken enough bulls by surprise to add the weight of their shock and disappointment to current selling. It points most immediately to a test of the 2285 low recorded on May 3, so let’s make that our minimum downside objective for now. It would take a print all the way down at 2170.70 to generate a bearish impulse leg on this chart, but that is a prospect we needn’t worry about at the moment.

GCM24 – June Gold (Last:2345.50)

Posted on May 26, 2024, 5:15 pm EDT

Last Updated May 25, 2024, 9:00 am EDT

Posted on May 26, 2024, 5:15 pm EDT

Last Updated May 25, 2024, 9:00 am EDT