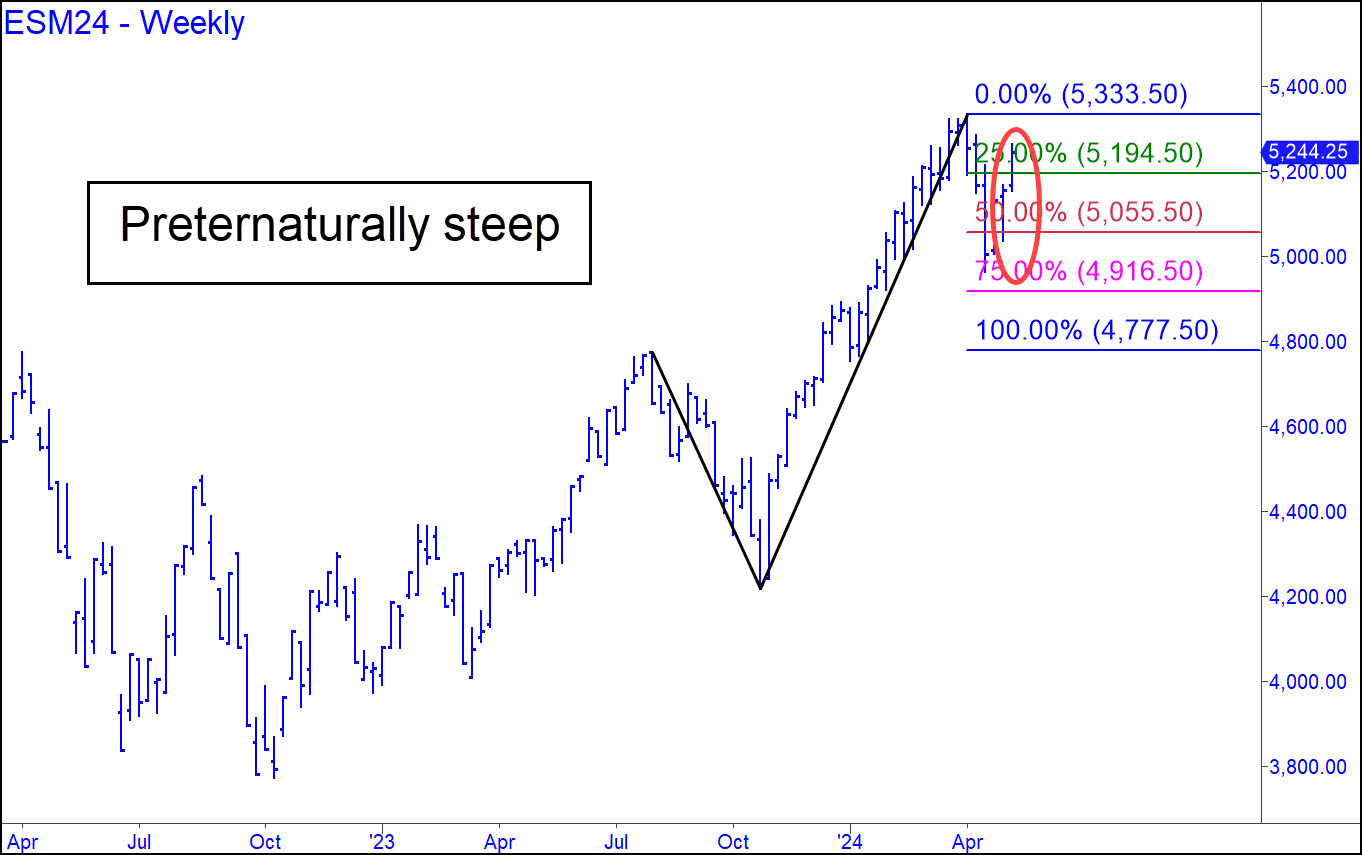

The armpit-sniffing monkeys who believe themselves to be in control of the markets seem to have forgotten what kicked off this too-steep rally. It was the uncannily well-timed announcement by AAPL of a $110 billion stock buyback a week earlier. Ironically, although AAPL appears to have stalled out with a relatively modest 6% gain on news they’d ginned up themselves to cover a faltering outlook, the S&Ps were as revved-up as ever last week, looking like they want to vault the previous all-time high at 5333.50 recorded on April Fool’s Day. They made such dramatic progress toward that goal last week that I am not going to insist that the old high will endure. Even so, I will be on Defcon One alert to the possibility Mr. Market will set the hook for bulls and bears alike via an irresistible feint to marginal new highs. Buying power would be supplied mainly by short-covering, so look for signs that bears are getting shredded, defenestrated, mauled, tortured and impaled by oscillations near 5333.50.

The armpit-sniffing monkeys who believe themselves to be in control of the markets seem to have forgotten what kicked off this too-steep rally. It was the uncannily well-timed announcement by AAPL of a $110 billion stock buyback a week earlier. Ironically, although AAPL appears to have stalled out with a relatively modest 6% gain on news they’d ginned up themselves to cover a faltering outlook, the S&Ps were as revved-up as ever last week, looking like they want to vault the previous all-time high at 5333.50 recorded on April Fool’s Day. They made such dramatic progress toward that goal last week that I am not going to insist that the old high will endure. Even so, I will be on Defcon One alert to the possibility Mr. Market will set the hook for bulls and bears alike via an irresistible feint to marginal new highs. Buying power would be supplied mainly by short-covering, so look for signs that bears are getting shredded, defenestrated, mauled, tortured and impaled by oscillations near 5333.50.

ESM24 – June E-Mini S&Ps (Last:5243.50)

Posted on May 12, 2024, 5:20 pm EDT

Last Updated May 15, 2024, 3:59 pm EDT

Posted on May 12, 2024, 5:20 pm EDT

Last Updated May 15, 2024, 3:59 pm EDT