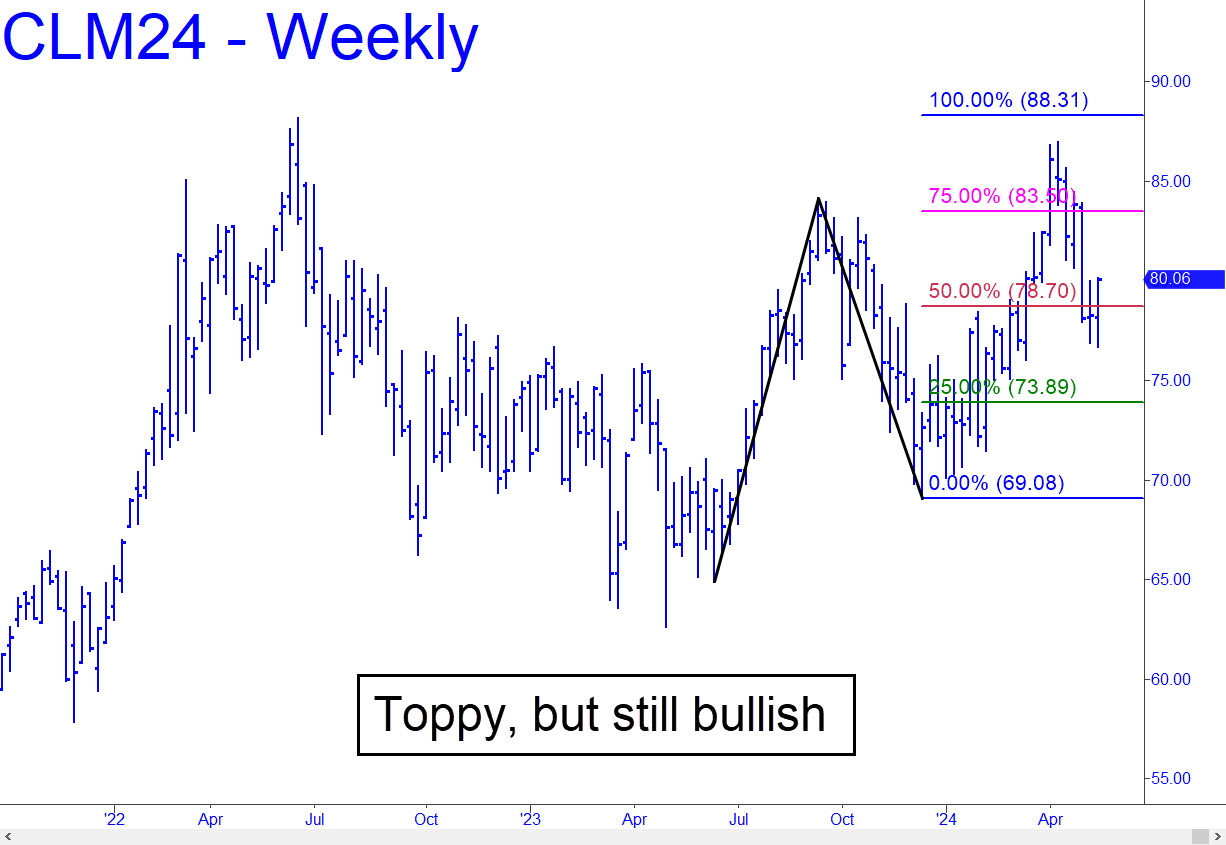

There were two good reasons for the June contract to have retreated from its recent high at 86.97. First was the daunting resistance from the 88.15 peak recorded nearly two years ago, and second was a coincident Hidden Pivot resistance at 88.31 that is shown in the chart. Together, with help from behind-the-scenes election-year manipulation, they stopped a move into the $90s that still seems all but ordained by the longer-term chart. In the meantime, the so-far moderate correction looks to be in no hurry to get traction. It suggests that quotes could be rangebound-to-lower until mid-summer (or so). Of course, there will always be the possibility of an exogenous event or even a black swan spiking prices outlandishly. Considering that Houthi missiles fired at tankers in the Suez caused barely a blip in quotes, however, we can assume that larger forces of supply and demand are in near-stasis at the moment and will continue to keep volatility subdued. _______ UPDATE (May 25): I’m updating with a chart of the July contract, but the comments above still apply. It has just breached a double support by dipping beneath a midpoint Hidden Pivot at 76.48 and also May’s 76.36 low. It has rallied as we might have expected, since crude is the champ of fake-outs that stop out everyone, but I doubt it’ll get very far.

There were two good reasons for the June contract to have retreated from its recent high at 86.97. First was the daunting resistance from the 88.15 peak recorded nearly two years ago, and second was a coincident Hidden Pivot resistance at 88.31 that is shown in the chart. Together, with help from behind-the-scenes election-year manipulation, they stopped a move into the $90s that still seems all but ordained by the longer-term chart. In the meantime, the so-far moderate correction looks to be in no hurry to get traction. It suggests that quotes could be rangebound-to-lower until mid-summer (or so). Of course, there will always be the possibility of an exogenous event or even a black swan spiking prices outlandishly. Considering that Houthi missiles fired at tankers in the Suez caused barely a blip in quotes, however, we can assume that larger forces of supply and demand are in near-stasis at the moment and will continue to keep volatility subdued. _______ UPDATE (May 25): I’m updating with a chart of the July contract, but the comments above still apply. It has just breached a double support by dipping beneath a midpoint Hidden Pivot at 76.48 and also May’s 76.36 low. It has rallied as we might have expected, since crude is the champ of fake-outs that stop out everyone, but I doubt it’ll get very far.

CLM24 – June Crude (Last:79.26)

Posted on May 19, 2024, 5:09 pm EDT

Last Updated May 31, 2024, 11:37 pm EDT

Posted on May 19, 2024, 5:09 pm EDT

Last Updated May 31, 2024, 11:37 pm EDT