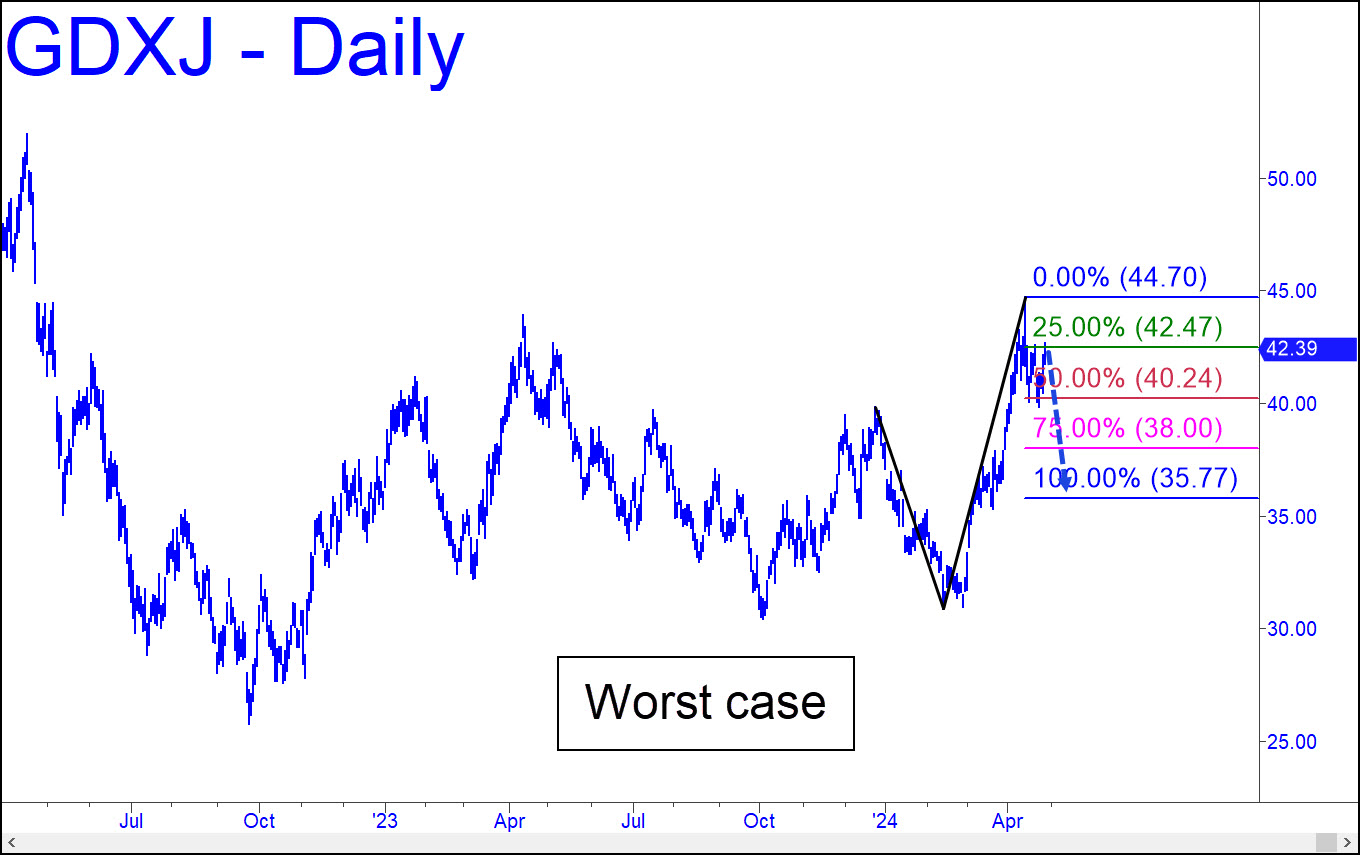

Although the downtrend’s stall at 40.24 suggests the midpoint support might hold, my bias is bearish due to a silver chart that suggests bullion’s correction has further to go. That implies sellers will breach p, headed to at least p2=38.00, or possibly to d=35.77. That is as bad as I could see, as the chart suggests, although it is not theoretically the worst case, which would be 31.27 (on the daily chart, use reverse a=43.89 on 4/13/23). The good news is that the associated p at 37.99 would offer another potential turnaround spot where we could attempt to bottom-fish aggressively with risk under very tight control. There is also the possibility that p=40,24 will hold and the GDXJ, along with gold and silver futures, will break out to new highs. For that to happen after so fleeting a shallow a correction would be very bullish.

Although the downtrend’s stall at 40.24 suggests the midpoint support might hold, my bias is bearish due to a silver chart that suggests bullion’s correction has further to go. That implies sellers will breach p, headed to at least p2=38.00, or possibly to d=35.77. That is as bad as I could see, as the chart suggests, although it is not theoretically the worst case, which would be 31.27 (on the daily chart, use reverse a=43.89 on 4/13/23). The good news is that the associated p at 37.99 would offer another potential turnaround spot where we could attempt to bottom-fish aggressively with risk under very tight control. There is also the possibility that p=40,24 will hold and the GDXJ, along with gold and silver futures, will break out to new highs. For that to happen after so fleeting a shallow a correction would be very bullish.

GDXJ – Junior Gold Miner ETF (Last:42.39)

Posted on April 28, 2024, 5:13 pm EDT

Last Updated April 28, 2024, 12:54 pm EDT

Posted on April 28, 2024, 5:13 pm EDT

Last Updated April 28, 2024, 12:54 pm EDT