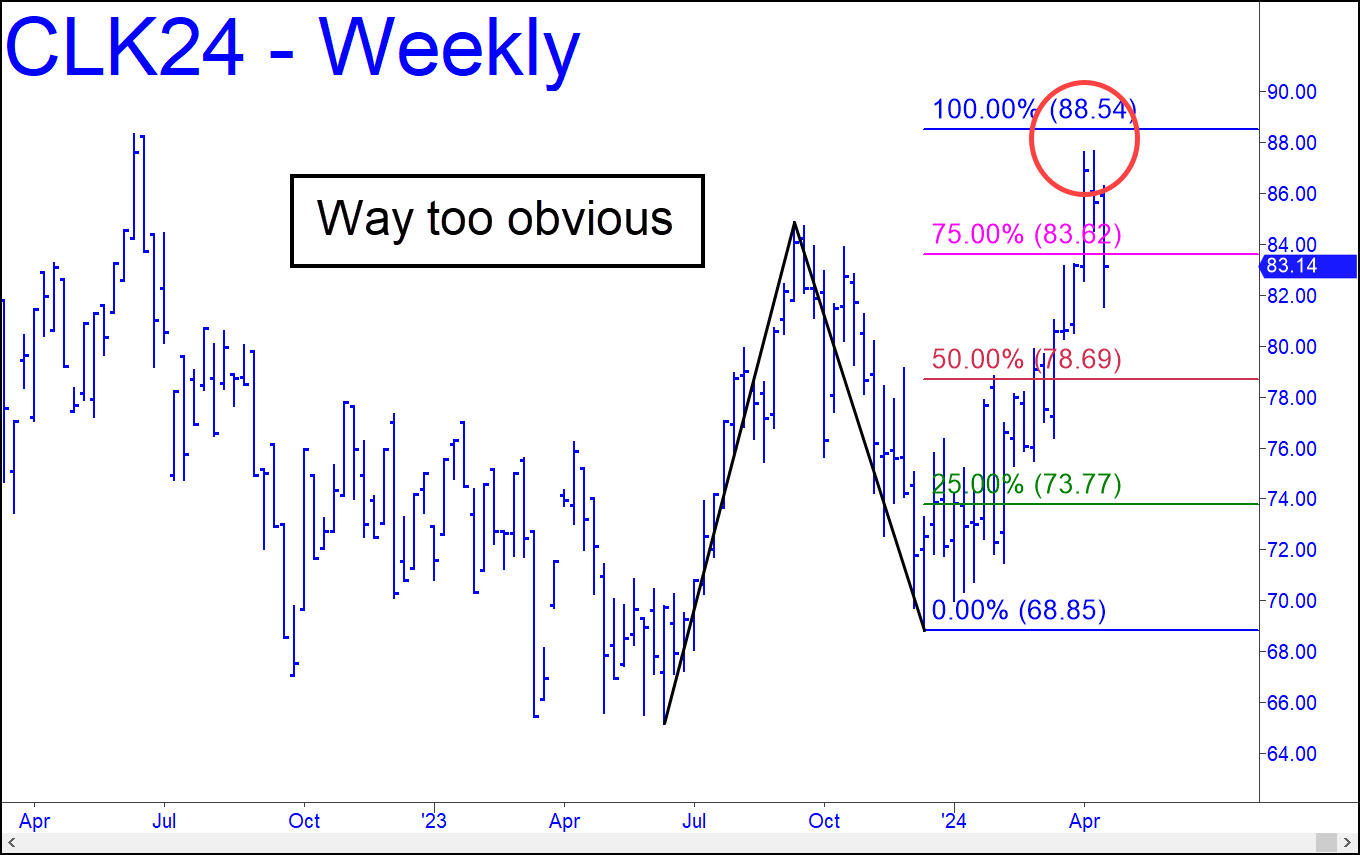

Although 2024’s steep rally from $69 failed just shy of an important Hidden Pivot target at 88.54 (see inset), I expect a second-wind push to get there, surpassing the key external peak at 88.31 recorded in June 2022. That would create an impulse leg of weekly-chart degree sufficiently powerful to push crude to $100, a psychologically terrifying level in a world where inflation has stubbornly refused to cool off. I am bullish on crude in part because the recent high occurred in too obvious a place — i.e., slightly below the D target of a pattern that virtually every trader would have observed, and less than a dollar below the June 2022 peak. This doubly obvious resistance’ begs to be tested, and so it shall be. _______ UPDATE (Apr 28): The 88.54 rally target is still my minimum upside objective for the near term, but here’s why the futures may have to come down to 80.39 first. The equivalent numbers for the June contract, respectively, are 88.31 and 80.03.

Although 2024’s steep rally from $69 failed just shy of an important Hidden Pivot target at 88.54 (see inset), I expect a second-wind push to get there, surpassing the key external peak at 88.31 recorded in June 2022. That would create an impulse leg of weekly-chart degree sufficiently powerful to push crude to $100, a psychologically terrifying level in a world where inflation has stubbornly refused to cool off. I am bullish on crude in part because the recent high occurred in too obvious a place — i.e., slightly below the D target of a pattern that virtually every trader would have observed, and less than a dollar below the June 2022 peak. This doubly obvious resistance’ begs to be tested, and so it shall be. _______ UPDATE (Apr 28): The 88.54 rally target is still my minimum upside objective for the near term, but here’s why the futures may have to come down to 80.39 first. The equivalent numbers for the June contract, respectively, are 88.31 and 80.03.

CLK24 – May Crude (Last:83.02)

Posted on April 21, 2024, 5:22 pm EDT

Last Updated May 4, 2024, 11:53 pm EDT

Posted on April 21, 2024, 5:22 pm EDT

Last Updated May 4, 2024, 11:53 pm EDT