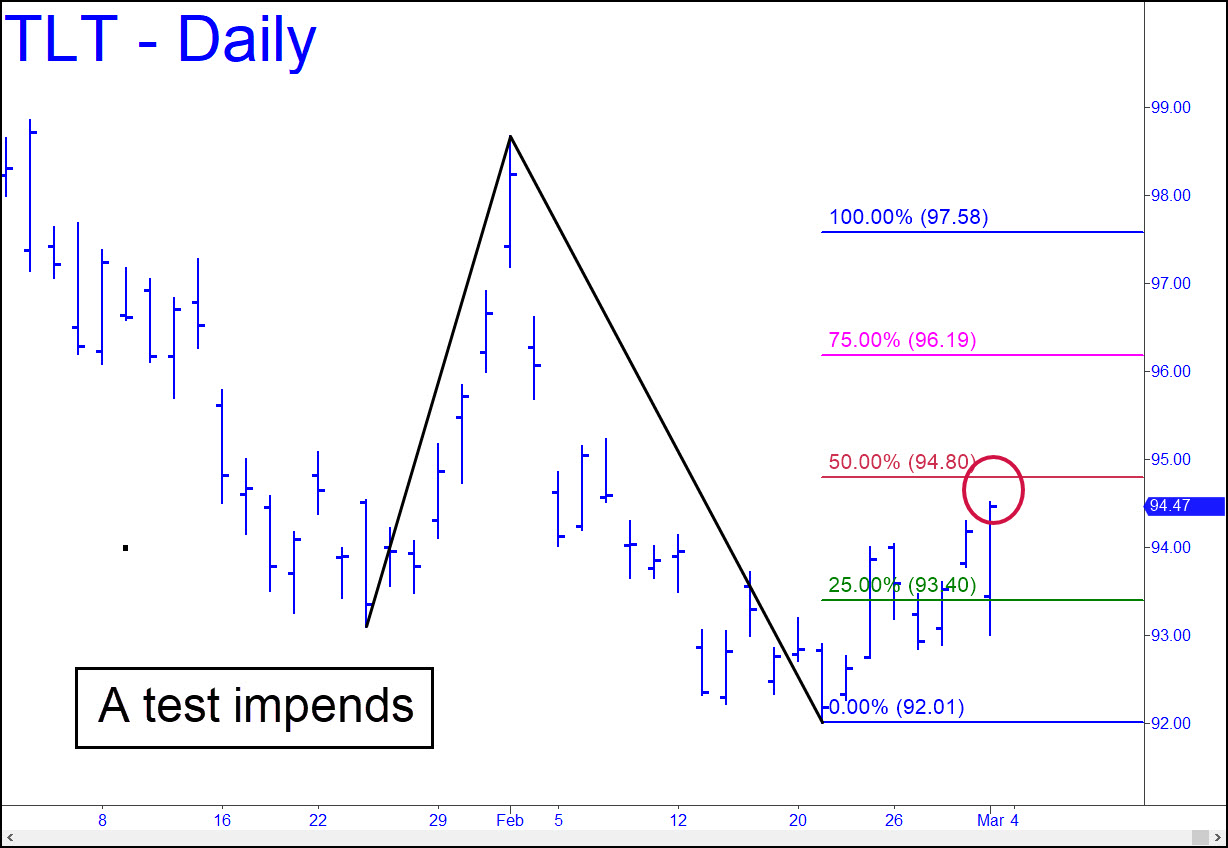

T-Bonds have been on a theoretical buy signal since February 23, when this vehicle popped through the green line (x-93.40). The minimum upside objective is p=94.80, but we’ll be more interested to see how buyers interact with that ‘hidden’ resistance than in trading GDXJ. A quick and decisive push past it would provide a tailwind for a move to as high as 97.58 over the next several weeks. _______ UPDATE (Mar 9): Last Tuesday’s gap through p=94.80 all but guarantees the rally will reach a minimum 97.58, the ‘D’ target of this pattern. An easy move through that Hidden Pivot resistance would imply that the bull cycle begun from 82.42 last October is about to surge anew.

T-Bonds have been on a theoretical buy signal since February 23, when this vehicle popped through the green line (x-93.40). The minimum upside objective is p=94.80, but we’ll be more interested to see how buyers interact with that ‘hidden’ resistance than in trading GDXJ. A quick and decisive push past it would provide a tailwind for a move to as high as 97.58 over the next several weeks. _______ UPDATE (Mar 9): Last Tuesday’s gap through p=94.80 all but guarantees the rally will reach a minimum 97.58, the ‘D’ target of this pattern. An easy move through that Hidden Pivot resistance would imply that the bull cycle begun from 82.42 last October is about to surge anew.

TLT – Lehman Bond ETF (Last:95.91)

Posted on March 3, 2024, 5:10 pm EST

Last Updated March 9, 2024, 2:36 pm EST

Posted on March 3, 2024, 5:10 pm EST

Last Updated March 9, 2024, 2:36 pm EST