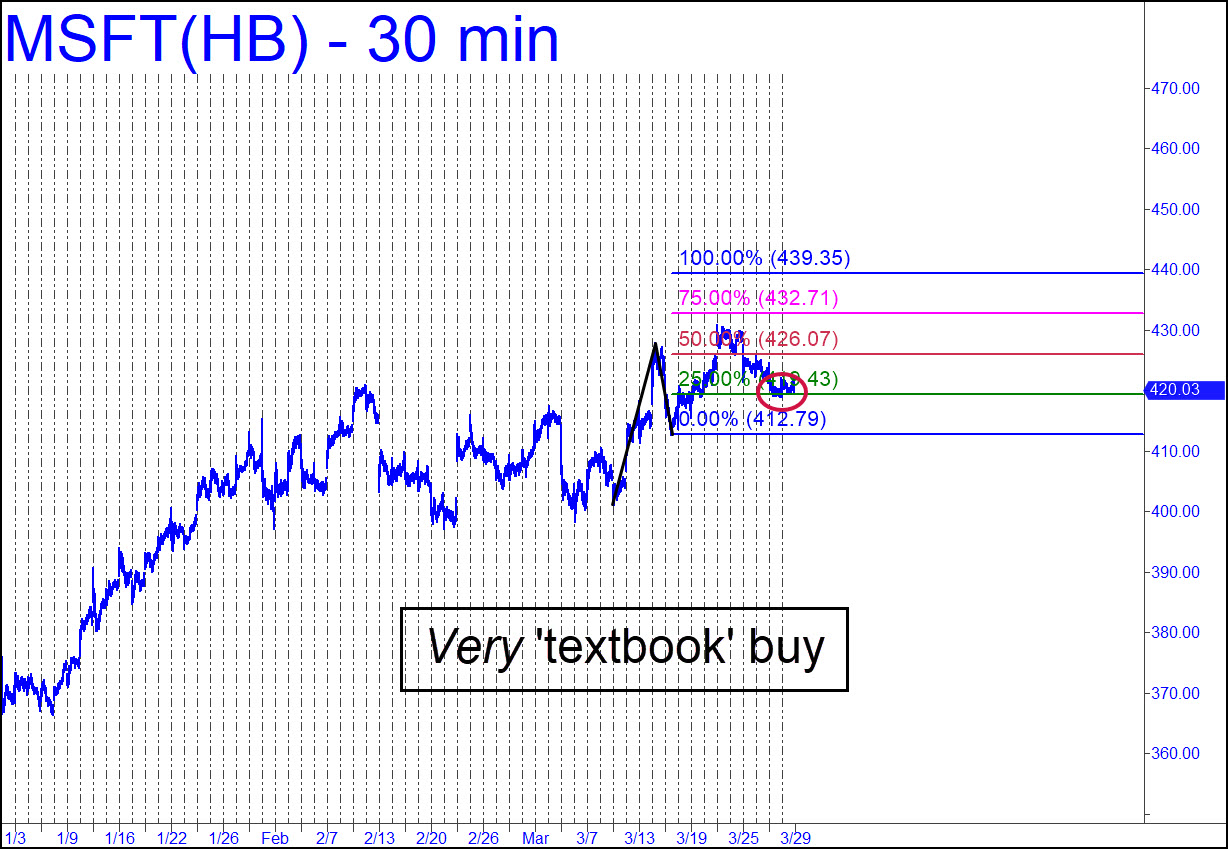

The ‘mechanical’ buy that triggered when MSFT fell to the green line last Thursday was about as ‘textbook’ as they come, meaning it is all but certain to deliver a profit unless truly dreadful news greets stocks when they begin to trade Sunday evening. Acting on the signal by purchasing call options would have been a non-starter, however, since fully four days will have elapsed if the stock begins to move as early as Monday. That’s why we should never purchase options just ahead of a long holiday weekend. Perhaps another opportunity will arise this week ahead of the stock’s presumptive ascent to D=439.35. Stay tuned to the chat room and your email ‘Notifications’ to keep apprised. And, yes, this does mean my longstanding, ostensibly major target at 430.58 has been diminished by the certitude that a higher target of lesser degree will be reached. _______ UPDATE (Apr 2, 11:13 a.m.): Today’s so-far moderate selloff has brought the stock down to the green line for the second ‘mechanical’ buy signal in three days. The first produced a one-level profit, but we’ll be keenly interested to see whether this signal delivers as well. It would be unusual for so well-formed a pattern to fail to reach its D rally target — in this case 439.35. _______ UPDATE (Feb 5, 9:48 a.m.): Microsoft has triggered a third ‘mechanical’ buy this morning since correctively bottoming at 412.79 three weeks ago. Ordinarily, the signal’s usefulness degrades with each repetition, and so I am not suggesting that you jump on this ‘sloppy thirds’ opportunity. However, it will be interesting to see whether the stock fails to achieve a hat-trick of ‘mechanical’ winners. This would be rare for the stock, which has notched precious few lower lows over the last several years without having completed a bullish ABCD move. Here’s the chart, with a still unfilled target at 439.35 that would decisively exceed my billboarded bull-market killer at 430.58. Here’s a chart that shows it all.

The ‘mechanical’ buy that triggered when MSFT fell to the green line last Thursday was about as ‘textbook’ as they come, meaning it is all but certain to deliver a profit unless truly dreadful news greets stocks when they begin to trade Sunday evening. Acting on the signal by purchasing call options would have been a non-starter, however, since fully four days will have elapsed if the stock begins to move as early as Monday. That’s why we should never purchase options just ahead of a long holiday weekend. Perhaps another opportunity will arise this week ahead of the stock’s presumptive ascent to D=439.35. Stay tuned to the chat room and your email ‘Notifications’ to keep apprised. And, yes, this does mean my longstanding, ostensibly major target at 430.58 has been diminished by the certitude that a higher target of lesser degree will be reached. _______ UPDATE (Apr 2, 11:13 a.m.): Today’s so-far moderate selloff has brought the stock down to the green line for the second ‘mechanical’ buy signal in three days. The first produced a one-level profit, but we’ll be keenly interested to see whether this signal delivers as well. It would be unusual for so well-formed a pattern to fail to reach its D rally target — in this case 439.35. _______ UPDATE (Feb 5, 9:48 a.m.): Microsoft has triggered a third ‘mechanical’ buy this morning since correctively bottoming at 412.79 three weeks ago. Ordinarily, the signal’s usefulness degrades with each repetition, and so I am not suggesting that you jump on this ‘sloppy thirds’ opportunity. However, it will be interesting to see whether the stock fails to achieve a hat-trick of ‘mechanical’ winners. This would be rare for the stock, which has notched precious few lower lows over the last several years without having completed a bullish ABCD move. Here’s the chart, with a still unfilled target at 439.35 that would decisively exceed my billboarded bull-market killer at 430.58. Here’s a chart that shows it all.

MSFT – Microsoft (Last:421.52)

Posted on March 31, 2024, 5:18 pm EDT

Last Updated April 5, 2024, 9:49 am EDT

Posted on March 31, 2024, 5:18 pm EDT

Last Updated April 5, 2024, 9:49 am EDT