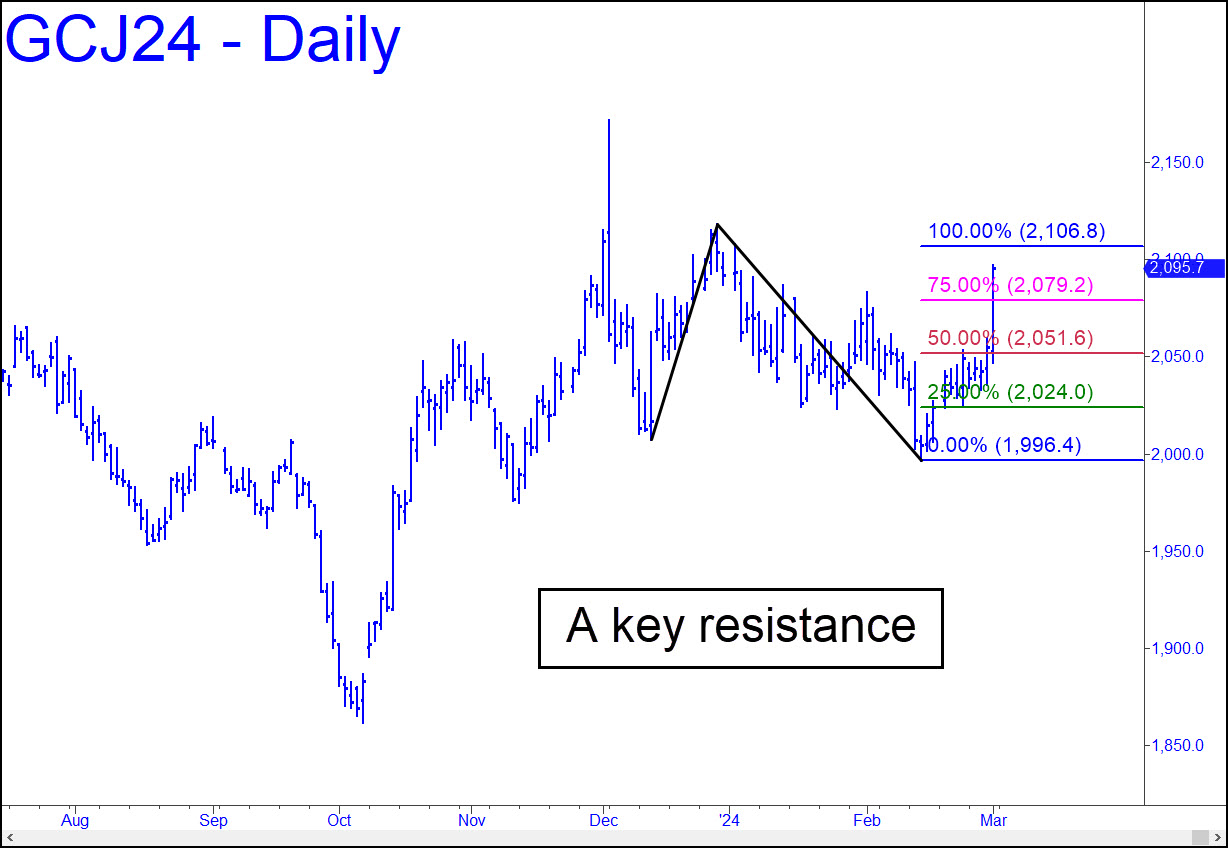

Friday’s surge will face a test of resistance at 2106.80, the ‘d’ target of the reverse pattern shown. If the futures go just a little higher, exceeding the ‘external’ peak at 2118.00 recorded on December 28, that would generate a strong impulse leg and open up a path to as high as 2204.00. The ‘p’ resistance associated with that target lies at 2105.80, meaning there are multiple ‘hidden’ impediments nearby that are going to put bulls’ mettle to the test. A clean blast through all of these HPs will signal the tone change we’ve awaited since December. _______ UPDATE (Feb 5, 10:32 a.m.): As implied above, yesterday’s blast through a tight cluster of ‘hidden’ resistances has put the futures on course for a run-up to at least 2204.00. Here’s another target, never broached here before: 2307.00. It is derived from A=1861.70 on 10/6, and tied to p=2151.70, where a stall could occur. ______ UPDATE (Feb 5, 6:20 p.m.): The steep rally begun last Friday did in fact stall almost precisely at the 2150.70 Hidden Pivot identified in my last update. The pullback has been shallow so far, with no impact on the likelihood of D being reached. ______ UPDATE (Mar 6, 5:20 p.m.): The little poke through p=2151.70 may not look like much, but it is quite bullish for two reasons: 1) at that price, there is double resistance from two p midpoints of different degree; and, 2) the futures have closed above the resistance on the first bar in which they encountered the resistance. If the futures close above 2151.70 for a second consecutive day, that would shorten the odds of a further run-up to 2307.00 to no worse than an even bet.

Friday’s surge will face a test of resistance at 2106.80, the ‘d’ target of the reverse pattern shown. If the futures go just a little higher, exceeding the ‘external’ peak at 2118.00 recorded on December 28, that would generate a strong impulse leg and open up a path to as high as 2204.00. The ‘p’ resistance associated with that target lies at 2105.80, meaning there are multiple ‘hidden’ impediments nearby that are going to put bulls’ mettle to the test. A clean blast through all of these HPs will signal the tone change we’ve awaited since December. _______ UPDATE (Feb 5, 10:32 a.m.): As implied above, yesterday’s blast through a tight cluster of ‘hidden’ resistances has put the futures on course for a run-up to at least 2204.00. Here’s another target, never broached here before: 2307.00. It is derived from A=1861.70 on 10/6, and tied to p=2151.70, where a stall could occur. ______ UPDATE (Feb 5, 6:20 p.m.): The steep rally begun last Friday did in fact stall almost precisely at the 2150.70 Hidden Pivot identified in my last update. The pullback has been shallow so far, with no impact on the likelihood of D being reached. ______ UPDATE (Mar 6, 5:20 p.m.): The little poke through p=2151.70 may not look like much, but it is quite bullish for two reasons: 1) at that price, there is double resistance from two p midpoints of different degree; and, 2) the futures have closed above the resistance on the first bar in which they encountered the resistance. If the futures close above 2151.70 for a second consecutive day, that would shorten the odds of a further run-up to 2307.00 to no worse than an even bet.

GCJ24 – April Gold (Last:2156.50)

Posted on March 3, 2024, 5:15 pm EST

Last Updated March 6, 2024, 5:23 pm EST

Posted on March 3, 2024, 5:15 pm EST

Last Updated March 6, 2024, 5:23 pm EST