The Fed’s main job supposedly is to manage our expectations. But have Powell & Co. painted themselves into a corner? At the moment, it would appear that investors have no clue what to expect from the Fed. That wouldn’t necessarily be a bad thing, except that their default mode has been to push stocks with multitrillion dollar capitalizations into unsustainably steep rallies. This trend is growing more dangerous and delusional by the week, and even a slight feint toward monetary clarity by policymakers could pop the bubble, turning an economic boom quickly into a global downturn. Meanwhile, the Fed’s credibility suffers every time they suggest inflation is mellowing. What their hemming and hawing suggest in reality is that no one on the Open Market Committee has bought gas or groceries in a long time.

The Fed’s main job supposedly is to manage our expectations. But have Powell & Co. painted themselves into a corner? At the moment, it would appear that investors have no clue what to expect from the Fed. That wouldn’t necessarily be a bad thing, except that their default mode has been to push stocks with multitrillion dollar capitalizations into unsustainably steep rallies. This trend is growing more dangerous and delusional by the week, and even a slight feint toward monetary clarity by policymakers could pop the bubble, turning an economic boom quickly into a global downturn. Meanwhile, the Fed’s credibility suffers every time they suggest inflation is mellowing. What their hemming and hawing suggest in reality is that no one on the Open Market Committee has bought gas or groceries in a long time.

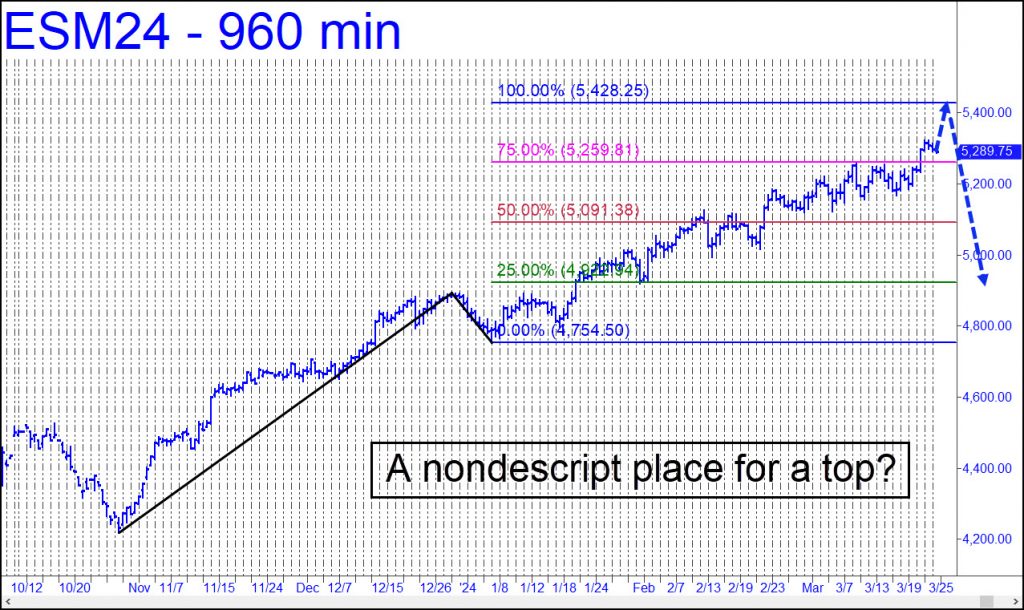

Stocks have been in an unnaturally steep climb since October, and no one would be surprised to see it end. Yeah, you’ve heard that before. But we’ll continue to serve up bear market porn anyway because the bullish case is too stupid and boring to write about. However bullish you might be, let’s face it: Stocks do not remotely deserve to be trading at these levels, and only an imbecile or someone paid to lie about it would argue otherwise.

Lunatic Sector

So how soon might we expect the market to go into a hellish dive? The chart above suggests the S&P Index could make an important top just 2.6% above these levels. We like the target because there is so little drama in the chart pattern that produced it. However, before we infer that the end is nigh, we need to put aside the fact that some key stocks in the lunatic sector — specifically Microsoft, Nvidia and Facebook — have already topped within a hair of major Hidden Pivot targets. NFLX in particular looks to have peaked last week with a high at 634.36 that exceeded a longstanding target at 632.47 by just 0.3%.

For now, set a screen alert as a reminder that 5428.25 is an opportune spot to short the E-Mini S&Ps. Even if there’s no immediate reaction, remember that bear markets do happen and that this bull is long overdue for a rebuke.