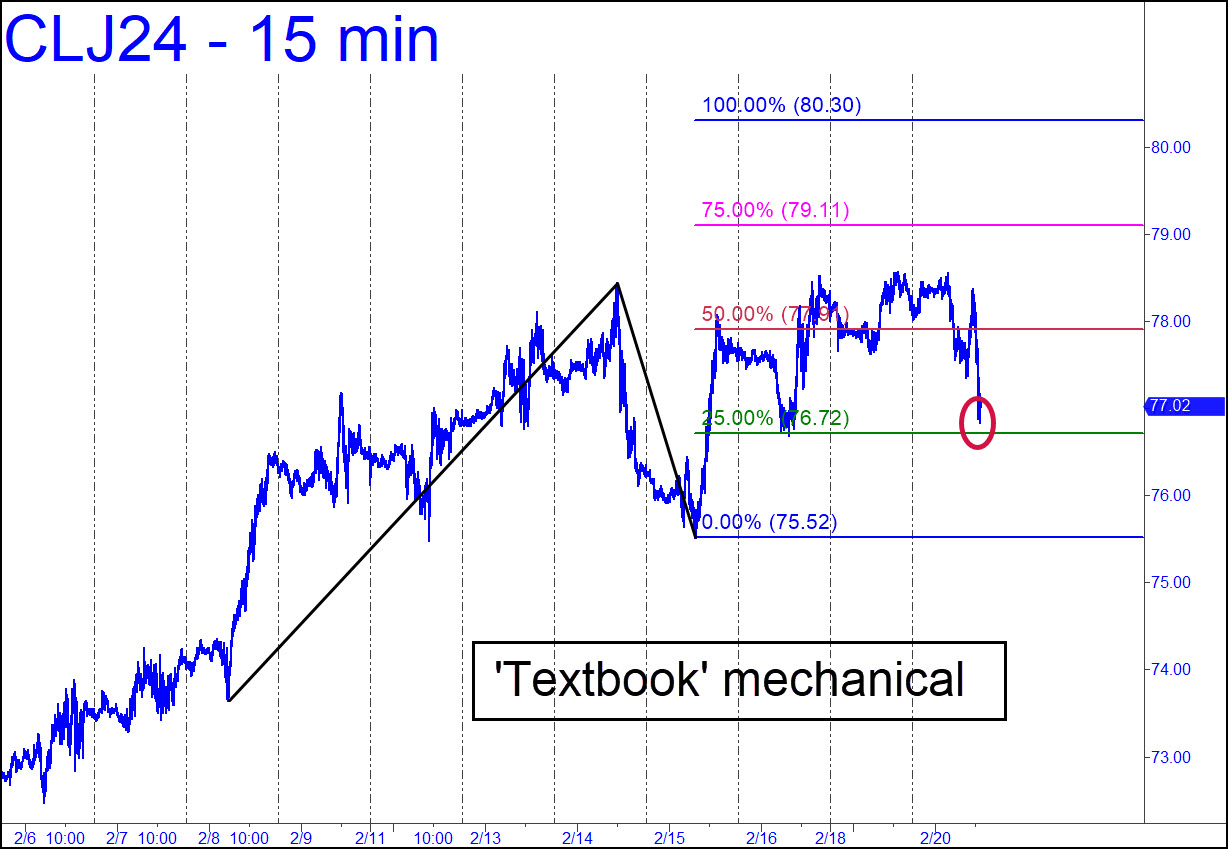

Crude is the most agitated trading vehicle I track, but paradoxically the easiest to trade. We can practically count on every tradable price reversal to come from within a tick or two of an in-your-face-obvious prior high or low — i.e., from smack-dab-in-the-middle of a ‘discomfort zone’. The pattern shown has a rally target at 80.30, and we know from experience that the political powers that be and their lackeys will be there to impede the uptrend, lest gasoline prices become problematical for voters nine months ahead of the election. The pattern is also an inch from triggering a textbook ‘mechanical’ buy at the green line. Watch it develop if you are bored. _______ UPDATE (Feb 23): The green line (x=76.71) could have been used to make as much as $2,200 per contract with little difficulty, since the futures made a nearly two-level move after dipping slightly below the line on Wednesday morning. A subscriber reported having used UCO to do the trade. Here’s the chart. The 80.30 target given above remains valid.

Crude is the most agitated trading vehicle I track, but paradoxically the easiest to trade. We can practically count on every tradable price reversal to come from within a tick or two of an in-your-face-obvious prior high or low — i.e., from smack-dab-in-the-middle of a ‘discomfort zone’. The pattern shown has a rally target at 80.30, and we know from experience that the political powers that be and their lackeys will be there to impede the uptrend, lest gasoline prices become problematical for voters nine months ahead of the election. The pattern is also an inch from triggering a textbook ‘mechanical’ buy at the green line. Watch it develop if you are bored. _______ UPDATE (Feb 23): The green line (x=76.71) could have been used to make as much as $2,200 per contract with little difficulty, since the futures made a nearly two-level move after dipping slightly below the line on Wednesday morning. A subscriber reported having used UCO to do the trade. Here’s the chart. The 80.30 target given above remains valid.

CLJ24 – April Crude (Last:76.57)

Posted on February 20, 2024, 11:33 am EST

Last Updated February 23, 2024, 8:29 pm EST

Posted on February 20, 2024, 11:33 am EST

Last Updated February 23, 2024, 8:29 pm EST