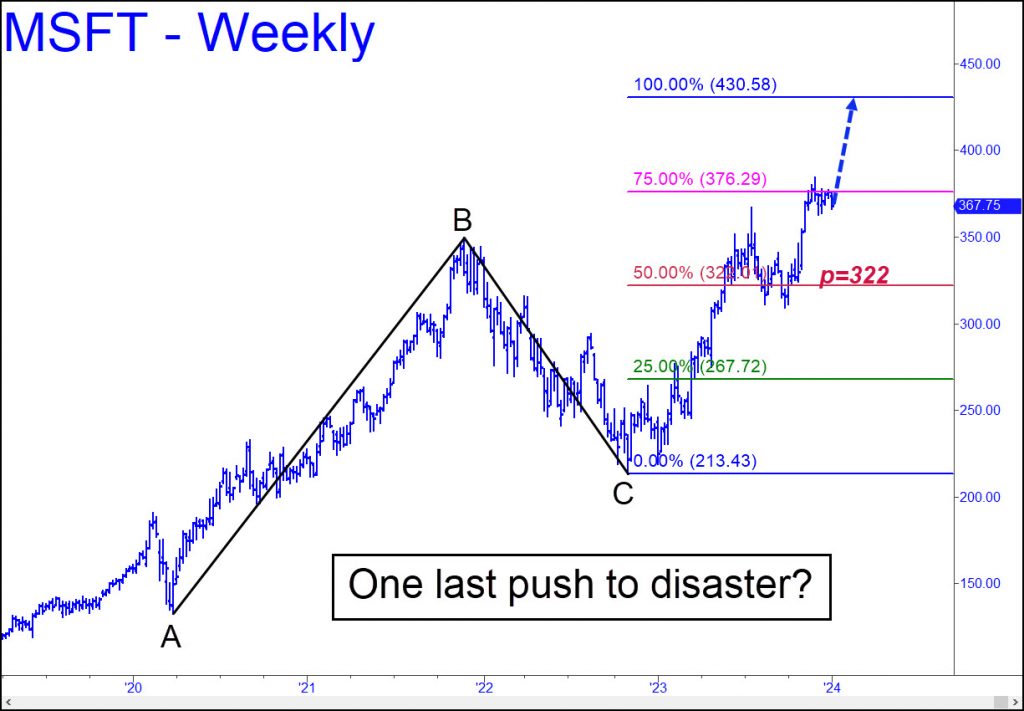

The stock market is so pumped with hubris, lies and delusions that I’m beginning to doubt whether the bull market will see Microsoft rally to $430 before everything comes crashing down. I’ve been using MSFT as a bellwether because it has been the strongest megacap stock in the world for the last four years, and because the company’s subscription-based revenues will continue to flow even in a severe economic downturn. The stock’s weekly chart implies it will make a very important top if and when it hits 430, but there are no guarantees it will get there. The chart’s bullishness is persuasive on this point because of the ease with which buyers exceeded the p=322 ‘midpoint pivot’ of the pattern. However, the implied power of the move would have been greater if the rally had impaled p and never looked back. Instead, MSFT took its sweet old time over a period of five months in turning the midpoint pivot into a launching pad. This, in my estimation, has made the stock an 80% likelihood to reach 430, as opposed to a 95% bet if buyers had pulverized p=322 on first contact.

So how do we deal with 20% uncertainty about how and when a top will occur? It is important to get this right, since the bear market that’s coming stands to bring even greater hardship to most Americans than the 1930s. People were more resourceful then, with 30% of the work force tied to agriculture, literally living off the land. They were not in hock up to their eyeballs, and women had the option of staying home with their children. The dollar was backed by gold and fundamentally sound. Government statistics tied to job creation, unemployment and GDP growth were not horse manure like the numbers shoveled at us today, and the economy was mostly brick-and-mortar rather than financialized beyond honest reckoning. These days, even eggheads at leading universities can’t tell for certain whether the economy is booming or dying. It is supposedly 60% consumption-driven, but as Main Street USA has become increasingly boarded up, only a relative handful of big retailers have survived. To make things worse, with the minimum wage headed inexorably toward $20, they have been investing heavily in ways to shrink their payrolls. ‘Strong’ job growth is a dirty lie, as anyone can plainly see; and if unemployment can be reported as unbelievably low, it is mainly because young people would rather not work. Lawyers are a tireless exception, but AI and hard times are about to decimate their ranks like an avenging angel.

No Dollar Alternatives

With trade in goods and services dwarfed by a paper-shuffling economy perhaps twenty times as large, our focus should be on the dollar, more than on Microsoft, to tell us when the financial system has begun to implode. It is logical to think the Fed’s monetization blowout, with yet another phase likely to begin in 2024, will cheapen the dollar. Some observers think greenbacks will be replaced by a form of gold, perhaps tokens. However, there are no alternatives to the dollar even remotely large enough to handle the $2 quadrillion of speculative action enabled by the derivatives market. When this house of cards implodes, triggered by who-knows-what, it will shrink the fungible supply of dollars so severely as to cause a short squeeze on dollars. Traders in particular understand how this can propel the nominal value of even worthless securities into the stratosphere. The same could happen to a dollar that already is just a heavily encumbered IOU. And although the short squeeze would likely be over quickly, it would take but a few days to turn the economy and the banking system into smoldering ruin.

That’s why we should keep a close eye on the dollar, which has been falling since the last quarter of 2022. The decline could accelerate as Putin, China, the BRICs, oil producers, the Houthis and just about everyone else continue to humiliate into oblivion the waning myth of American power and influence. But don’t expect the dollar to go quietly into the night. Its sinking spell could be likened to the receding tide that precedes a tsunami. When the big wave comes, few who owe dollars will be able to survive financially. A stock-market plunge will signal the impending disaster, and we can expect it to begin visibly just as the Fed announces its first rate-cut in years.

Wow, Mr. Gloom & Doom!

Here’s why you’re likely to be wrong:

1. As economist Michael Hudson has said repeatedly: “Debts that can’t be repaid, won’t be.” Sounds obvious, but you should apply that to the 2 quadrillion derivatives debt you cite. So what if the institutions owed that debt aren’t repaid? The point is whether governments want to keep them functioning, clear out the rot (finally), not pay off OTHER rotten institutions that should never have taken such bets in the first place. Former Asst. Treasury Secretary (and I, in an article on Opednews, independently: https://www.opednews.com/articles/A-necessary-addendum-to-Pa-by-Scott-Baker-120606-371.html) believe that the punishment for “sophisticated” investors who deliberately failed to do due diligence should be them not getting paid, and even penalized for fraud, EVEN if they “win” the bet and can’t collect. Would YOU take a bet on whether it would rain tomorrow with me for $10 million, without being darn sure I could pay if I lost? Didn’t think so. Also, it’s not $2Q. It’s probably less than half that because for every bet on rain, there’s a counterbet in the other direction. It’s less still, because derivatives are on all kinds of things, and they literally cannot fail all at once.

2. The sanctions are responsible for the weakness in the dollar. Most countries, even the ones that hate us, were content to use the Swift system and the dollar tied to that, to transact foreign trade since Bretton Woods. They might have grumbled, but they realized how hard it would be to set up an alternative. But America has had endless & expanding sanctions now – including the ridiculous one against Cuba that should have ended when the Soviet Union fell – and they felt there was no alternative. But, according to Peter Zeihan and others, having India and China in the same counter-dollar alliance, as well as other weaker countries, just guarantees chaos and failure to agree on currency valuations. Unlike the dollar, China’s Yuan doesn’t trade freely. And the Rupee is domestically manipulated, with cash being phased out almost arbitrarily to combat fraud, but also to go to digital money – in a country with severe famine and non-electrification still issues. Are these the kinds of currencies one wants to replace the dollar with??

3. The wars are indeed an existential crisis, though they also show how untrustworthy alternate currencies will be. If Ukraine falls, Europe will depend on America all the more, while importing American weapons even more, boosting our domestic producers. If, unlikely but not impossible, Israel fails to stop the spread of Islam via two terrorist organizations & their Iran backers, it’s going to be a very volatile world, and it’s hard to see how any ME country will be trusted (already a problem). America, fortunately, is now oil/NG-independent. Europe is now racing ahead with renewable alternatives, spurred on by boycotting Russia and Iran. Oil prices are going DOWN, not UP, though that’s also a rigged market, driven by speculators, not true supply (which is variable, but ample in a world which is gradually switching to renewables, while new discoveries in Guiana, and elsewhere, increase supplies) and demand (which is constant).

4. The market is over-bought in the short term, but not dangerously so with AI and even robots upending all models and systems, ultimately mostly for the good.

I could go on, but this is too long already.

&&&&&

You seem like a very smart guy, Scott, and I sincerely appreciate the effort you’ve put into spreading sunshine into this otherwise gloomy redoubt. However, you lost me with your first sentence, the one that dismissed countless hundreds of trillions of dollars of debt with an imperious wave of the hand. The unfortunate and indisputable fact is that EVERY PENNY of EVERY debt MUST ultimately be repaid — if not by the borrower, then by the lender.

Although you seem not to have noticed, this has been happening quietly for quite some time via an egregious downward adjustment in our standard of living. We have fabulous gizmos, cars and sports equipment to distract us from the deterioration all around us and the growing squalor of our cities. However, in ALL of the important categories, the good life has become steeply less affordable for middle class Americans. This is directly tied to all the borrowing we have done, the frightening, cumulative growth of debt, and to the grim fact that unless interest rates remain heavily suppressed, we will soon be unable to pay even the interest on all the borrowing.

This self-destructive trend began in the 1970s, when housewives were forced by economic necessity to join the work force instead of staying home with their children. Recall that in the 1950s/60s, good medical care and college tuition were affordable even for single-income families. This is no longer true, to put it mildly. Just wait till you see how all of those debts that you would assert do not matter leave Baby Boomers with triaged medical care, a scarcity of coronary bypass operations, hip and knee replacements, and monthly Social Security checks that have been cut by 80%. (That’s unless you believe Gen-xers and Millennials who live in their parents’ basements, and who will never be able to pay off the loans that financed their art history degrees, can foot the Boomers’ retirement bills). Re-read ‘Road to Serfdom’ if you want to understand the ‘how’ and the ‘why’.

I wish I could share your optimism, but it is not rooted in reality. Debt matters, and we have amassed far more of it than we can ever hope to repay. Your wave of the hand will not get rid of those student loans. All $1.8 trillion of it will be recorded as a loss by bondholders, with a corresponding reduction in the total wealth available to “the system’. The $1.8 trillion is not even a drop in the bucket compared to the sums on loan via the $2 quadrillion derivatives market. When it collapses under its owm, grotesque weight, every dime of it will be lost to the economic ecosystem. This cannot but portend a drastic reduction in amenities, services and quality of life that stands to be even worse than the Great Depression.

RA