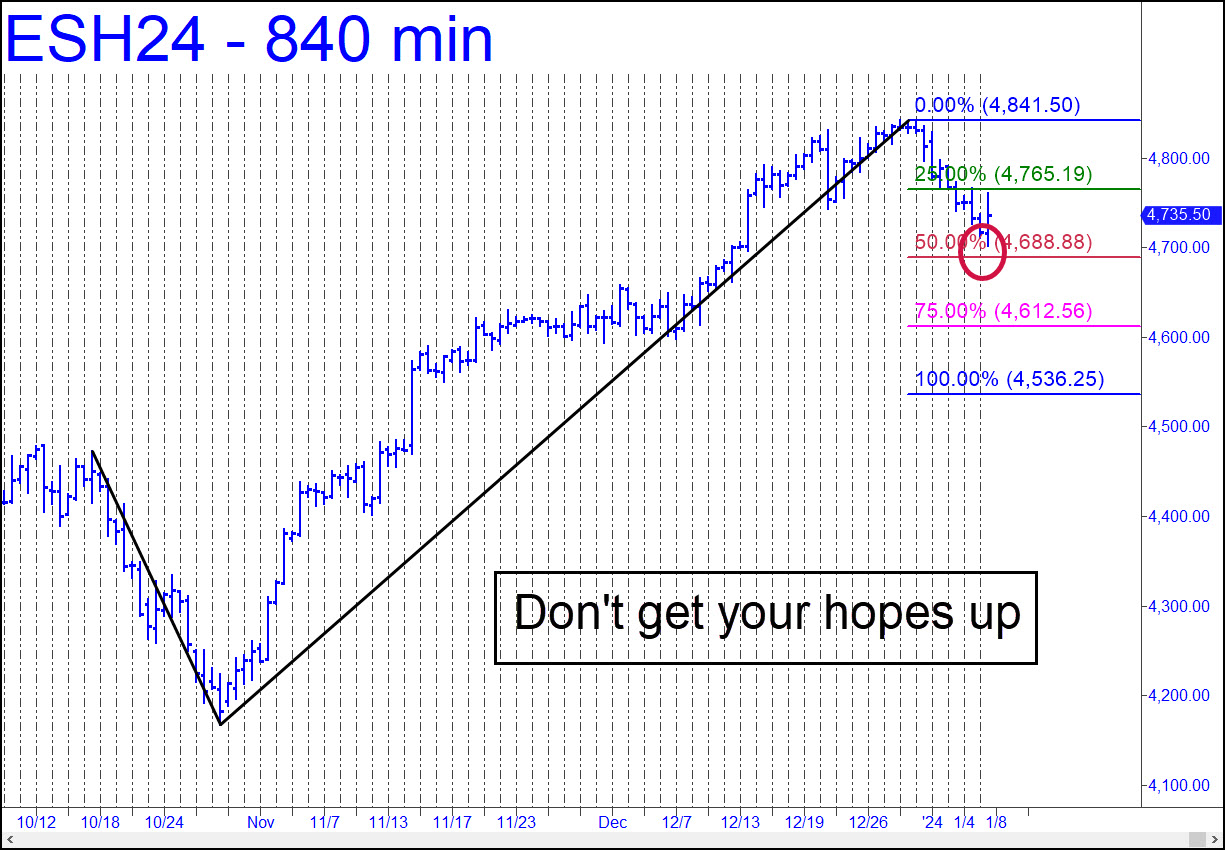

The futures are bound for an all but certain test of the 4688.75 midpoint support, which I expect to fail. We’ll wait for a verdict in real time, but p can be bottom-fished nonetheless with an rABC trigger interval of 24.50 points (a= 4743.25 on 12/20). The $5,000 entry risk demands a ‘camouflage’ set-up on the 15-minute chart or less, so the trade is advised for skilled Pivoteers only. The pattern looks reliable for trading purposes and targeting even though its A-B segment is unusually steep and elongated. That implies it would trigger a ‘mechanical’ short with a rally back to x from p or lower. _______ UPDATE (Jan 12, 9:03 a.m.): Surprising strength has trashed my bearish outlook, sending me back to the chart for a second look. It turns out the ‘mechanical’-short set-up I’d found so striking never occurred. That would have required the decline from late December’s highs to have touched the red line. It missed by 11 points, actually, implying that any rally back up to the green line would signal strength capable of achieving new highs. So far, the effort has fallen shy by four points. The rally may yet fail, possibly after a breakout to a marginal new peak. We’ll keep close track in any event, and act accordingly, as the futures continue to frolic menacingly in the ‘discomfort zone’.

The futures are bound for an all but certain test of the 4688.75 midpoint support, which I expect to fail. We’ll wait for a verdict in real time, but p can be bottom-fished nonetheless with an rABC trigger interval of 24.50 points (a= 4743.25 on 12/20). The $5,000 entry risk demands a ‘camouflage’ set-up on the 15-minute chart or less, so the trade is advised for skilled Pivoteers only. The pattern looks reliable for trading purposes and targeting even though its A-B segment is unusually steep and elongated. That implies it would trigger a ‘mechanical’ short with a rally back to x from p or lower. _______ UPDATE (Jan 12, 9:03 a.m.): Surprising strength has trashed my bearish outlook, sending me back to the chart for a second look. It turns out the ‘mechanical’-short set-up I’d found so striking never occurred. That would have required the decline from late December’s highs to have touched the red line. It missed by 11 points, actually, implying that any rally back up to the green line would signal strength capable of achieving new highs. So far, the effort has fallen shy by four points. The rally may yet fail, possibly after a breakout to a marginal new peak. We’ll keep close track in any event, and act accordingly, as the futures continue to frolic menacingly in the ‘discomfort zone’.

ESH24 – March E-Mini S&Ps (Last:4814.50)

Posted on January 7, 2024, 5:20 pm EST

Last Updated January 12, 2024, 9:12 am EST

Posted on January 7, 2024, 5:20 pm EST

Last Updated January 12, 2024, 9:12 am EST