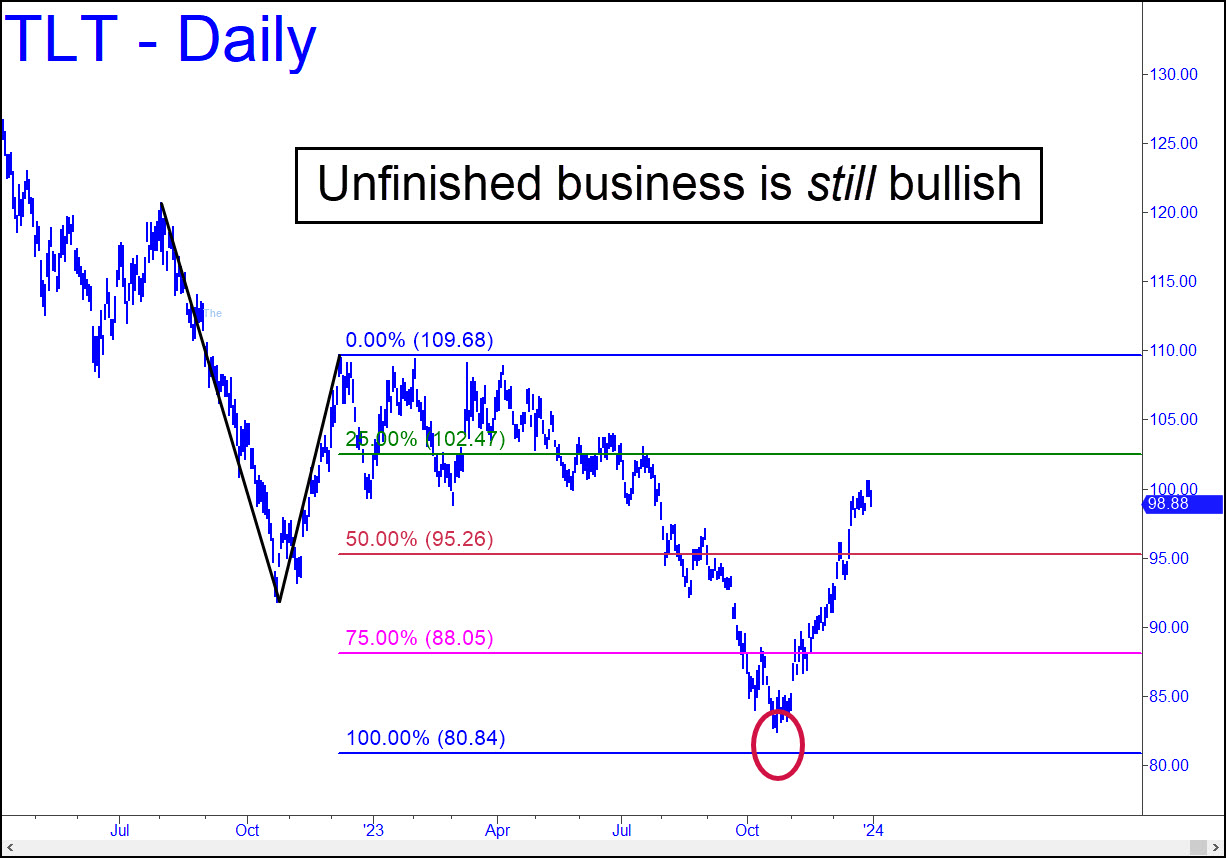

We used a rally target from the weekly chart to buy put options last Wednesday for 0.19, just pennies off their all-time low. By week’s end they had traded for as much as 0.43, giving subscribers an opportunity to cash out of half of them for at least twice what they’d paid. This effectively lowered their cost basis to zero, giving everyone a riskless position with a week left on it. The chart shown is bullish, but if this corrective move picks up steam it could yield a fat gain for everyone. I recommend holding at least a fraction of the original position until Friday afternoon, when the options expire. _______ UPDATE (Jan 2, 6:47 p.m.): The puts traded as high as 0.72 today, nearly four times what we paid for them, so you should be out of at least half of your position. _______ UPDATE (Jan 5): The puts that subscribers bought for 0.19 or less a week ago traded for ten times that today, yielding exceptional profits for anyone who did the trade — even those who bailed out early. I’d explicitly advised holding a few puts until they expired (see above), a strategy that paid off at jackpot odds when T-Bonds relapsed following an opening-hour short squeeze. Now, the plunge could continue to as low as 95.26 over the near term. Here’s a chart that shows the target.

We used a rally target from the weekly chart to buy put options last Wednesday for 0.19, just pennies off their all-time low. By week’s end they had traded for as much as 0.43, giving subscribers an opportunity to cash out of half of them for at least twice what they’d paid. This effectively lowered their cost basis to zero, giving everyone a riskless position with a week left on it. The chart shown is bullish, but if this corrective move picks up steam it could yield a fat gain for everyone. I recommend holding at least a fraction of the original position until Friday afternoon, when the options expire. _______ UPDATE (Jan 2, 6:47 p.m.): The puts traded as high as 0.72 today, nearly four times what we paid for them, so you should be out of at least half of your position. _______ UPDATE (Jan 5): The puts that subscribers bought for 0.19 or less a week ago traded for ten times that today, yielding exceptional profits for anyone who did the trade — even those who bailed out early. I’d explicitly advised holding a few puts until they expired (see above), a strategy that paid off at jackpot odds when T-Bonds relapsed following an opening-hour short squeeze. Now, the plunge could continue to as low as 95.26 over the near term. Here’s a chart that shows the target.

TLT – Lehman Bond ETF (Last:98.32)

Posted on December 31, 2023, 5:17 pm EST

Last Updated January 6, 2024, 10:30 am EST

Posted on December 31, 2023, 5:17 pm EST

Last Updated January 6, 2024, 10:30 am EST