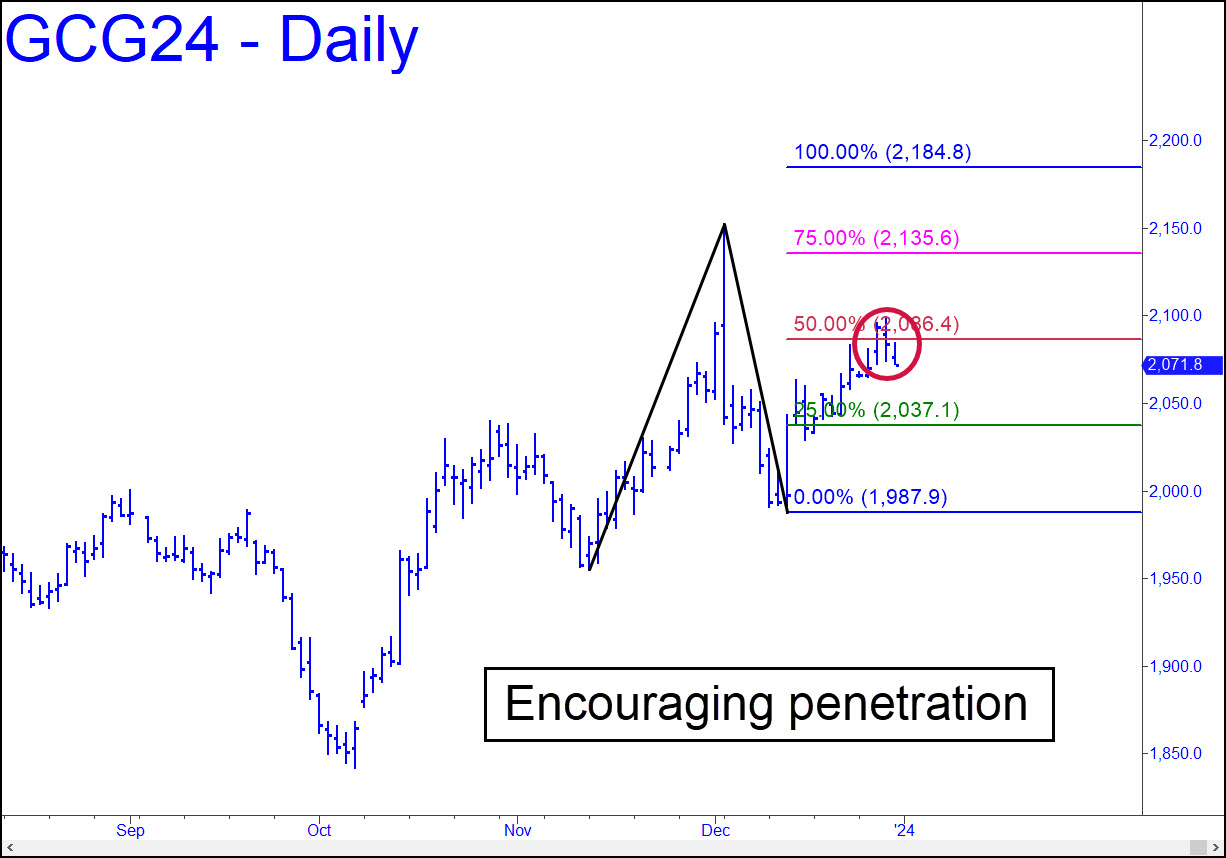

The futures made a little headway toward the 2184.80 target with a marginal penetration of the pattern’s midpoint resistance, p=2086.40. The target is slightly higher than the one given earlier, which used a one-off ‘A’ on the hourly chart. A pullback to the green line (x=2037.10) should be treated as a gift, since it would enable a ‘mechanical’ buy that looks quite fetching in prospect. The implied 50-point stop-loss would demand the use of a ‘camouflage’ trigger designed to cut entry risk by at least 90%. I will furnish timely details if possible, so be sure to check your email ‘Notifications’ if the trade gets close. _____ UPDATE (Jan 5): Sellers pushed the futures down to the green line, triggering a ‘mechanical’ buy with an unacceptably wide stop-loss at 1987.80. I did not put out a trade because there was no a-b segment clear enough to set up a lower-risk, reverse-pattern entry. We’ll spectate for now, but with the goal of jumping in on the long side if the right opportunity comes along.

The futures made a little headway toward the 2184.80 target with a marginal penetration of the pattern’s midpoint resistance, p=2086.40. The target is slightly higher than the one given earlier, which used a one-off ‘A’ on the hourly chart. A pullback to the green line (x=2037.10) should be treated as a gift, since it would enable a ‘mechanical’ buy that looks quite fetching in prospect. The implied 50-point stop-loss would demand the use of a ‘camouflage’ trigger designed to cut entry risk by at least 90%. I will furnish timely details if possible, so be sure to check your email ‘Notifications’ if the trade gets close. _____ UPDATE (Jan 5): Sellers pushed the futures down to the green line, triggering a ‘mechanical’ buy with an unacceptably wide stop-loss at 1987.80. I did not put out a trade because there was no a-b segment clear enough to set up a lower-risk, reverse-pattern entry. We’ll spectate for now, but with the goal of jumping in on the long side if the right opportunity comes along.

GCG24 – February Gold (Last:2049.80)

Posted on December 31, 2023, 5:15 pm EST

Last Updated January 6, 2024, 11:13 am EST

Posted on December 31, 2023, 5:15 pm EST

Last Updated January 6, 2024, 11:13 am EST