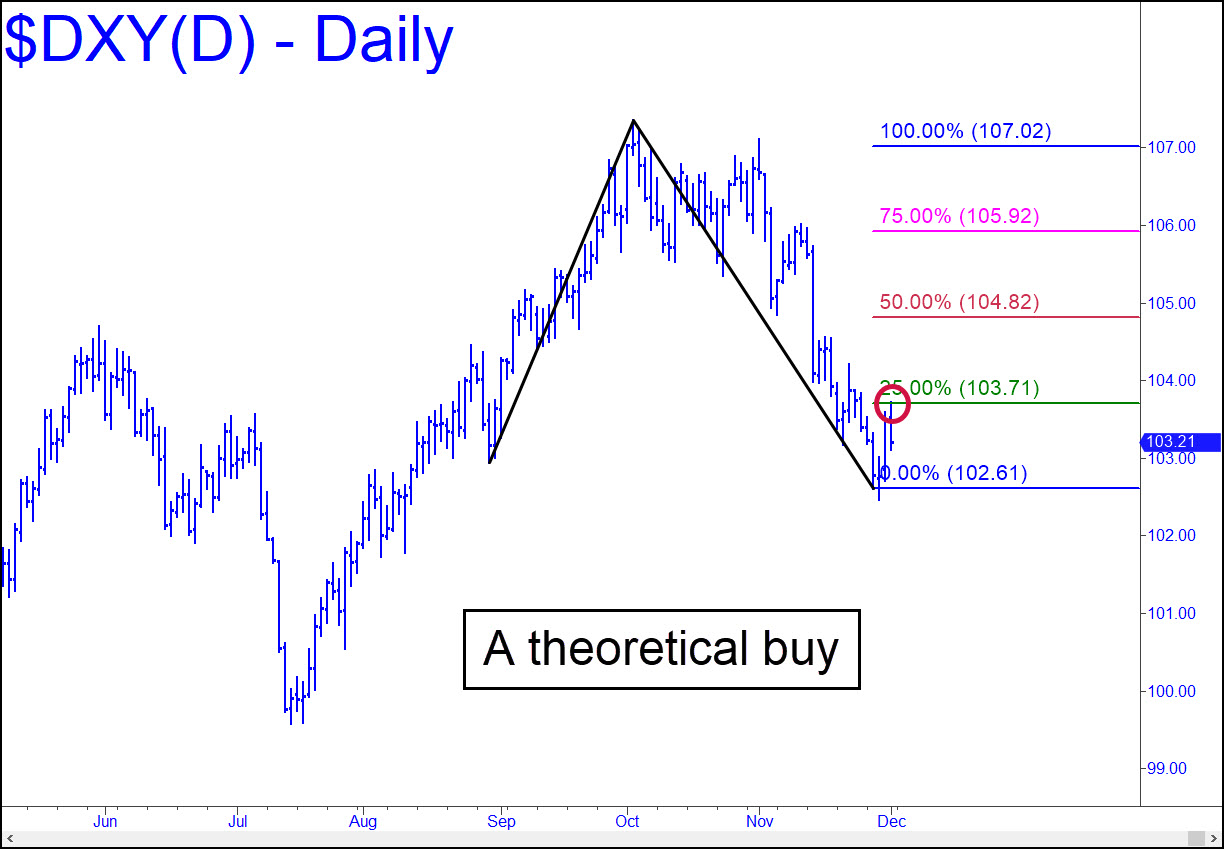

The Dollar Index tripped a theoretical buy signal on Friday when it slightly exceeded the green line (x=103.57) early in the session. A hypothetical trade would have finished in the red, but we’ll await more evidence next week to determine whether the rally has the moxie to reach p=104.82, the midpoint Hidden Pivot resistance. Although we don’t actually trade this vehicle, its gyrations inform and influence our outlook for other vehicles, particularly bonds and bullion. Assuming the latter remains strong, it will be interesting to see whether the dollar and gold/silver are able to rise simultaneously. That would be an important tone change — something we haven’t seen before for a prolonged period of time. _______ UPDATE (Dec 8): Nothing dramatic, but the dollar made encouraging progress last week toward the 104.68 midpoint pivot of the pattern shown in this chart. If it reaches it this week, that would generate the first bullish impulse leg we’ve seen on the daily chart since September. _______ UPDATE (Dec 13, 11:20 p.m.): Nothing cheers the chimps who manage your money like a falling dollar, since a strong one will undo every assumption that has powered global markets and economies (and Globalists!) for as long as anyone can recall. A day of reckoning is coming, so don’t expect the dollar to keep falling just because Wall Street and the bozos who invent the news are spinning everything Powell says these days as wildly dovish.

The Dollar Index tripped a theoretical buy signal on Friday when it slightly exceeded the green line (x=103.57) early in the session. A hypothetical trade would have finished in the red, but we’ll await more evidence next week to determine whether the rally has the moxie to reach p=104.82, the midpoint Hidden Pivot resistance. Although we don’t actually trade this vehicle, its gyrations inform and influence our outlook for other vehicles, particularly bonds and bullion. Assuming the latter remains strong, it will be interesting to see whether the dollar and gold/silver are able to rise simultaneously. That would be an important tone change — something we haven’t seen before for a prolonged period of time. _______ UPDATE (Dec 8): Nothing dramatic, but the dollar made encouraging progress last week toward the 104.68 midpoint pivot of the pattern shown in this chart. If it reaches it this week, that would generate the first bullish impulse leg we’ve seen on the daily chart since September. _______ UPDATE (Dec 13, 11:20 p.m.): Nothing cheers the chimps who manage your money like a falling dollar, since a strong one will undo every assumption that has powered global markets and economies (and Globalists!) for as long as anyone can recall. A day of reckoning is coming, so don’t expect the dollar to keep falling just because Wall Street and the bozos who invent the news are spinning everything Powell says these days as wildly dovish.

DXY – NYBOT Dollar Index (Last:102.45)

Posted on December 3, 2023, 5:11 pm EST

Last Updated December 14, 2023, 2:47 pm EST

Posted on December 3, 2023, 5:11 pm EST

Last Updated December 14, 2023, 2:47 pm EST