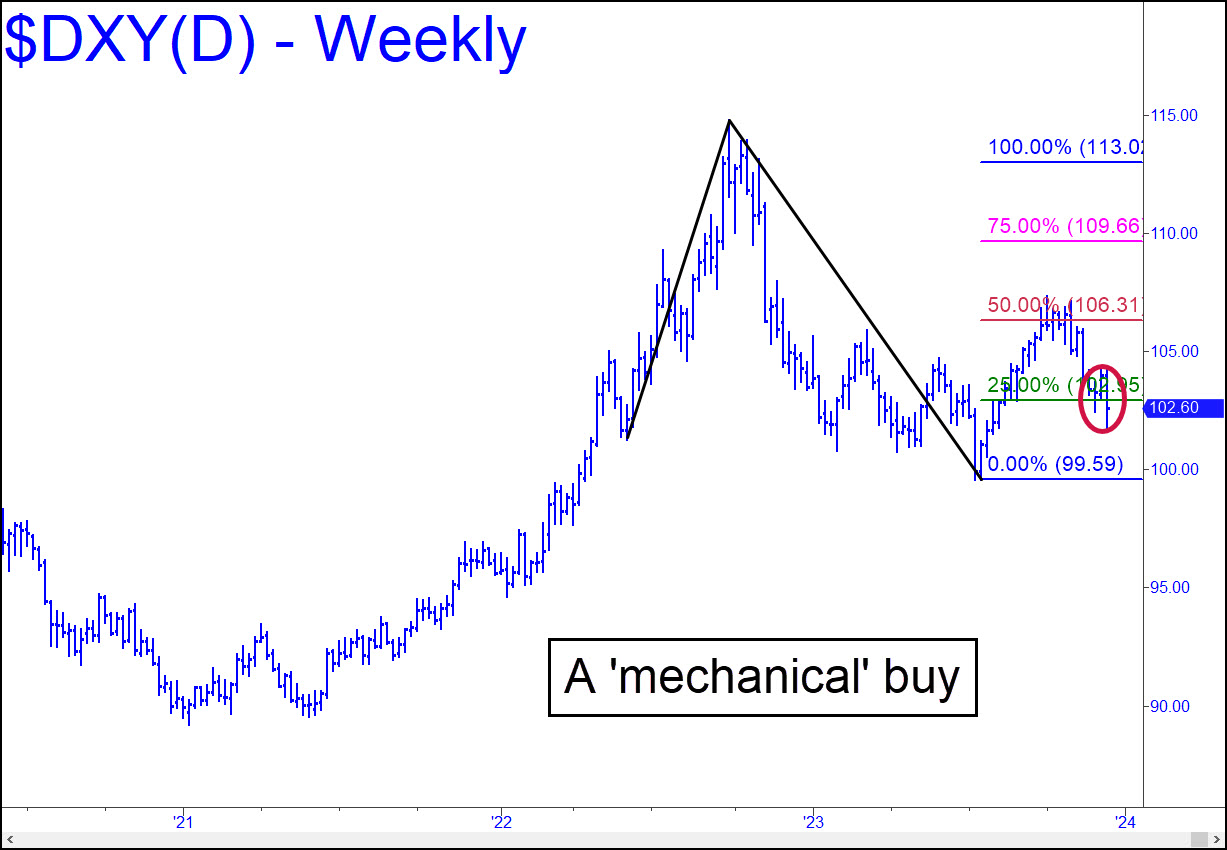

This should be interesting, since the Dollar Index has triggered an appealing ‘mechanical’ buy with its return to the green line earlier this month. A stop-loss at 99.59 would apply, although we won’t be trading on the signal. A sustained rally would end the stock-market rally begun in October, since there is nothing that Wall Street, the banksters and everyone who owes money should fear more than a resurgent dollar. My hunch is that the rally would need to reach p2=109.66 or so before still-dim perceptions of the threat would sharpen. The first to feel the pain would be the growing hoard of motorists whose cars, including a few Bentleys, are slated for repossession. I’m looking for this debtor epiphany to occur simultaneously with MSFT’s fall from a 430.58 bull-market target billboarded here earlier.

This should be interesting, since the Dollar Index has triggered an appealing ‘mechanical’ buy with its return to the green line earlier this month. A stop-loss at 99.59 would apply, although we won’t be trading on the signal. A sustained rally would end the stock-market rally begun in October, since there is nothing that Wall Street, the banksters and everyone who owes money should fear more than a resurgent dollar. My hunch is that the rally would need to reach p2=109.66 or so before still-dim perceptions of the threat would sharpen. The first to feel the pain would be the growing hoard of motorists whose cars, including a few Bentleys, are slated for repossession. I’m looking for this debtor epiphany to occur simultaneously with MSFT’s fall from a 430.58 bull-market target billboarded here earlier.

DXY – NYBOT Dollar Index (Last:102.60)

Posted on December 17, 2023, 5:23 pm EST

Last Updated December 17, 2023, 7:39 pm EST

Posted on December 17, 2023, 5:23 pm EST

Last Updated December 17, 2023, 7:39 pm EST