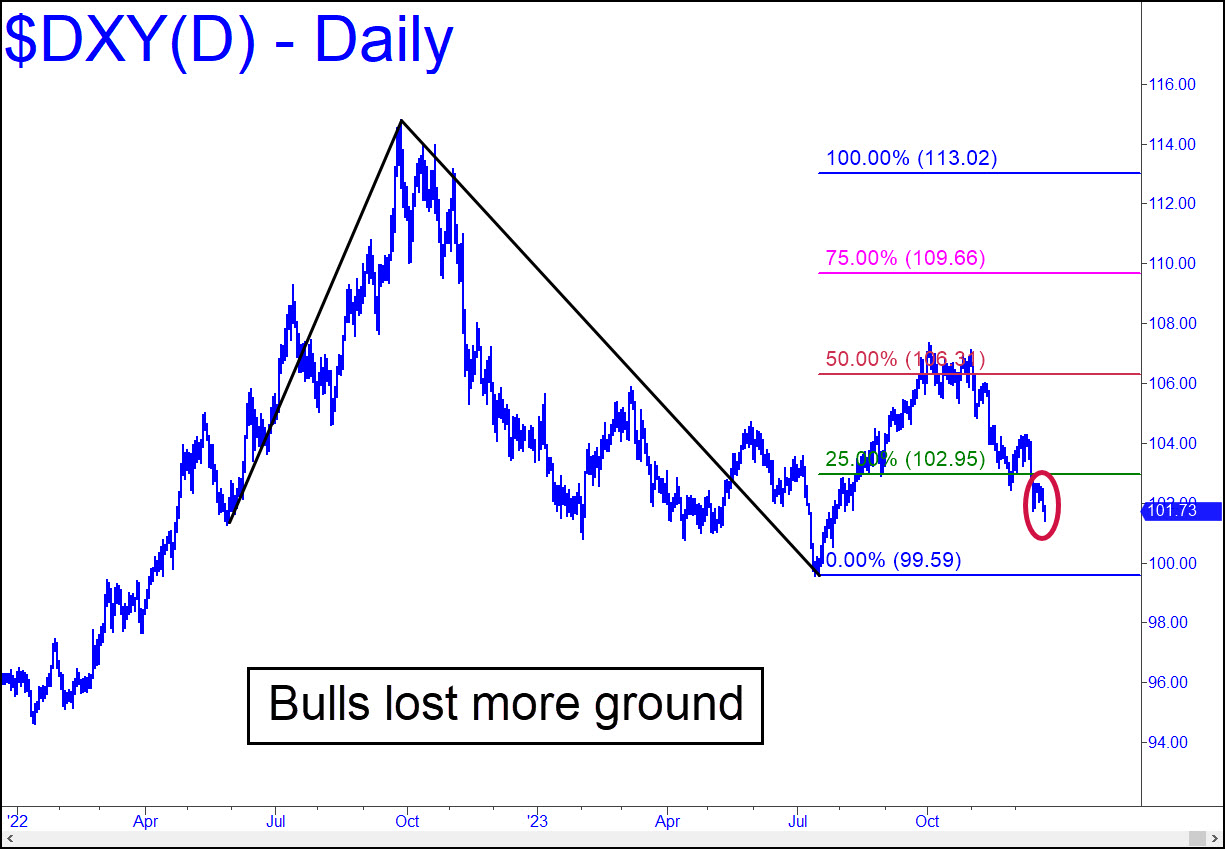

Dollar bulls ceded more ground last week, further thwarting Powell’s efforts to raise the cost of dollars so that they are no longer effectively free to speculators and money-changers. DXY’s moderate slippage left it somewhat shy of wrecking an incipiently bullish pattern via a dip beneath the point ‘C’ low; however, the direction and rate of decline were hardly encouraging. The dollar remains on a ‘mechanical’ buy signal in theory, but the strategy no longer looks likely to produce a winner. If the plunge takes out C=99.59, we should brace for more slippage into the mid 90s.

Dollar bulls ceded more ground last week, further thwarting Powell’s efforts to raise the cost of dollars so that they are no longer effectively free to speculators and money-changers. DXY’s moderate slippage left it somewhat shy of wrecking an incipiently bullish pattern via a dip beneath the point ‘C’ low; however, the direction and rate of decline were hardly encouraging. The dollar remains on a ‘mechanical’ buy signal in theory, but the strategy no longer looks likely to produce a winner. If the plunge takes out C=99.59, we should brace for more slippage into the mid 90s.

DXY – NYBOT Dollar Index (Last:101.73)

Posted on December 24, 2023, 5:17 pm EST

Last Updated December 26, 2023, 11:42 am EST

Posted on December 24, 2023, 5:17 pm EST

Last Updated December 26, 2023, 11:42 am EST