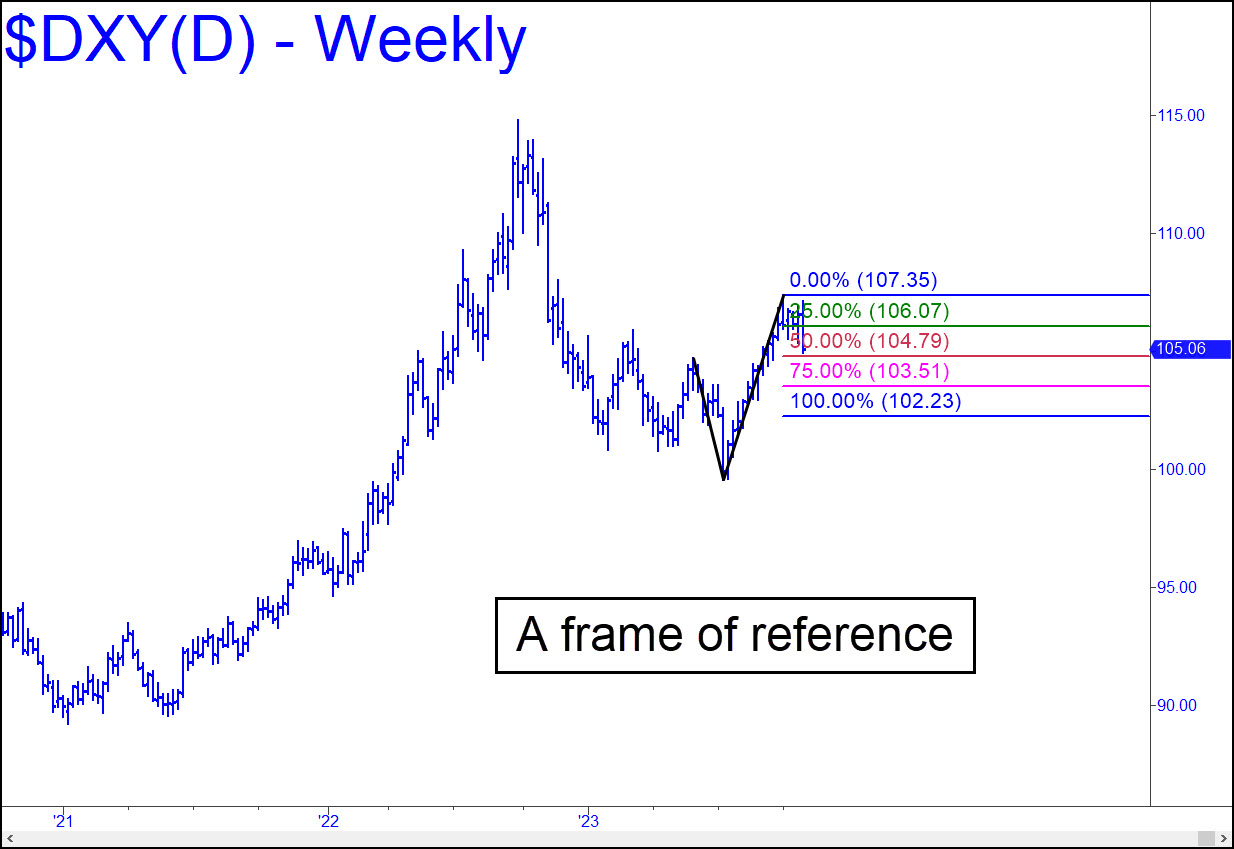

Last week’s decline was the sharpest in four months and could conceivably come down to the 102.23 target shown, That would amount to an approximately 5% correction, entirely normal considering the steepness of the run-up from 100 to 107 that occurred between mid-July and November. A milder correction that reverses from p=104.79 would underscore the power of the renascent bull market begun from 90 in 2021. Wherever and whenever the pullback ends, upside potential thereupon would be to p=112.14 of this pattern most immediately, and to 124.70 ultimately. It is no exaggeration to suggest that a dollar at that height will have drastically altered the global economy and its fatally financialized infrastructure.

Last week’s decline was the sharpest in four months and could conceivably come down to the 102.23 target shown, That would amount to an approximately 5% correction, entirely normal considering the steepness of the run-up from 100 to 107 that occurred between mid-July and November. A milder correction that reverses from p=104.79 would underscore the power of the renascent bull market begun from 90 in 2021. Wherever and whenever the pullback ends, upside potential thereupon would be to p=112.14 of this pattern most immediately, and to 124.70 ultimately. It is no exaggeration to suggest that a dollar at that height will have drastically altered the global economy and its fatally financialized infrastructure.

DXY – NYBOT Dollar Index (Last:105.06)

Posted on November 5, 2023, 5:21 pm EST

Last Updated November 5, 2023, 2:12 pm EST

Posted on November 5, 2023, 5:21 pm EST

Last Updated November 5, 2023, 2:12 pm EST